Published on

Tuesday, August 4 2020

Authors :

Robert Auers and John Auers

By any measure, 2020 has not gone as planned for anybody and this is particularly true for refiners for whom almost nothing seems to have gone right. This point is coming across loud and clear during the round of 2nd quarter earnings calls currently being conducted by both independent and integrated oil refiners. They all entered the year with hopes for strong refining margins and a wider light-heavy differential driven by the impact of the 2020 IMO regulations and have instead been met by the largest demand destruction event in history, sending refining margins to levels not seen since the Great Financial Crisis. This plight reminds us of Kris Kristofferson when he wrote, “Sunday Mornin’ Comin’ Down” back in 1969. Kristofferson wrote the song, about being depressed and hungover on a Sunday morning, shortly after his wife had left with their only child. This was after Kristofferson, a former Rhodes Scholar and aspiring novelist, had forgone an opportunity to become an English literature professor at West Point to pursue songwriting. One has to imagine that, at this low point in his life, he was feeling much the same as refiners today. Fortunately for Kristofferson, better times lay ahead, as the song was recorded by Johnny Cash and shot to number 1 on the Billboard country charts. This led Kristofferson to be awarded “Songwriter of the Year” at the Country Music awards and propelled him to a long and successful career as both a song writer and performer (and even actor to some degree). This brings us to today, where despite the current headwinds and dire situation for the refining industry, some bright shoots are beginning to appear and better times lie ahead.

COVID-19 Outlook

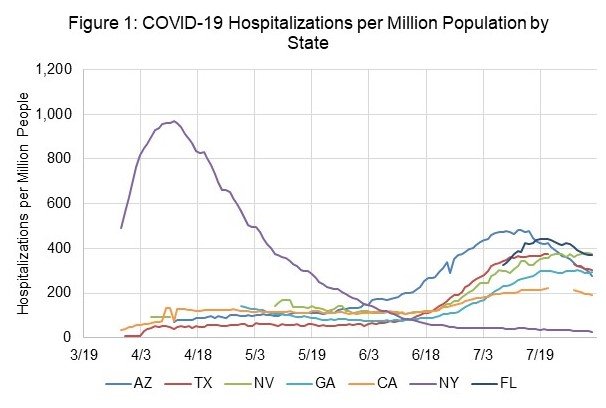

While we are certainly not epidemiologists, nor COVID-19 experts (but then who really is), we feel it is both possible and important to make a supportable forecast for the progression of the disease, which ultimately will be critical in making similar forecasts for petroleum demand and market prices. COVID-19 is certainly a serious disease but at the same time it does not appear to be drastically different than similar flu viruses. As with other viruses, it will continue to be present and lead to infections in both the U.S. and globally until “herd immunity” is reached or a vaccine is developed. Effective herd immunity does not require that everyone or even a majority of people are infected but only that a threshold level of immunity has been reached in a given geography. We are already seeing this in many regions (Sweden, Italy, New York/New Jersey, etc.) where the data has shown that prevalence of new infections begins to decrease rapidly once widespread antibody test results begin to return a positive rate of 10-15%. Encouragingly, results in some of the recent “hot spots” such as Texas, Florida, Arizona and even most of California are beginning to show this same dynamic. Overall, we believe effective herd immunity has been reached in most of the Mid- Atlantic and Northeastern states and significant new outbreaks there are unlikely. Most of the South and West appear well on their way to herd immunity as well and infection levels in most of the largest states in those regions appear to be moderating or reversing. As this trend continues, we expect to see public fear of COVID-19 recede and state and local governments resume economic reopening steps over the next two to three months. This should in turn drive increased economic activity and petroleum demand. We do caution that another wave of increased infections remains a distinct possibility in the colder regions of the country, primarily parts of the Midwest that have not yet reached herd immunity as we move into the fall and winter. However, we also note that the June/July outbreaks are much less severe than those seen in March/April and would expect that dynamic would likely apply in any new “spike.” This is shown in Figure 1, which compares COVID-19 hospitalization rates in New York and three of the more recent “hot spot” states. We note that hospitalization data for 7/22 – 7/27 for Texas and California is not shown due to reporting issues which led to erroneous data for those dates. Another encouraging data set is the Swedish example, where COVID-19 has nearly disappeared and the overall death rate (as a percentage of the total population) remains less than one-third that seen in New York and New Jersey.

The developing world has generally shown an inability to control the spread of COVID-19 despite staunch efforts to do so. Data obviously remains of much lower quality in most developing countries as compared to that in the developed world, but outbreaks appear to be moderating in many countries, even as they reopen, and indefinite lockdown in many of these countries (including those in Latin America, South and Southeast Asia, and Africa) will not be possible without severe side-effects (most notably famine), that could kill more people than COVID-19. As a result, we expect reopening activity to continue in most of the developing world even as COVID-19 continues to spread.

In the rest of the developed world, COVID-19 appears to be under control for now, though a potential second wave remains a possibility in the fall or winter, particularly in countries that did not experience a marked first wave. We do not expect many countries would revert to a full lockdown (comparable to what was seen in April) if this does occur, but demand would nonetheless be negatively affected as new restrictions are put in place and people choose to stay in to protect themselves.

Globally, we expect COVID-19 will be largely eradicated by the Spring of 2021 regardless of whether a vaccine is found by then or not. Some lingering disease fears may persist and governments will likely continue to exercise caution as well, but we expect residual recessionary impacts stemming from the original lockdowns (rather than new lockdowns) will be the primary factor limiting demand for most of 2021.

Demand Outlook

Despite our relatively upbeat perspective regarding the COVID-19 outlook, global demand will remain challenged through at least 2021 due to the economic fallout resulting from the COVID-19 lockdowns, but this still means significant additional demand growth from the depressed levels of the second quarter. In 2Q 2020, global demand fell by 16.6 MMBPD year-over-year (YoY). In 3Q, we expect demand to be up 11.9 MMBPD sequentially, but still down 6.4 MMBPD YoY. For 4Q, we see another 3 MMBPD of demand growth, but, again, it will still be down 3.7 MMBPD YoY. We expect this trend of strong sequential demand growth to continue in 2021, but 2021 demand is still expected to be down 1.5 MMBPD as compared to 2019 levels. Gasoline demand has, and will continue to be, relatively strong, while distillate (especially jet) demand will lag.

Longer term, our downward revisions for post-2025 demand (from our pre-COVID-19 forecasts) remain modest, as we expect global demand to surpass 2019 levels by 2022, with global growth continuing thereafter until the end of our forecast period in 2040. Of course, demand growth will be uneven between product categories. Gasoline demand growth will become increasingly challenged longer term due to pressure from alternatives and increasing efficiencies. De-dieselization in Europe will help offset this trend through 2030. Once the latent COVID-19 impacts are overcome during the next two to three years, middle distillate, and particularly jet fuel, demand growth is expected to be relatively healthy, while demand for residual fuels will continue its decline.

Refining Closures and New Construction

While we expect a relatively robust demand recovery, refinery closures have already accelerated and the pace of new project announcements has slowed. Europe will be the most challenged region and Gunvor, Total, and Eni have already announced that they are considering the permanent closures of their Antwerp (110 MBPD), Grandpuits (93 MBPD), and Milazzo (160 MBPD) refineries, respectively. Other closures across Europe will take place as well, with pressures from the IMO regulations also becoming a catalyst for those decisions. In Japan, JXTG had already announced the planned closure of its 115 MBPD Osaka refinery and more closures in the country also remain likely. In Australia, the 109 MBPD Lytton refinery is under an “extended closure” due to the current pricing environment, and it is possible that this closure could become permanent, depending on the pace of the recovery. Other closures in Australia remain a possibility as well and the Point Marsden refinery in New Zealand also faces significant challenges due to the strict lockdown and sharp drop in petroleum demand in that country.

In the U.S., Marathon just announced this weekend the permanent closure of their 161 MBPD Martinez and 26 MBPD Gallup refineries, both of which were temporarily idled in April 2020. The Martinez site will be converted to a terminal and Marathon is considering converting some of the existing equipment there to produce renewable diesel as well. Despite this closure of Martinez, the Phillips 66 Santa Maria/Rodeo refinery remains under threat, particularly due to the logistical issues surrounding crude sourcing at Santa Maria. In Southern California, both Valero Wilmington and PBF Torrance remain vulnerable in the event of an HF alky ban, though we believe that scenario to be unlikely in the short- to medium-term, especially considering the Martinez shutdown. On the East Coast, the Delta Trainer, PA refinery remains the most vulnerable, although the shutdown of the largest refinery in the region, Philadelphia Energy Systems (PES), along with the announced and expected shutdowns in Europe do improve the regional supply/demand balance to some extent.

This long list of closures bodes well for future refining margins if and when demand recovers. Further, the lack of new project announcements is likely to begin showing its effects by 2023, providing perhaps another tailwind for margin growth.

Reports

Turner, Mason and Company (TM&C) issues two comprehensive reports analyzing the refining industry and providing key market forecasts on a biannual basis. The Crude and Refined Products Outlook (C&RPO) has the broader scope of these two reports. The C&RPO covers the entire spectrum of the petroleum products markets, from crude oil through finished products, and has been in publication for 15 years. A major aspect of the report is to provide a comprehensive, independent price deck which can be used as a basis to evaluate capital projects or other strategic initiatives, including acquisitions. Our forecasts are supported by analysis of key drivers and background information on critical assumptions.

Our forecast of global petroleum markets, includes over two dozen crudes in seven geographic regions. Key crude price relationships are developed to evaluate light/heavy differentials, comparisons between North American and global marker grades, and sweet/sour spreads. Commentary is provided in multiple report sections which describe how pricing relationships will react over time in response to key market and regulatory developments. Forecasts for product prices are also provided in the same seven geographic regions and include not only the key transportation fuels of gasoline, diesel and jet fuel, but also feedstocks, intermediates and specialty products (LPG, naphtha, VGO, aromatics, asphalt, petroleum coke, etc.).

In order to develop the price sets, we prepare petroleum products demand forecasts for the U.S., Europe, Asia Pacific, and the Rest of the World through 2040, considering expected GDP and population growth, improved efficiencies, and increasing use of alternatives (both with market driven and regulatory motivations), etc. To this end, we include a forecast for Electric Vehicle (EV) penetration and their likely impact on global petroleum demand. Appendix tables detail global Alternative Fuels production growth, a forecast of RIN prices through 2035 and data on the California Low Carbon Fuel Standard Program. We also include detailed information regarding midstream crude oil infrastructure, identifying possible bottlenecks. Particular emphasis is given to pipelines serving the Permian Basin, Western Canadian Sedimentary Basin (WCSB), Bakken, and Cushing, OK. This is accompanied by a crude oil and NGL production forecast for each of the major U.S. producing regions (Permian, Bakken, Eagle Ford, Niobrara/Rockies, Anadarko, and Gulf of Mexico) and for total U.S. and Canadian crude oil production. Lastly, we include a list of probable global refinery construction projects with details regarding capacity, expected crude quality (light, medium, heavy), expected product slate, cost and downstream unit capacity.

We are currently working on completing the 2020 Mid-Year edition of the C&RPO, and it will be issued over the next week or so.

The next report is the Worldwide Refinery Construction Outlook (WRCO). Each year, numerous global refining projects are announced, generally with the best of intentions and with a keen desire to see the projects come to fruition. Many of these projects are complete refineries while others are expansions to existing facilities. If all were to be completed, the world would be awash in surplus product and the margins for all would be poor. TM&C catalogues each of these announced projects and forecasts which will be actually constructed in the biannual WRCO.

Critical metrics are determined for each refining project including location, owners, construction timing, capacity additions, downstream unit capacities and cost. Crude slate changes and product yields are estimated for each project. Our assessment of each project results in the determination of a Probability Index for the project. Each is assigned a ranking of one to five based on our judgment of the likelihood for completion. Projects with a one or two are deemed as unlikely to be constructed while a five has the highest probability and is generally already in the construction phase. The probability rankings are based on the economic rationale, regional crude and product balances and the financial standing of both the project and sponsors and the owners’ past track record for project completions. The WRCO is also scheduled to be release over the next two weeks.

Turner, Mason & Company (TM&C) is continually monitoring developments in the global petroleum markets and assessing how they will impact the industry. Considering the dynamic events impacting the petroleum industry (IMO, COVID-19, trade wars, low carbon standards, EV incentives, sanctions, OPEC policy, etc.), the future landscape of the petroleum industry is as uncertain as ever. TM&C not only executes regular and comprehensive studies of the industry, such as the C&RPO and WRCO, but also one-off studies focusing on specific issues, such as the recent report we completed on options available to overcome bottlenecks impacting the production and transportation of Western Canadian crude – Clearing the Bitumen Bottleneck. We also use the findings of these studies and our expertise to assist clients in all segments of the petroleum supply chain in specific and focused consulting engagements. For more information on our subscription studies or our consulting capabilities, please call us at 214-754-0898 or visit our website at turnermason.com.