Published on

Tuesday, August 11 2020

Authors :

Eamon Cullinane and Sam Davis

The COVID-19 pandemic has had a profound impact across the industry, with companies having had to respond to unprecedented declines in transportation fuel demand and a historic crash in crude oil prices.

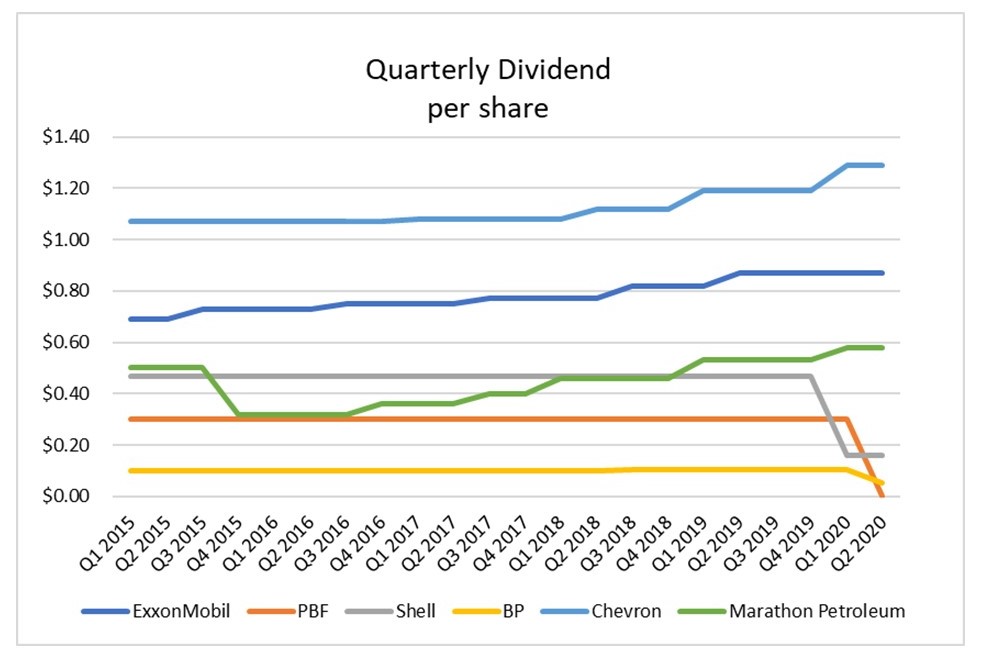

To boost liquidity and shore up cash reserves, companies across the board have reduced capital and operating costs by postponing projects, deferring final investment decisions, reducing salaries, suspending share buybacks, selling assets, and in some cases cutting the precious dividend.

In today’s blog, we will profile six oil majors and independent refiners, three which have opted to cut the dividend or suspend it all together while the rest have decided (for now) to continue dividend payout to shareholders.

Let’s start with three companies that have continued to maintain their dividend: Exxon, Marathon Petroleum and Chevron.

Exxon

Exxon has a long history (37 years to be exact) of maintaining or raising the dividend each quarter. It seems they will do anything to protect and defend the dividend even as they announced earnings losses for the second straight quarter.

In the most recent earnings call, Neil Chapman, Senior Vice President, said: “A large portion of our shareholder base has come to view that dividend, as a source of stability in their income and we take that very seriously.”

Indeed, they have taken it very seriously. The company continues to move toward a 15% reduction in cash OPEX and a 30% reduction in CAPEX for 2020 as they delay projects while also taking on more debt to increase liquidity. This is in combination with an 8-10% workforce reduction, salary freezes and 401k cuts (the pension has remained untouched).

Even though the oil giant posted a $1.08 billion loss for 2Q 2020, recent actions to shore up finances have resulted in about $15 billion in cash reserves, which positions Exxon to address the impacts of the pandemic. The company also continues to develop its most profitable projects such as the Permian and Guyana plays. Exxon’s Permian production was up 9% vs. 2Q 2019 despite all the curtailments while Guyana continues to progress with Liza Phase 2 remaining on schedule for a 2022 start-up.

Though no dividend is safe in this environment, Exxon now appears to be in a better place from a liquidity standpoint and continues to demonstrate the lengths they will go to maintain the dividend.

Marathon Petroleum

Marathon has been in the headlines lately, first with the announced sale of its Speedway retail business to 7-Eleven in a $21 billion all-cash transaction, followed by the indefinite idling (which now appear permanent) of its Martinez and Gallup refineries. With all that is going on there, the company has remained constant in meeting its dividend payment and the recent sale of Speedway provides additional flexibility.

CEO Mike Hennigan, said this in reference to the sale, “We expect two primary uses of proceeds. One is to defend our investment-grade profile and then returning capital to our shareholders.”

In the 2Q 2020 earnings report, Marathon reported squeaking out a $9 million profit (vs. $1.1 billion 2Q 2019). Like Exxon, the company appears to have established sufficient liquidity ($7.7 billion of available borrowing capacity) to weather the current crisis.

Commenting on the potential repurposing of the idled Martinez refinery into a renewable diesel facility in the most recent earnings call, Executive Vice President of Refining, Ray Brooks said, “We believe that transitioning Martinez to a renewable diesel plant ultimately creates value for our shareholders, and there are certain unique advantages for this site.” Retrofitting the refinery would allow the site to produce ~48,000 barrels per day of renewable diesel. This would be an interesting pivot for the refinery that would allow them to capture the LCFS incentives in the California market.

Overall, given the sentiment around the dividend during the earnings call combined with the influx of cash from the sale of Speedway, Marathon has all intentions to continue to payout shareholders.

Chevron

Like Exxon, Chevron has a long history of 32 straight years maintaining or growing the dividend. In the most recent earnings call, CFO Pierre Breber said this, “All of our actions are designed consistent with our financial priorities. The first is to sustain and grow the dividend. We showed our stress test last quarter at $30 that I think was made very clear that we have the financial capability and the flexibility in our capital program, the ability to manage our costs to sustain that dividend through what is a stress test. And we’re continuing to sustain long-term value of the business.”

The company posted a loss of $8.3 billion in 2Q 2020 vs. earnings of $4.3 billion in 2Q 2019, making it the largest quarterly loss for the company since 1998. Chevron continues to respond to the current environment with a commitment to lowering OPEX and CAPEX like many other companies. They also announced last month an agreement to acquire Noble Energy which will certainly help increase and diversify Chevron’s portfolio.

Now let’s look at three notable companies that have opted to cut the dividend: PBF Energy, BP and Shell.

PBF Energy

PBF has taken one of the more drastic responses to COVID-19 related impacts by reducing 2020 planned capital spending by 50% and suspending its quarterly dividend payments. The CAPEX cuts represent more than a $350 million reduction. Matt Lucey, PBF President, said during the most recent earnings call that, “We expect ’21 CAPEX to actually be significantly below what we expected 2020 to be. So, I would expect CAPEX in ’21 to be in the $500 million to $600 million range, which is $200 million below what we thought ’20 was going to be.” Beyond the cuts, PBF Energy posted a quarterly loss of $433 million compared to a profit of $191 million in 2Q 2019.

The cuts, in combination with assets sales (most notably five hydrogen plants), have put PBF in a much better position. As of July, liquidity was at $1.9 billion on an estimated $1.2 billion of cash.

BP

BP recently announced a cut in the dividend from 10.5 cents to 5.25 cents per share, following the company’s reported $16.8 billion loss for 2Q 2020, compared to a $1.8 billion profit in 2Q 2019. The last time BP cut its dividend was in 2010 due to the aftermath of the Deepwater Horizon spill.

Similar to steps being taken by other companies, BP continues to cut CAPEX with a plan to decrease it by 25%. However, these cuts are expected to be in its core oil and gas business with upstream production expected to decline by 40% over the next decade. As they continue to progress their commitment to reinventing themselves as a low carbon clean energy company, the company is ramping up investments in this area from the current $500 million in CAPEX for low carbon activities to $5 billion over the next 10 years.

The sale of the upstream portion of BP’s Alaska business and the first payment from the sale of its petrochemicals business to INEOS provided $1.1 billion in proceeds which helped BP further increase liquidity. As part of the company’s shift to renewable energy, BP also announced an organizational redesign which will result in a reduction of around 10,000 jobs globally.

Based on the 2Q earnings call, BP intends to keep the dividend at its current level with no further reductions. Murray Auchincloss, CFO, had this to say in the call, “Our first priority is a resilient dividend of $0.0525 per ordinary share per quarter that we intend to remain fixed at this level.”

Shell

Lastly, Shell made industry-wide headlines in the first quarter after announcing it was cutting the dividend for the first time in more than 70 years. Most recently in the second quarter, the company reported a loss of $18.4 billion, compared with a profit of $3 billion in 2Q 2019. As expected, analysts were interested in how Shell views its dividend policy going forward following the major announcement last quarter.

Here is what CFO Jessica Uhl had to say about the new dividend policy in the most recent earnings call, “As things recover, at this moment in time, we think the progressive dividend is the right way to go. Of course, we can top that up with share buybacks, and I would expect that would be a feature as we have excess cash in terms of the nature of shareholder distributions going forward. But at this moment in time, I think right now, we see the value of stability and introducing a high degree of volatility around the dividend, particularly at this moment in time, didn’t look like the right choice for us, but we actively review it. And as the company changes, cash flow changes over the next five to 10 years, different models may be appropriate, and we’ll continue to actively consider it.”

As they free up cash flow and come out of the downturn, it will be interesting to see if they do start to bring the dividend back up or instead opt for increasing share buybacks.

Turner, Mason & Company will continue to closely monitor developments related to the COVID-19 pandemic, the progress made by states and countries to reopen their economies, crude and refined product supply/demand dynamics, and all other events that could impact the various segments of the oil industry. We will continue to comment on our changing views on all these issues in upcoming blogs over the next several weeks and incorporating our updated market forecasts into the next edition of our Crude & Refined Products Outlook which will be published to clients later this week. If you would like more information on this publication or for any specific consulting engagements with which we may be able to assist, please visit our website: www.turnermason.com and send us a note under ‘Contact’ or give us a call at 214-754-0898.