Published on

Tuesday, August 18 2020

Authors :

Eamon Cullinane and Robert Auers

The COVID-19 pandemic (and responsive government actions), together with the wave of violent protests and calls to “defund the police” are leading to potentially major shifts in where and how people in the U.S. live in the coming years. These shifts can be referred to as either de-urbanization or counter urbanization, which are exactly what they sound like, the movement of people from living in major urban areas to smaller cities, suburban communities or even rural areas. We have seen these types of demographic moves many times before in the U.S. (rural to urban during the industrial age, urban to suburban post-WWII and also post-60’s riots, suburban back to urban over the past 20 years due to “gentrification”) and in each case, they had noticeable influences on energy usage. In today’s blog, we will be discussing this potential new trend and how the ability to work remotely is accelerating de-urbanization, particularly in select urban areas negatively impacted by concerns about safety, governance and high living costs. We will also address the implications it may have on oil demand both in the near term and long term.

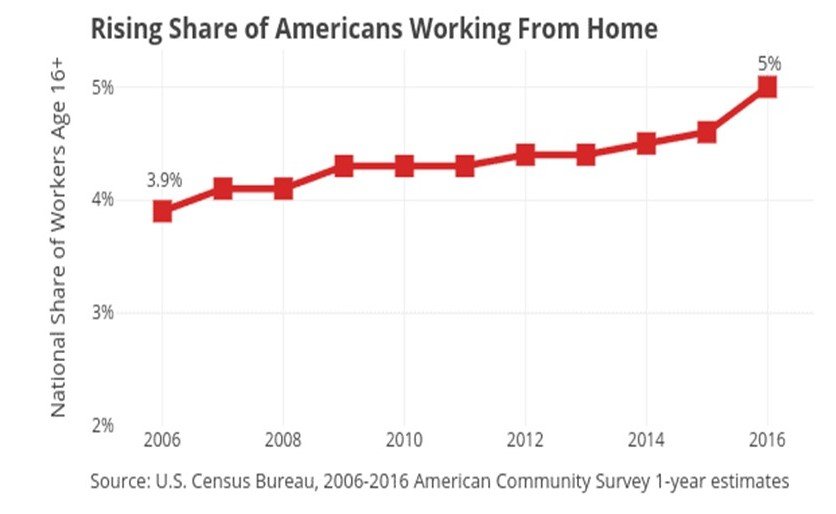

The ability to work remotely certainly didn’t start with the COVID-19 lockdowns and had already been taking place for some time in the U.S as the percentage of Americans working from home has continued to rise year after year over the last 15 years.

As a larger percentage of the workforce migrates to remote working, they are no longer tied to remaining near the physical office location. Even employees working remotely only a few days of the week may decide they can live farther away from the physical office if they only need to commute 1-2 days a week.

As a larger percentage of the workforce migrates to remote working, they are no longer tied to remaining near the physical office location. Even employees working remotely only a few days of the week may decide they can live farther away from the physical office if they only need to commute 1-2 days a week.

The COVID-19 pandemic has forced companies into operating remotely to limit the spread of the virus. As many companies are not seeing the expected reduction in productivity and eye the cost reductions associated with an increase in the number of employees working remotely, some have chosen to make this arrangement permanent. For instance, several of the major tech companies have already announced that their employees will be able to work remotely (indefinitely) if they so choose, and it would appear that many will indeed take advantage of these policies.

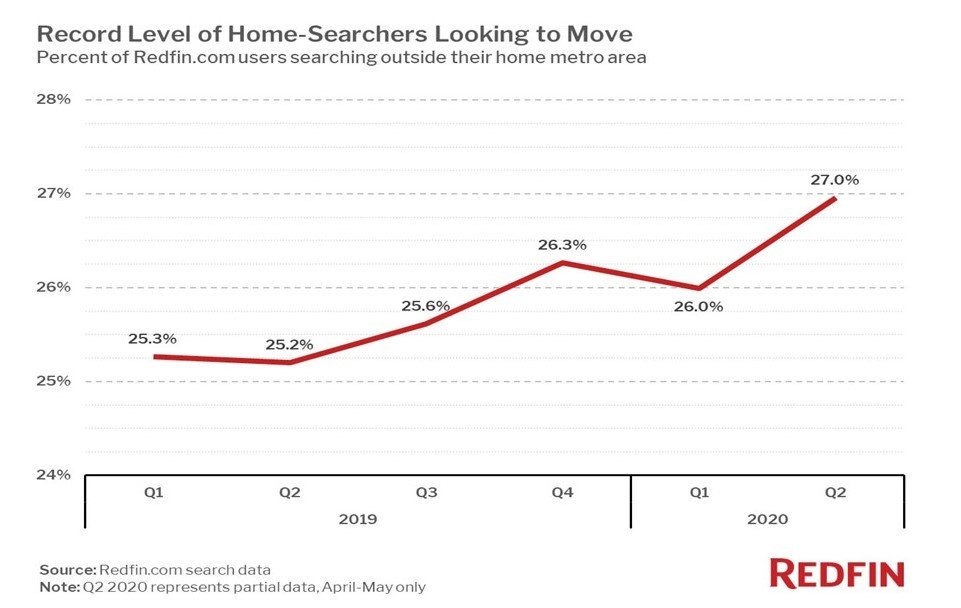

As remote working ticks up, the data already shows that people once tied to a specific metro area are now looking elsewhere. The chart below looks at the percentage of people searching for a place outside of their current metro area.

The recent uptick in Q2 2020 might demonstrate how quickly folks are embracing the new wave of working remotely and uprooting from their given city. Compounding this issue are the recent riots and looting in many major U.S. urban centers combined with increasing rates of violent crime. According to reporting by the Wall Street Journal, the nation’s 50 largest cities have seen murders increase by 24% this year as compared to the same period in 2019. At the same time, the amenities (such as restaurants, bars, and entertainment) offered by large cities have been largely shuttered (particularly in places like San Francisco and New York).

In a recent survey by Bright MLS, it found that current home buyers are most interested in a dedicated home office (31 percent), a bigger yard (26 percent), and a less dense neighborhood (21 percent), while 70% of respondents were interested in purchasing single-family homes. Its clear people want more space and for that to be achieved they will need to move outside of dense urban areas and to smaller metros and suburban areas, where one can capture more square footage at an advantaged price.

The rate at which that is currently happening looks to be on the slow side for now, but it could very well be a long-term trend as we continue to see companies adopt 100% remote options for employees.

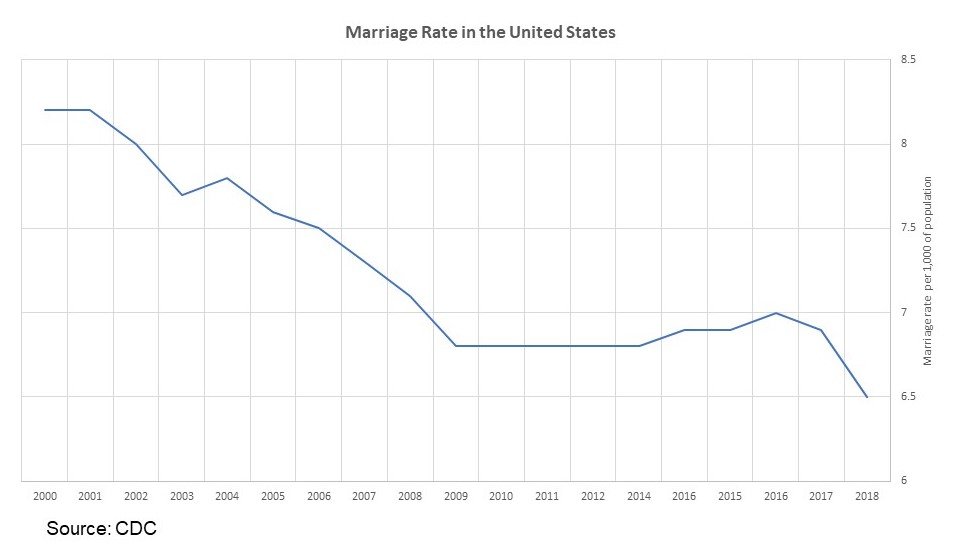

An important question is what percent of the population that currently lives in the city would truly want to move outwards to the suburbs or a smaller city? Typically, married couples and families with children would be the target demographics. Interestingly enough, both the marriage rate and fertility rate in the United States are at all-time lows, which might suggest there are upper limits on the portion of the population that would want to move to the suburbs or smaller metros. Still, many U.S. suburbs and smaller metros have, themselves, already begun to attract some amount of young people due to the affordability crisis in many of the nation’s most prestigious metro areas (such as New York and San Francisco), so it is not implausible to see younger and/or unmarried individuals leaving these large cities as well.

Nonetheless, we don’t see cities going away any time soon, but perhaps the trend toward re-urbanization will slow, and potentially reverse, at least in the short term as some portion of urbanites move to less-dense settings in the suburbs and/or smaller metros.

Impact of Energy Demand

It’s clear, the initial lockdown resulted in immediate oil demand destruction. In the long term when COVID-19 vaccines are developed and de-urbanization/remote work trends remain, what will be the impact on oil demand and energy usage?

An obvious factor is a decline in commuting, both from private passenger vehicles to public transit. In 2019, 70% (14.06 million barrels per day) of oil consumption in the U.S. was due to transportation with the majority of this consumption by light-duty vehicles used for commuting. The lack of commuting could present demand destruction of 1 -2 million barrels per day in the U.S. where the average round-trip commute sat close to 1 hour before COVID-19. We might also see travel patterns changing that could increase consumption such as personal travel (i.e., weekend trips), increased home deliveries and a decrease in public transportation usage.

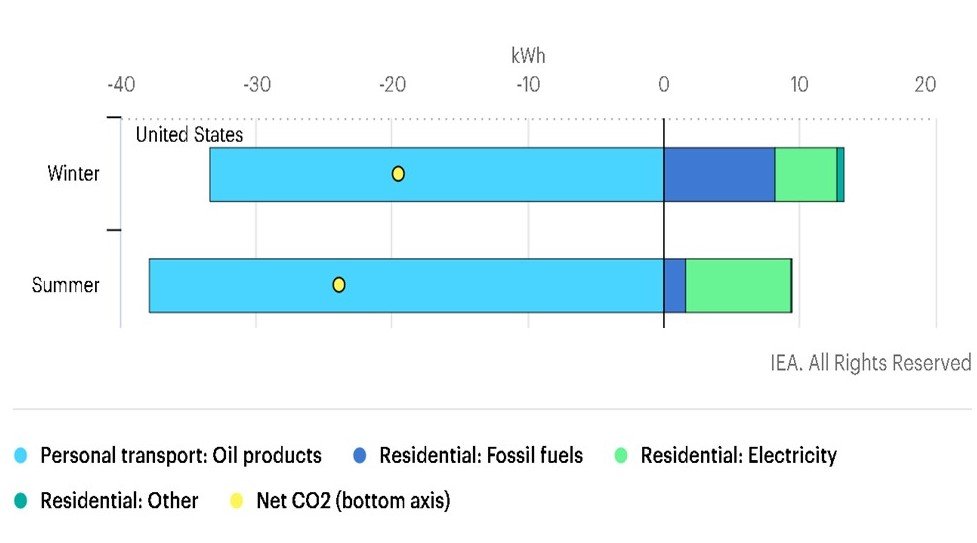

Another interesting factor will be the energy used to heat/cool homes versus large office buildings. In general, larger buildings tend to operate more efficiently than the average home HVAC. IEA did an interesting study that evaluated the energy usage impact of one day of home working for a single household with a car commute versus going to the office and working.

The analysis shows there is a net reduction in CO2 and energy usage for people that have average to long commutes. However, for folks with short commutes (<5 miles) working remotely from home could be a net increase in energy due to residential usage, especially if compared to using public transit. Utility companies have indeed reported large increases in residential electricity consumption during the weekdays. The demand increase, however, comes primarily in the form of natural gas or coal, with little (if any) associated increase in petroleum demand.

Further, as people move out of large cities like New York and San Francisco and out to the suburbs or smaller cities, the percentage of nonwork trips utilizing a car increase. Additionally, some people may continue to commute to the office 1-2 days per week and may accept a longer commute since they are making the trip less often, at least partially offsetting the lost demand from making the commute less often.

As de-urbanization continues to progress along with the movement towards remote working there will be many factors to consider in understanding the effect on petroleum demand.

Turner, Mason & Company will continue to closely monitor developments related to the COVID-19 pandemic, the progress made by states and countries to reopen their economies, crude and refined product supply/demand dynamics, and all other events that could impact the various segments of the oil industry. We will continue to comment on our changing views on all these issues in upcoming blogs over the next several weeks and incorporating our updated market forecasts into the newest edition of our Crude & Refined Products Outlook. If you would like more information on this publication or for any specific consulting engagements with which we may be able to assist, please visit our website: https://www.turnermason.com and send us a note under ‘Contact’ or give us a call at 214-754-0898.