Published on

Tuesday, July 21 2020

Authors :

Cinda Lohmann

The Renewable Fuel Standard (RFS) was established by the Energy Policy Act of 2005 and was further expanded in 2007 as part of the Energy Independence and Security Act (EISA). The RFS program is a Federal policy requiring a specific volume of renewable fuel to be used in place of petroleum-based fuels through 2022. The four renewable fuel categories under the RFS are cellulosic biofuel, biomass-based diesel, advanced biofuel, and total renewable fuel. The Clean Air Act provided the Environmental Protection Agency (EPA) the authority to adjust the total volumes established by Congress as part of the annual rulemaking process. In addition, there is a general waiver authority allowing the EPA Administrator to waive the RFS volumes in whole or in part based on a determination that the implementation could result in severe economic or environmental harm, or on inadequate domestic supply.

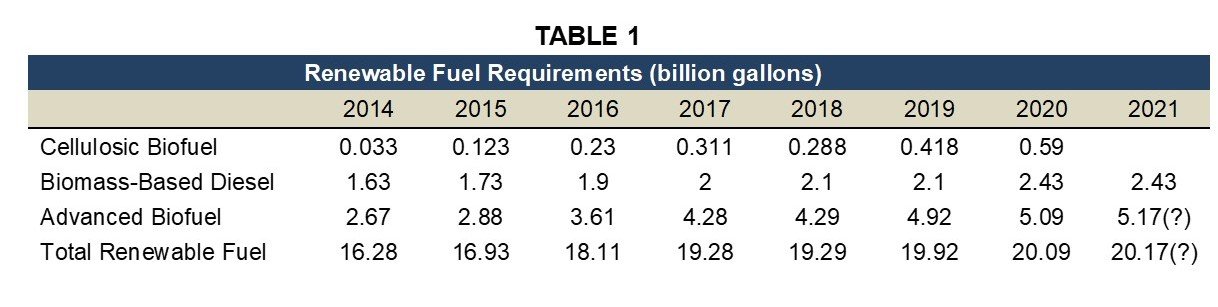

In regards to the current rule-making process for the 2021 obligation, the agency had sent their recommendations to the Office of Management and Budget (OMB) in late spring. However, sources close to the EPA say the process has been indefinitely placed on hold with analysts anticipating a slight up-tick in the 2021 total renewable fuel volume, 20.17 billion gallons as shown in Table 1.

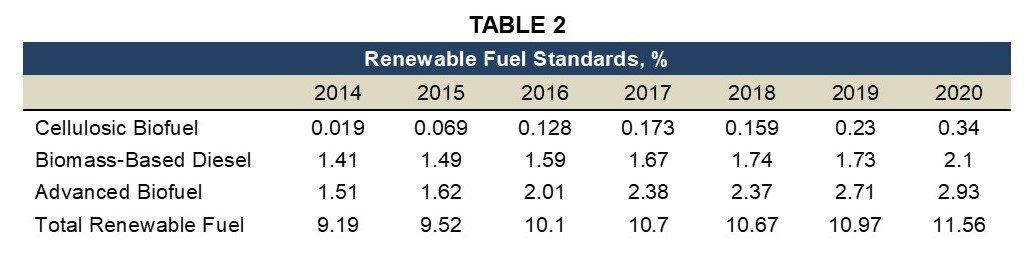

The volume requirements of Table 1 are then translated into an annual renewable fuel standard and adopted into the RFS regulation. Table 2 displays the RFS requirements of an obligated party to demonstrate compliance. This nuance is important for the industry to understand.

An obligated party can either satisfy their obligation by directly blending the appropriate renewable fuel, or by purchasing a Renewable Identification Number (RIN). In addition, a party can choose to carry-over up to 20% of prior year RINs to satisfy the next years compliance obligation. The total volume of carried-over RINs is known as the RIN Bank.

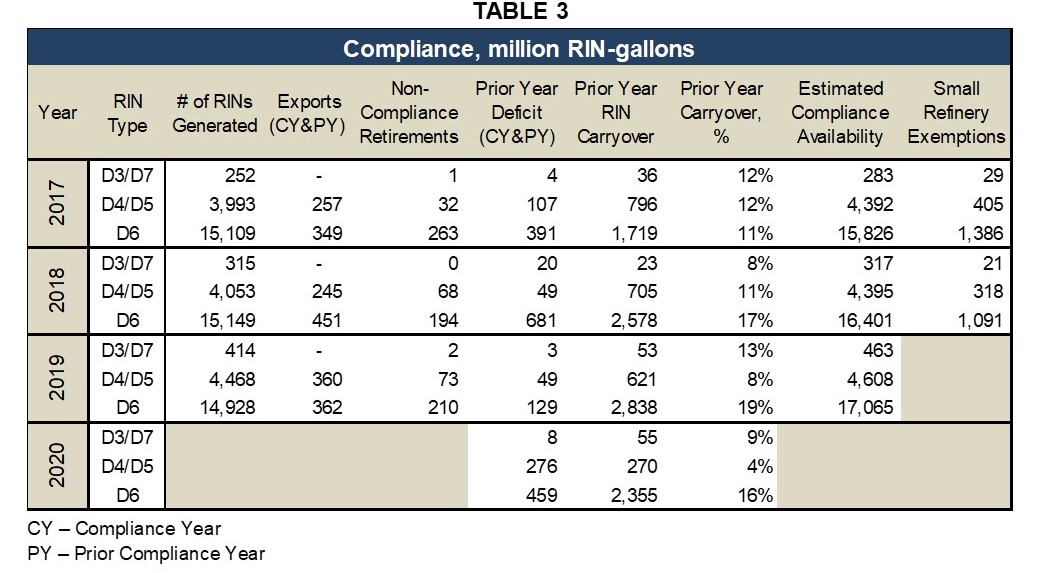

Table 3 shows a look into the last three years of the RFS program compliance. The table gives a glimpse into the outlook for 2020 and 2021 RIN Bank. The RIN carryover should be in the healthy 10%-20% range in order to help keep RIN prices from fluctuating significantly.

Pay particular attention to the percentages of D4 / D5 Prior Year carryover. This volume has decreased each year from 12% in 2017 to an estimated 4% currently. The current carry-over of D4 / D5 RINS is estimated at only 270 million RIN gallons. Also of note, the compliance deficit for D4 / D5 RINS carried forward is approximately 276 million RIN gallons, which will consume all of the prior year RIN carryover (270 million RIN gallons).

Another variable is the uncertainty around the small refinery exemptions (SRE) and the requirement that the exempted volume must be redistributed across all other obligated parties. As of July 16, there were 27 petitions for 2019 awaiting approval, and 1 petition for 2020. It is unclear whether these petitions will be approved. We believe some small refineries fulfilled their 2019 obligation while others did not and await a final decision by the agency. In addition, the agency announced in March their intent to extend the 2019 RFS compliance date for small refiners. Therefore, it is not possible to fully know the extent of the small refinery obligation which was fulfilled in 2019.

“Note that on March 27, 2020 the Agency announced its intent to extend the 2019 RFS compliance date for small refineries to provide them with additional flexibility. As a result, 2019 compliance data does not reflect input from small refineries who have not yet retired RINs or submitted annual reports.”

For illustration purposes only, if most small refiners leveraged this extension and have not yet fulfilled their obligation, there may be upwards of an additional 320 million D4 / D5 RIN gallons which must be retired for 2019 compliance.

In conclusion, TM&C anticipates the RIN Bank to continue to be stressed, which in turn will lead to higher price volatility in the RIN market.

TM&C’s Fuels Regulatory Practice has a wealth of experience spanning several decades in virtually all of the clean fuel programs affecting refiners and marketers. In addition, the practice received accreditation as a third-party verification body for the California LCFS program. Throughout its history, TM&C has provided consultation on EPA and state fuel programs in essentially all aspects of compliance. TM&C publishes a monthly newsletter focused on a deeper dive into the current regulatory issues facing the industry. If you would like to be included on the distribution list, please visit our “Contact” page on our website and let us know in the message box. For questions regarding regulatory issues, contact our regulatory team at (214) 754-0898.

Note: This blog is an update to our recently published Focus on Fuel (FoF) newsletter on the 2021 RFS.