Published on

Tuesday, July 14 2020

Authors :

Robert Auers and John Auers

It wasn’t long ago that Kelcy Warren (Chairman and CEO of Energy Transfer) said he was so proud of the Dakota Access Pipeline (DAPL) project that he thought of it as if it were his son. Perhaps this was because he was able to build and start-up the 570 MBPD pipeline back in 2017 despite significant opposition. Like a proud father, he saw it become a very successful and critical component of the U.S. crude infrastructure environment, carrying growing volumes of Bakken crude from North Dakota to Patoka, IL, where it could then be sent farther to the United States Gulf Coast (USGC) and exported to world markets. This comparison ultimately reminded us of the 1980 John Lennon ballad, “Beautiful Boy,” written about his only son with Yoko Ono, Sean. But Warren’s “Beautiful Boy” took a major and surprising hit on July 6, 2020, when U.S. District Judge James Boasberg ordered that DAPL must be emptied of crude oil by August 5 until a complete Environmental Impact Statement (EIS) can be completed, a process that will likely take at least a year. In today’s blog, we examine what might come next in this saga and examine potential implications of a world where DAPL might no longer be available.

“Say a little prayer” – Prospects for the decision being overturned

Energy Transfer (the pipeline operator) immediately requested a stay from Judge Boasberg to allow the pipeline to continue to operate while the EIS is completed, but the request was quickly denied. However, Boasberg appeared sympathetic to extending the shutdown date, particularly as Energy Transfer testified that it would take approximately three months to safely empty the pipeline. Still, Energy Transfer said they would prefer a quick denial rather than spend more time negotiating a final shutdown deadline to enable an Appeal to the D.C. Circuit Court of Appeals. Time will tell whether or not this appeal will prove successful, but we do expect that, in any case, the pipeline will continue to operate at least through August (and possibly well into the fall) even if a stay is not granted, based on an agreed upon safe shutdown process.

If Energy Transfer and the Army Corp of Engineers fail to get the requested stay and is forced to shut down, the ultimate fate of the pipeline will likely depend on the results of the U.S. Presidential Election in November. The Trump Administration could be expected to allow for an expedited EIS that could likely be completed sometime in the second quarter of 2021. Upon completion of the EIS, Energy Transfer would be able to restart the pipeline. However, if Biden wins, his administration would be able to withdraw any remaining court appeals that have not yet been ruled upon (as U.S. Army Corp of Engineers is actually the entity being sued). At that point, the Biden administration could essentially delay issue of the EIS indefinitely. As a result, DAPL would likely remain shut down at least until the end of a Biden administration and would only be able to restart again if and when a more friendly administration is elected in the future. In the case of a Biden victory, the Trump Administration could also attempt to push through a rushed EIS to be issued before Trump left office in January, though such a rushed EIS is sure to be challenged (and likely overturned) in court.

“I guess we’ll both have to be patient” – Waiting to see the impacts of the shutdown

If DAPL is shutdown, several options exist for North Dakota producers to transport their crude to market, but there are limits and issues with each option. First, it’s important to note that Bakken production has fallen by over 400 MBPD since peaking at over 1.5 MMBPD in the fourth quarter of 2019. While the return of shut-in wells may cause a slight bump in production in July and August, as compared to May and June, this bump is likely to be short-lived. This is because of a near total lack of both drilling and completion activity at current price levels, which will result in natural declines at existing wells causing a resumption of production decreases until crude prices rise enough to incentivize new activity. As a result, the demand for alternative transportation options will be much lower than it would have been just a few short months ago.

The first step would be to fill spare capacity on existing lines to Guernsey, WY (where additional pipes connect to Cushing, OK) and north to the Canadian Border, from which pipelines can carry the barrels farther to the Enbridge Mainline and from there to Superior, WI, to the Rest of PADD 2, and even down to the USGC. However, some issues remain, particularly as some barrels produced in the Eastern part of the Bakken are not able to effectively access pipelines going to Guernsey, WY. The completion of the 150 MBPD South Bend pipeline to Baker, MT, in Mid-2021 should solve this issue, but pipeline capacity (without DAPL) would still be insufficient to meet demand. A return of production growth would further exacerbate the shortage of pipeline takeaway capacity.

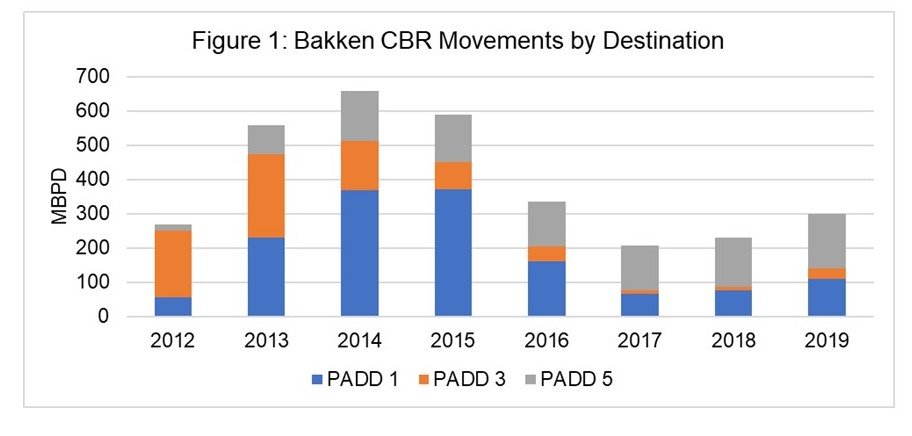

As a result, producers will likely be required to turn to rail to move barrels which can’t be placed on pipelines, just as they did before DAPL started up in 2017. The volumes from the Bakken going to Washington State refineries by rail would certainly continue to flow regardless of the pipeline situation, due purely to economics. A Washington State law passed last year had effectively limited this volume to historical levels of ~160 MBPD, but this regulation was overruled by the U.S. Department of Transportation in May 2020, meaning that Washington State refiners can now officially increase their receipts of crude-by-rail (CBR) volumes from the Bakken to whatever level economics dictate. It is likely that this decision will be challenged in court by the state of Washington and a Biden administration may reverse the ruling of the current U.S. Department of Transportation anyway. Regardless of how this plays out, it is unlikely that Washington state refiners can increase their CBR receipts above 200 MBPD, at least in the near term. Any remaining barrels will need to be railed to the East Coast, the primary destination for Bakken CBR prior to the completion of DAPL in 2017. Still, despite the existing infrastructure necessary for CBR (which was built out prior to DAPL), it will take some time to ramp up volumes again. The rail companies will be hesitant to ramp up activity without longer term agreements, which in turn may be a difficult proposition due to the uncertain outlook for DAPL, at least until the results of the presidential election are known in November. Figure 1 displays historical Bakken CBR movements by destination, illustrating that the physical capacity is there, even if it may take some time and will to revive it. Certainly, the cost to move barrels by rail will be higher than by pipe, which will result in lower netbacks for Bakken producers and as a result lower production level. And of course, it’s certainly difficult to make the case that it is an environmental or safety “win” to shift barrels from pipeline to rail.

“The Monster’s (not) gone” – Broader Implications

The most important fallout from this decision, outside of North Dakota, if the decision holds up, is likely to be the new precedent set by the court that an operating pipeline, with no safety or operation issues can be shut down, regardless of the economic disruption. This will further deter new pipeline investment across the U.S. as the costs and risk associated with greenfield (and even brownfield) midstream investment continues to increase. The issues and recent judicially imposed hurdles imposed on other key pipelines, including Enbridge Line 3 and Line 5, Keystone XL, and the Atlantic Coast pipeline (which caused its recent cancellation) further illustrate these issues.

TM&C constantly monitors developments of all types impacting petroleum demand and supply and the evolving regulatory environment surrounding the petroleum industry. We include our independent analyses of these impacts in our semiannual Crude and Refined Products Outlook, the most recent edition of which was released in late February, with the next edition, the 2020 Crude and Refined Products Outlook Mid-Year Update due out in August 2020. For more information on this or on any of our other analyses or our consulting capabilities, please send us an email or give us a call at 214-754-0898.