The RFS was established by the Energy Policy Act of 2005 and was expanded as part of the Energy Independence and Security Act (EISA) of 2007. The 2005 statute is generally referred to as “RFS1” and the 2007 statute as “RFS2.” The program has been administered by the U.S. Environmental Protection Agency (EPA). The RFS2 statute required the EPA to establish volume requirements for four categories of biofuels for each year from 2008 through 2022: cellulosic biofuel, biomass-based diesel, total advanced biofuel, and renewable fuel. The RFS statutes require the EPA to implement the standards via annual rulemakings, with the final rules to be released by the end of November prior to the compliance year. The statute includes annual volume targets and requires EPA to translate those volume targets or use alternative volume requirements using the statutory waiver authority.

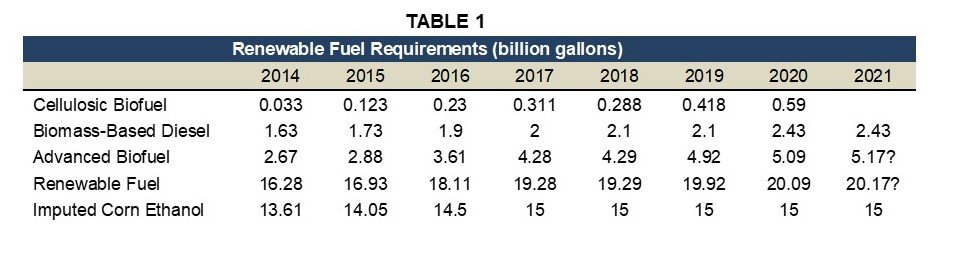

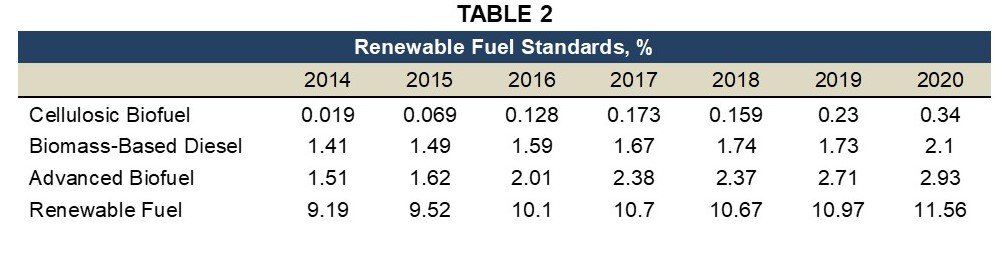

Tables 1 and 2 show the last seven years of RFS requirements and yearly percentage standards that obligated parties must meet to demonstrate compliance with the RFS as set by a formula in the 2010 EPA rulemaking. Sources are saying that the EPA has put the 2021 blending mandate on hold. Many anticipated that the 2021 mandate would be set at 20.17 billion gallons as shown in Table 1. You will note that the imputed corn ethanol has remained constant at 15 billion gallons since 2017. Also of interest is that the advanced biofuel obligation increased by 15% and 3.5% respectively in compliance years 2019 and 2020 and is anticipated to increase another 2% in 2021.

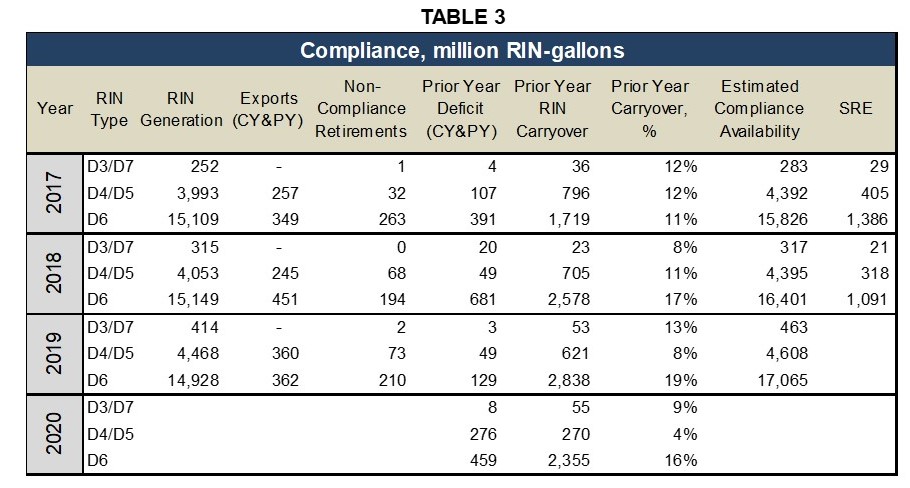

Table 3 shows a look into the last three years of RFS compliance. The table can give a glimpse of the outlook for 2020 and 2021 RFS compliance. The estimated compliance availability is calculated from adding prior year RIN carryover to RIN generation and then subtracting out RINs used when exporting renewable fuel, noncompliance retirements, and prior year deficit. Prior year RIN carryover should be in the healthy 10%-20% range in order to help keep RIN prices from swinging wildly since an obligated party can use up to 20% prior year RINs in order to satisfy its obligation. It is worth paying particular attention to the D4/D5 RIN carryover since it has been decreasing each year, going from 12%, 11%, 8%, and down to 4% from 2017 through 2020. The 2019 D4/D5 carryover into 2020 is only 270 million RIN gallons. The D4/D5 prior year deficit at 276 million RIN gallons essentially swallows all of the prior year RIN carryover. It is unclear whether any small refineries will be granted a hardship exemption in 2019. We believe that some small refineries fulfilled their 2019 obligation while others did not. It is not possible to know the extent of the small refinery obligation that was fulfilled in 2019 since they were allowed to extend their compliance and there is no public data posted. Below is an excerpt from the EPA’s website.

“Note that on March 27, 2020 the Agency announced its intent to extend the 2019 RFS compliance date for small refineries to provide them with additional flexibility. As a result, 2019 compliance data does not reflect input from small refineries who have not yet retired RINs or submitted annual reports.”

If most small refineries did not yet fulfil their obligation and were mandated to, there might be up to an additional 320 million RIN-gallons of D4/D5 that must be retired for 2019 compliance. The 320 million RIN-gallons of D4/D5 is based on what the 31 small refineries that were granted hardship petitions retired in 2017. Granted that there are 27 outstanding 2019 small refinery exception (SME) petitions, the effect could be on the same order of magnitude.

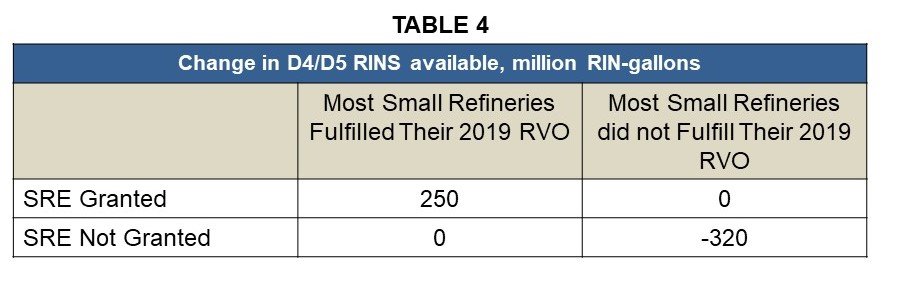

To reiterate the impact that the EPA ruling on 2019 SME could have on the 2020 RFS, consider Table 4. If most small refineries fulfilled their 2019 RVO and the SME were granted, the small refineries would be unretiring their 2019 RINs, which can be expected to be 80% of retired RINs. The extreme of this case could put 260 million RIN-gallons of D4/5 on the market. Contrary, if most small refineries did fulfil their 2019 RVO but were not granted hardship petition, they could be purchasing and retiring 320 million RIN-gallons, most likely of 2019 vintage. So, there should be some swing of RIN levels depending on the 2019 SRE ruling and how many small refineries already satisfied 2019 RFS compliance.

Without even discussing how many RINs have been generated in 2020 and the expected renewable volume obligation, it is clear that even if small refinery hardships were granted, meeting the 2020 D4/D5 RVO will be difficult. Prior year D4/D5 RIN carryover went from 8% to 4% from 2019 to 2020. If you factor in the D4/D5 deficit directly with the prior year D4/D5 RIN carryover, the numbers from 2019 to 2020 go from 8% to 0%. Also consider that the advanced biofuel obligation increased by 3.5% from 2019 to 2020, and is anticipated to increase by another 2% in 2021.

TM&C Fuels Regulatory Practice has a wealth of experience spanning several decades in virtually all of the clean fuel programs affecting refiners and marketers, and we are now available as a third-party verification body for the LCFS program. Throughout its history, TM&C has provided consultation on EPA and state fuel programs in essentially all aspects of compliance. TM&C publishes a monthly newsletter focused on a deeper dive into the current regulatory issues facing the industry. If you would like to be included on the distribution list, visit our “Contact Us Page” on our web site and let us know in the message box. Feel welcome to give our regulatory compliance team a call at (214) 754-0898.