Published on

Tuesday, July 7 2020

Authors :

Julia Tossetti, Elizabeth Hilbourn and Cinda Lohmann

Last week’s blog touched on the California Low Carbon Fuel Standard (CA-LCFS) program, and the prominent role it occupies in the renewable fuels market. This week, we focus more closely on it. First, a general discussion of how the program works will give us the appropriate context. Next, some of the recent trends in feedstock credit generation will be covered. Lastly, we shall examine three emerging transportation fuels: biogas, hydrogen, and alternative jet. The analyses in this blog will give us some idea of the changes in the CA-LCFS market since 2017.

The CA-LCFS’ goal is to reduce the carbon intensity of California’s transportation fuel pool by at least 20% by 2030. Simply put, the regulation creates a system in which transportation fuels generate credits and deficits. The use of fuels that generate the latter (i.e., petroleum diesel, gasoline, etc.) must be balanced by the usage of credit-generating fuels like biodiesel and ethanol. Whether a fuel generates a credit or deficit depends on the difference between its pathway carbon intensity (CI) value and the benchmark CI value, which is determined by the California Air Resources Board (CARB). The latter decreases each year, which ultimately causes annual increases in the required volumes of low-CI fuels. Given this background and context, it is time to examine recent trends of the CA-LCFS program.

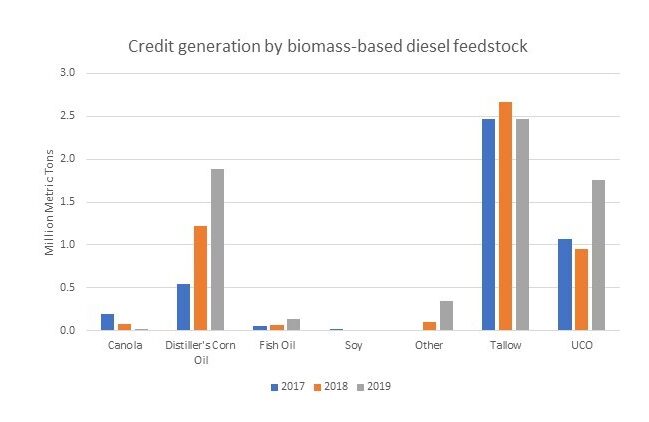

Figure 1, which illustrates credit generation by feedstock, shows a few interesting items. Look at distillers’ corn oil (DCO) and used cooking oil (UCO). Of the top three credit-producing feedstocks, these two have changed the most since 2017. DCO, which is a waste made during ethanol production, has steadily generated more and more credits. Formerly, this oil was predominantly utilized in animal feed but demand for it has shifted to the biomass-based diesel sector because of its coveted status as a waste feedstock. To help keep pace with demand, some ethanol plants now co-produce DCO. The pathway certifications of this feedstock from 2017 through 2019 have all been to domestic companies, which indicates that the steady uptick in DCO has been driven by the Midwest corn sector.

Figure 1 Source: Data from CARB

Source: Data from CARB

The story for UCO is also quite interesting. From 2017 to 2019, 46 UCO pathways were certified: four of them to foreign companies. One of these has a very sizeable production capacity, and it so happens that its pathway was certified in early 2019. This helps account for the surge of UCO credits generated that year. By contrast, the crop-based feedstocks, canola and soy oil, are dwindling. This makes sense because the biomass-based diesels that they produce have relatively high CIs; significantly greater quantities of them are needed to balance deficits. The opposite is true for waste-based feedstocks; smaller amounts can meet the deficit requirements since the CIs of their fuels are lower.

An additional point of interest concerns the “Other” category. This corresponds to nonlipid feedstocks, namely forestry residues. Since these feedstocks are quite different from lipids, they must undergo a different treatment to make biomass-based diesel. Current technologies favor the processing of lipids, which explains their preponderance of credit generation. Nevertheless, it is remarkable that despite their small credit volumes, these forestry feedstocks boosted their credit generation by 236% from 2018 to 2019.

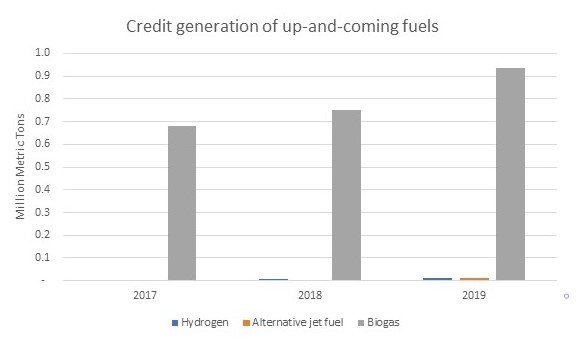

Figure 2 shows the recent credit generation of three up-and-coming fuels: biogas, hydrogen, and alternative jet. Biogas clearly has the biggest presence largely because it is interchangeable with fossil natural gas; it can be moved in the same distribution system and applied to the same array of uses (i.e., electricity production, transportation fuel, etc.) It can also be produced through a variety of pathways, landfill gas being the most historically predominant. Two additional pathways, animal manure and waste water treatment are also increasing in popularity. Last year, 11 manure and 5 waste water biogas pathways were certified, the largest annual number of these pathway certifications yet. In the same year, 34 landfill biogas pathways were also certified. It is because of these new pathways that biogas credit generation jumped in 2019. There is a lot of interest surrounding the animal manure pathways because their CI values are quite low. This is because the biogas generated from this process is categorized as having avoided methane venting.

Figure 2 Source: Data from CARB

Source: Data from CARB

The next fuel of interest, hydrogen, is generally produced using either the methane in natural (NG), or electricity. Either process can be accomplished using fossil or renewable energy. Unsurprisingly, this affects the CI value of the resulting hydrogen. It is interesting to note that in 2019, 7 pathways were approved to produce hydrogen from biogas. This was the largest number of such pathways to be certified in one year. In a similar vein, producing electricity from biogas is also gaining momentum; this pathway was approved for the first time last year. Unfortunately, data showing the breakdown of hydrogen produced from fossil versus renewable energy is not available. Perhaps this is because its credit generation is still relatively minute; however, this could very well change in coming years, depending on the development and deployment of transportation technologies that use hydrogen. Figure 2 also illustrates the emergence of alternative jet fuel, which is produced by additional refining of renewable diesel. Its presence is relatively small, but there is a spate of renewable jet projects happening worldwide. Some of them will produce the fuel using traditional lipid feedstocks, while others are on track to utilize the forestry residue feedstocks mentioned earlier.

Earlier this year, Turner, Mason & Company completed the application and training requirements to become an accredited verification body for the California LCFS program. In 2018, CARB approved amendments to LCFS, strengthening carbon reduction targets through 2030 and beyond. Included in the amendments was a requirement for third-party verification. Beginning with fuel pathway applications submitted in 2020, regulated entities are required to retain the services of independent verification bodies accredited by CARB. For more information about the verification process, including entities that are subject to the process, please visit our website: www.turnermason.com and send us a note under ‘Contact’ or give us a call at 214-754-0898.