Published on

Tuesday, September 22 2020

Authors :

Eamon Cullinane

On Monday, September 14, the EPA announced it denied 54 “gap-year” petitions filed by small refineries stating that since the refineries have already been able to comply with their past annual RFS obligations and have indeed remained a commercial entity, they do not qualify for the exemptions. This represents a win for the farmers and a loss for the small refineries; however, it seems the small refiners could potentially benefit via financial relief in the form of cash payments as the Trump Administration tries to satisfy both sides ahead of the November election. In today’s blog, we will discuss what “gap-year” petitions are, how did we get here, and what this means for the future.

How did we get here?

In 2005, as the RFS1 rulemaking was going into place, the EPA formed the Small Business Impact panel to reflect on how the rulemaking could potentially impact any small businesses in the industry. It was through this panel that the EPA decided it would be best to exempt all small refiners from compliance with the rulemaking through 2010. The EPA established a “small refiner” at the time and defined it as having fewer than 1,500 employees and less than 155 MBPD of crude processing capacity. Note, that a small refiner refers to the company where as a small refinery refers to the plant.

In 2010, the DOE conducted a study to determine whether or not the RFS2 rulemaking was leading to “Disproportionate Economic Hardship” (DEH) for small refineries. In the study, the DOE defined small refineries as having less than 75 MBPD of crude processing capacity. Note, this new definition allowed large refiners who happened to own small refineries to seek exemption. The study did indeed find that DEH would occur to some of the refineries, and the EPA would need to extend the small refinery exemptions to those that would be affected.

Each year after, refiners have been allowed to apply for an extension of the exemption on a case-by-case basis to demonstrate DEH. Those petitions are reviewed by the DOE and then decided upon by the EPA based on the DOE’s recommendation. Since you can submit a petition at any time, a refiner can go back and submit petitions for a previous year at any point if they choose. Recently, some refineries took advantage of this and applied for waivers going back multiple years to when they had never originally filed for an exemption. These petitions became known as “gap-year” petitions.

On January 24, the 10th Circuit Court of Appeals ruled it a requirement that a small refinery must have consistently received the exemption in prior years. Thus, to qualify for future waivers, a refinery would have to have been granted the initial blanket exemption and then received exemption extensions from 2011 to now. This led to a spike of gap-year petitions as refineries worried the 10th Circuit Court’s opinion would be implemented on a national level and many small refineries would no longer be eligible for the exemption.

This is when the EPA and DOE hit the pause button to reflect on how to handle these petitions. The reality was complicated. They already had a high-level court saying the gap-year petitions are voided while both the farmers and small refiners sent countless letters arguing their side and urging President Trump to get involved. It is worth noting that the RFS2 statute mandates the EPA has 90 days to provide a decision on an exemption petition. So, what happened after 90 days? Nothing. The refineries noted this and notices of intent to sue the EPA started coming in with the likes of Delek Refining, Kern Oil and Refining, and United Refining.

Even if the EPA did approve of the gap-year petitions, how would it work? If a refinery was given an exemption for the 2012 compliance year in 2020, it would make no sense to provide 2012 RINs as they have all expired. Do you provide them with current year RINs? How did the refinery experience DEH in 2012, comply with the obligation and still continue to operate today?

Where are we today?

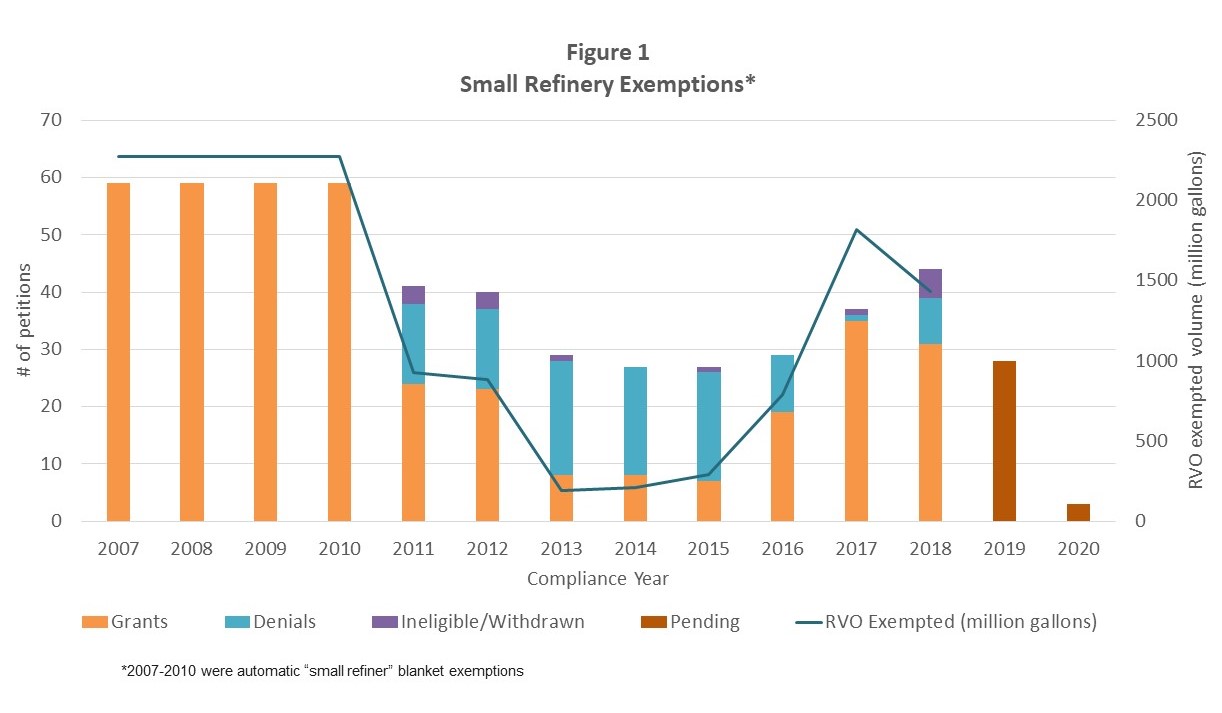

Last week, it was announced that the DOE reviewed 54 of the 68 gap-year petitions and found that none of them were able to prove that their viability was affected, but most did experience some degree of structural hardship. That being said, the DOE recommended 50% relief for the majority of the 54 petitions; however, the EPA denied all relief even to the refineries in which the DOE recommended 50% relief. The EPA argued that the DEH was not enough to prevent these refineries from complying with their past annual RFS obligations and have indeed continued to remain a commercial entity. Figure 1 reflects these denials along with the assumption that the remaining 14 gap-year petitions will be denied.

What does this mean?

This means RVO exemptions will remain the same for previous years with regards to small refinery exemptions. Even though the DOE only reviewed 54 of the 68, based on the EPA’s decision and commentary, we expect all 68 gap-year petitions to be denied. The interesting question will be how this affects the 2019 (and any future year) petitions. The EPA may side with the 10th Circuit Court of Appeals and only allow exemptions to refiners who have been previously granted exemptions from 2011 to present. This means at a maximum only seven refineries could potentially qualify and only 1-2 (most likely) of those having exemptions for each year. If this were to happen, there would be very low RVO exemption levels moving forward. Even lower than as seen during 2013 to 2016 before the Trump Administration and EPA started granting an increased number of petitions.

So how does this impact the RINs market?

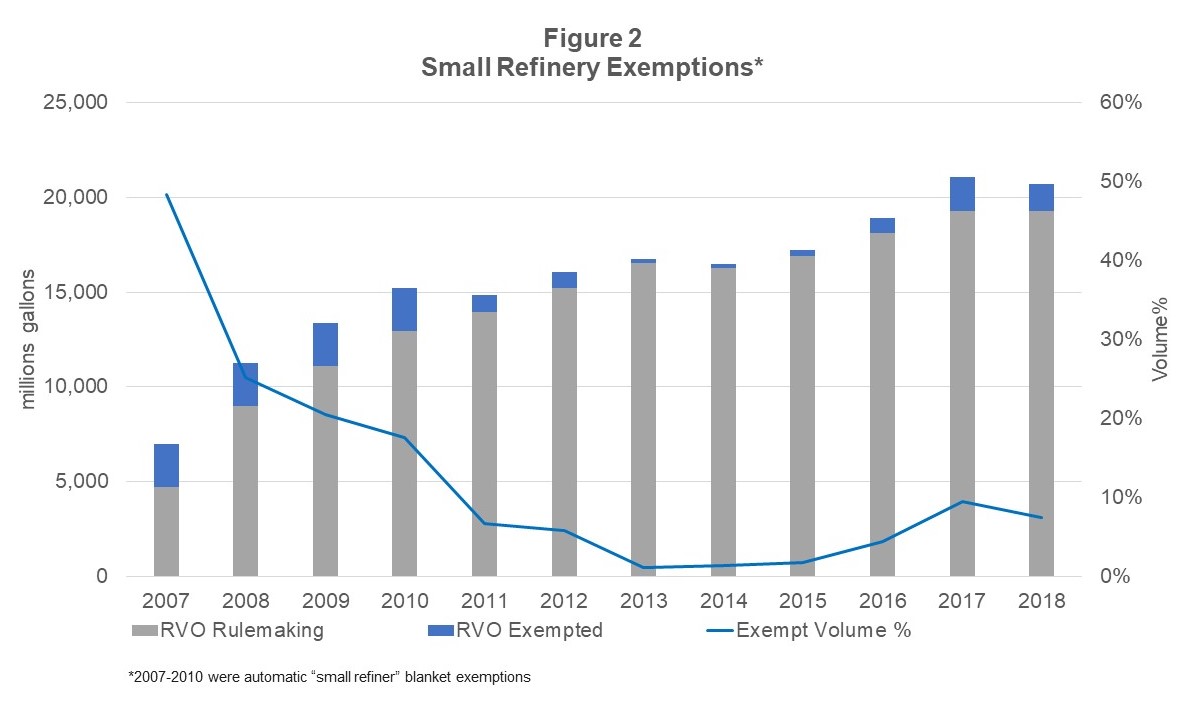

Recall, small refinery exemptions are retroactively granted and the EPA in the past has not estimated any expected exemptions volumes, leading to a reduction in the RFS fuel mandates each year. Note, this year the EPA has gone to an estimating system of future waiver volume exemptions due to the high amount of SRE waivers over the past few years. (2020 projected volume of gasoline/diesel for exempt small refineries is 4.24/3.02 billion gallons). The exemptions, in turn, allow the refineries to sell back RINs to the market creating additional RIN supply. This, then, drives RIN pricing down and further hurts the RIN producers. If the waivers are denied, the opposite is true and more obligated parties are required to procure RINs, driving up both demand and the price.

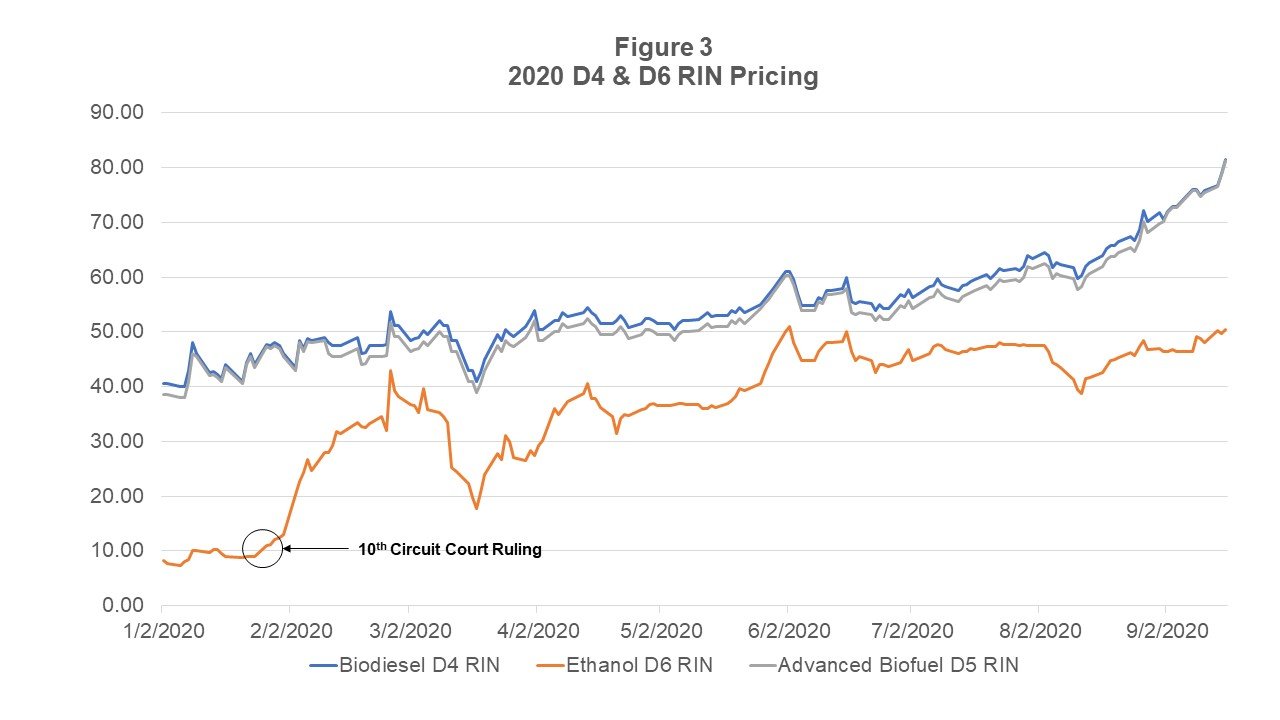

Yet none of this applies to past gap-year petitions. Remember, all those small refineries already complied with the volume obligations and for the majority of these past years, those RIN vintages don’t even exist anymore. So, from a fundamental’s standpoint, the denial of these exemptions should not impact the RIN price. This is unlike current petitions that do indeed affect the supply and demand of RINs in the market. For example, notice when the 10th Circuit Court denied three recent petitions in February this year, the D6 RIN price spiked.

Cash relief for small refineries?

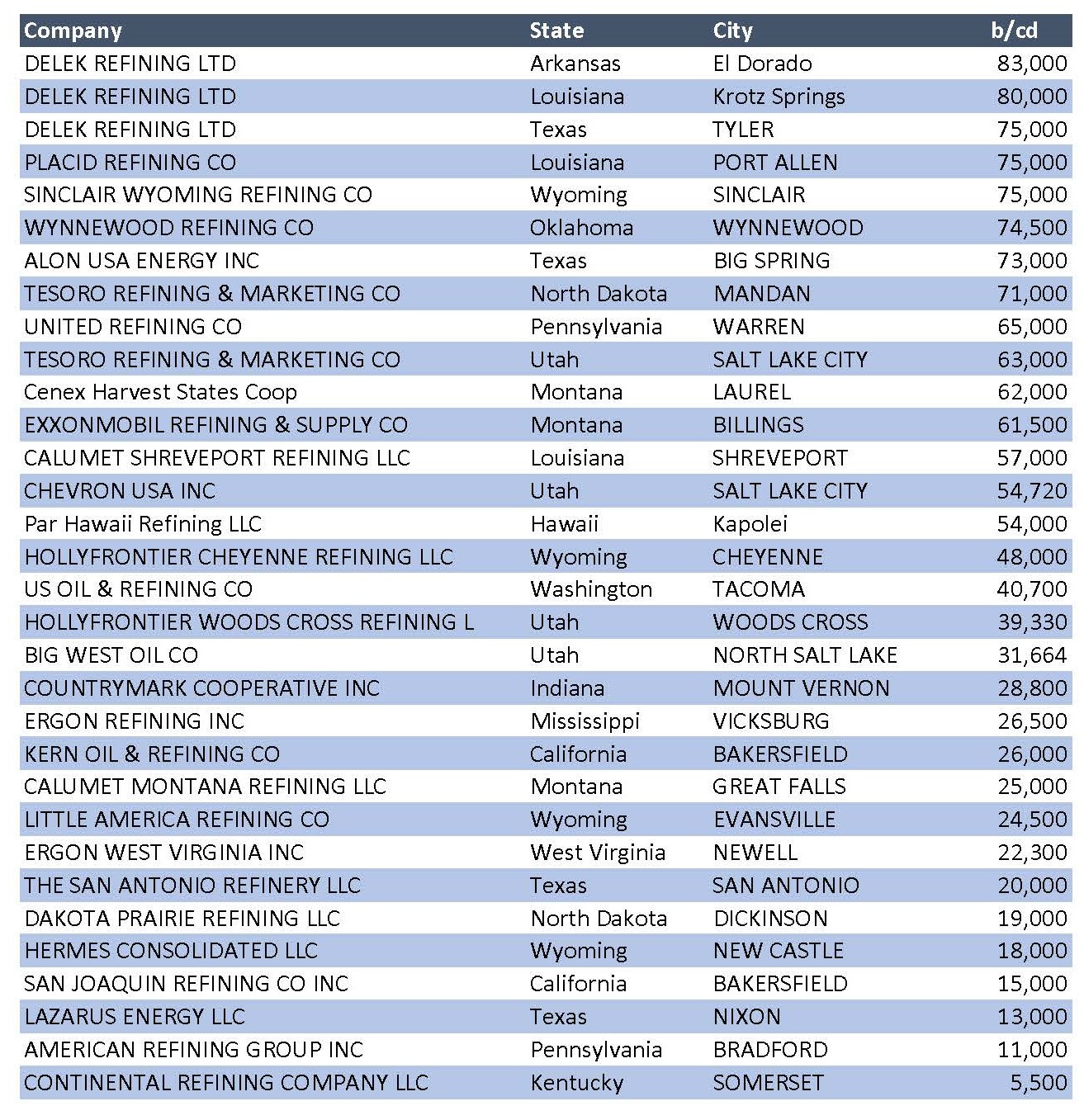

Lastly, reports claim that the Trump Administration is in discussions to create a financial package for the refineries denied to offset the potential economic damage. The cash might come from a reallocation of the COVID-19 relief funding. It is not clear which refineries will be eligible for the relief and since the SRE process is not transparent in terms of which refineries have applied for the exemptions, it is not possible to know which refineries have been granted or denied exemptions; however, through company announcements, lawsuits, letters to the EPA, letters to the Trump Administration, and other documents, here is a list of 32 refineries that have been publicly tied to the SRE program at some point in time.

Table 1

Turner, Mason & Company is continually monitoring developments in the global petroleum markets and assessing how they will impact the industry. Considering the dynamic events impacting the petroleum industry (IMO, COVID-19, trade wars, low carbon standards, EV incentives, sanctions, OPEC policy, etc.), the future landscape of the petroleum industry is as uncertain as ever. TM&C not only executes regular and comprehensive studies of the industry, such as the Crude and Refined Products Outlook and Worldwide Refinery Construction Outlook, but also one-off studies focusing on specific issues. We also use the findings of these studies and our expertise to assist clients in all segments of the petroleum supply chain in specific and focused consulting engagements. For more information on our subscription studies or our consulting capabilities, please call us at 214-754-0898 or visit our website at www.turnermason.com.