Published on

Tuesday, September 29 2020

Authors :

Robert Auers and John Auers

“Take this Job and Shove It” was written by David Allen Coe in 1977 and made famous that same year by Johnny Paycheck. Just as the protagonist in the song is making plans to quit his long-time and unsatisfying factory job, British Petroleum (one of the original “Seven Sisters”) more and more appears to be taking similar plans toward abandoning their long-time business of oil and gas production. While company leadership first used the phrase “Beyond Petroleum” to re-brand the firm almost two decades ago, it has really accelerated the process in recent years by selling both upstream and downstream assets and pushing into renewables in a major way. Certainly, the Macondo tragedy and resulting financial hit played a part in some of these steps, but general industry developments and a shifting regulatory environment have been even bigger drivers. Like all petroleum companies, BP was hit hard by the 2014-2016 oil price crash and now the even more severe COVID-19 driven demand cliff, paired with increasingly unfavorable government policies targeted at fossil fuels appear to have pushed BP to throw in the towel, and begin a full-on switch to “green energy.” The pessimistic view that BP has shifted toward regarding petroleum was further supported by the major changes made in their recent and highly publicized release of their 2020 Energy Outlook. We discuss those updates, the assumptions BP has employed in arriving at those views and highlight some of the major ways we differ with their outlook in today’s blog.

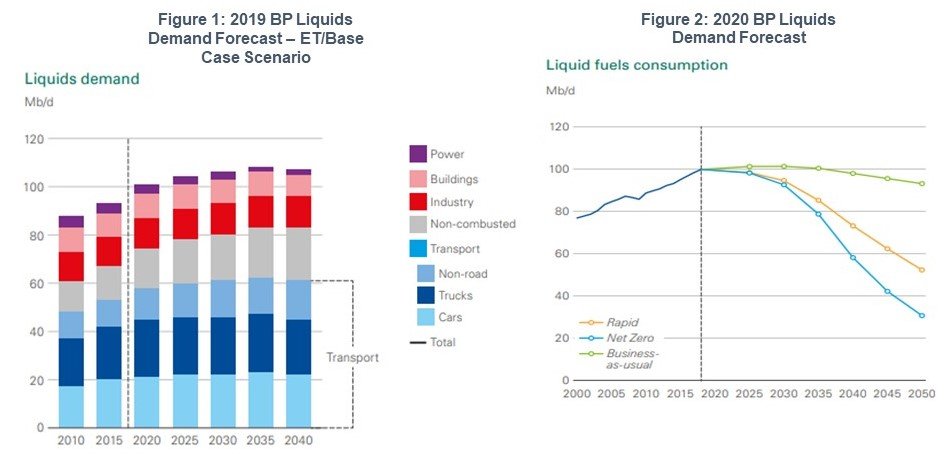

BP has significantly lowered their liquids demand forecast in their 2020 Energy Outlook relative to the 2019 edition of the same publication. Last year, BP forecasted global liquids demand to peak around 2035 at about 108 MMBPD in their Evolving Transition (ET) scenario, which was essentially their base case. BP also presented several alternative cases with 2040 petroleum demand expected to come in somewhere between 81 and 129 MMBPD in the range of cases. In the 2020 edition, BP presents only three scenarios – Business-as-usual, Rapid, and Net Zero. The “Business-as-usual” scenario, which is by far the most bullish of the three, assumes that government policies, technologies, and consumer preferences across the globe continue to slowly evolve in line with trends seen over the recent past. The “Rapid” scenario assumes more aggressive measures are taken, leading to a 70% decrease in global CO2 emissions by 2050. The “Net Zero” scenario, takes this even farther and assumes a 95% reduction in CO2 emissions by 2050. In the Business-as-usual scenario, BP projects petroleum demand to plateau just above 100 MMBPD in the back half of the 2020s before declining to roughly 95 MMBPD by 2040. The other two scenarios assume the liquids demand has already peaked, with demand expected to shrink to 55 MMBPD and 30 MMBPD by 2050 in the “Rapid” and “Net-Zero” scenarios, respectively. This data is presented in Figures 1 and 2 (both taken directly from BP’s Energy Outlook), below.

In making the major adjustments from their 2019 forecast, BP assumes that the COVID-19 pandemic will have significant long-term negative implications with regards to global petroleum demand. In the “Rapid” scenario, which appears to effectively be their base case, COVID-19 is expected to have a 3 MMBPD impact on 2025 demand and still have a 2 MMBPD impact as far out as 2050; however, even these large adjustments pale in comparison to their overall reduction in demand. Since BP has essentially lowered their 2040 demand forecast by 20-30 MMBPD, the large majority of this reduction is implied to be unassociated with COVID-19 and instead presumably due to stricter regulations and more rapid improvements in technologies to develop alternative sources of energy.

While, as Yogi Berra famously said, “it’s tough to make predictions, especially about the future,” we don’t see any reason for such a monumental shift in expectations in just a year’s time. In fact, while the COVID-19 lockdowns have certainly had an unprecedented impact on demand over the last several months, our longer demand outlook (beyond 2025 and especially after 2030) has changed little from last year. This is based on our view that COVID-19 and the governmental reaction to the pandemic will have limited residual impact with regards to global petroleum demand, in most cases just accelerating trends (such as work from home and expanded use of virtual meetings and conferences) that were already accounted for in our previous forecasts. We have also taken a less pessimistic view of the impact of anti-carbon policies in our base case and as such, we do not anticipate a peak in global demand before 2040 (the end of our outlook period); by which time, we expect global petroleum demand to reach almost 113 MMBPD.

BP provides limited explanations for the large changes in their Outlook from last year beyond the COVID-19 related adjustments we noted above. Certainly, EV sales (thus far this year) have, on a year-over-year basis, performed much better than those for ICEVs, but this was expected, particularly with several new models being released this year, with most primarily targeted for the European market. There have not, however, been any significant breakthroughs in battery technology over the past year that would lead us to believe the trajectory of technological improvement in batteries has been fundamentally altered in the way that the BP outlook evidently assumes. In fact, Nikola Motors, perhaps the most well-known developer of both Electric and Hydrogen trucks, is facing an SEC investigation and the resignation of its Founder and Chairman, Trevor Milton. While the final outcome of this investigation remains to be seen, recent events certainly cast doubt on the progress of their technology.

Despite this lack of major breakthroughs in potential replacements for petroleum, BP expects liquid fuels to decline to under 55% and under 40% of energy consumption in the transport sector by 2050 in their “Rapid” and “Net Zero” scenarios, respectively. Meanwhile, both scenarios expect a doubling in both road and air travel by 2050 relative to a 2018 baseline. To produce this result, BP assumes that 70-85% of the existing stock of passenger vehicles (cars and light-duty trucks) will be electric by 2050. Their forecasts in this area imply that sales of new cars would likely need to be majority electric by around 2030 and nearly 80% electric by 2040, up from around just 2% in 2019. At the same time, they expect the stock of medium-duty trucks to be 20% electric by 2050, implying a significant level of market penetration post-2030, since there are essentially no commercially available electric vehicles in this category on the near-term horizon. These projections ignore a host of likely headwinds with regards to EV uptake across all classes of vehicles, including lithium (and other raw material) supply challenges, charging infrastructure build-out (particularly for those that do not have a private garage at home), and perhaps most importantly, consumer acceptance. Looking at medium duty trucks, the issues become even more fraught, as the low energy density of batteries, as compared to liquid fuels, along with unacceptably long charge times, are major issues.

BP’s assumptions for petroleum substitution in other demand categories also appear extremely aggressive. They expect Marine consumption to shift primarily to hydrogen, ammonia and LNG by 2050 with Aviation continuing to rely almost entirely on liquid fuels (though they do expect a shift to primarily biofuels). On the aviation side, we agree that liquids will remain dominant (due to the lack of alternatives that meet the energy density requirements for this sector), but are very skeptical biofuels will penetrate the market as quickly as BP forecasts. On the Marine side, we don’t foresee the rapid uptake of hydrogen as a marine fuel. Zero-emissions hydrogen production (the only means of production that would justify its use rather than natural gas, a marine fuel) remains expensive and there is little indication that this technology can be developed and then scaled at that level in just thirty years.

In closing, BP’s assumptions appear too aggressive with regards to the rise of renewables and the decline of petroleum demand. While only a small portion of the demand destruction is directly blamed on COVID-19, it appears they have taken the short-term impacts of COVID-19 and the related government-imposed lockdowns and extrapolated these results out into the future. While they have partially explained their forecasts with an expected increase in the uptake of renewable fuels and electricity in the transportation sector, they do little to explain how such a revolution will take place in such a short amount of time. Moreover, demand is already recovering in many parts of the world, with Chinese demand already up on a year-over-year basis. Finally, while timing, regarding the end of the COVID-9 pandemic, remains uncertain and its long-term consequence on the global economy, consumer behavior, and petroleum demand remain equally clouded, we continue to believe that the COVID-19 pandemic will eventually pass and that the “new normal” will closely resemble the “old normal” in many respects, at least until a true paradigm shifting breakthrough takes place.

Turner, Mason & Company is continually monitoring developments in the global petroleum markets and assessing how they will impact the industry. Considering the dynamic events impacting the petroleum industry (IMO, COVID-19, trade wars, low carbon standards, EV incentives, sanctions, OPEC policy, etc.), the future landscape of the petroleum industry is as uncertain as ever. TM&C not only executes regular and comprehensive studies of the industry, such as our Crude and Refined Products Outlook and World Refinery Construction Outlook, but also one-off studies focusing on specific issues. We also use the findings of these studies and our expertise to assist clients in all segments of the petroleum supply chain in specific and focused consulting engagements. For more information on our subscription studies or our consulting capabilities, please call us at 214-754-0898 or visit our website at turnermason.com.