Published on

Wednesday, March 15 2023

Authors :

Harold "Skip" York

The impact of net-zero goals on petroleum company equity prices

Several petroleum companies made net-zero pledges just before the onslaught of COVID-19. Their investor presentations emphasized growth of their New Energies portfolio over prioritizing returns (similar to shale companies prior to 2019). These companies had an expectation that environmentally conscious investors would shift from relatively higher emissions petroleum companies in favor of those with lower carbon energy assets in their portfolios.

As companies work toward achieving net-zero goals, one measure of success is how their stock prices perform relative to peers without such a pledge. We delve into the implications of such pledges on equity prices and corporate portfolio positioning.

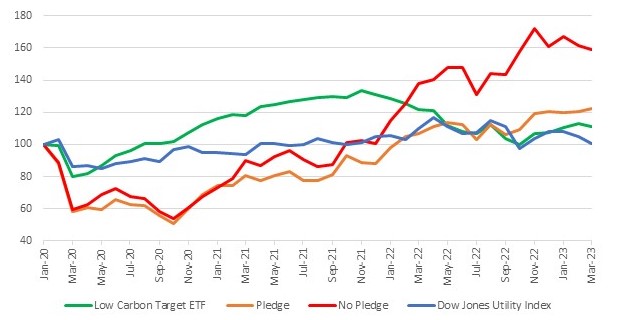

The chart below shows an equity price index for petroleum companies making a “net zero pledge” (orange line) and another index (red line) for petroleum companies that have not. A “net-zero premium” has yet to materialize for several reasons. In the near-term, new energy investments struggled to match returns from traditional energy assets as oil prices rose with the reopening of economies from the COVID pandemic (note the opening of a gap starting in early-2021). This gap in returns has been exacerbated by the “war premium” in crude oil and LNG prices since the beginning of the Russia-Ukraine conflict, i.e., a widening spread between red and orange lines beginning in Feb 2022. Additionally, over the longer term, companies need to resolve other uncertainties, such as verifying the quality of carbon offsets and how companies remain committed to the timeframe (at least four to six CEOs tenures) required to reach net-zero goals.

Figure 1: Equity Prices of Petroleum Companies (January 2020 = 100)

However, the “clean energy” trade (green line) did work for a number of companies with lower carbon exposure, such as Apple, Coca Cola, and Tesla. As this trade became more crowded and returns were diluted, low-carbon stock prices peaked in late-2021. Now these low carbon and net-zero petroleum company indexes are pricing more like regulated utilities (blue line). It appears net-zero petroleum companies face the challenge of their efforts not fully satisfying any investor group.

To close the current stock price gap with no pledge companies, net zero petroleum must demonstrate maintaining historical profitability by delivering low-carbon investments with returns that compete more effectively for company capital. These companies need to be much clearer on explaining why they have a competitive advantage in the New Energy space and what returns that advantage might capture. Not surprisingly, during recent earnings calls, several net-zero petroleum companies shifted investment focus from New Energy growth to one emphasizing returns and profitability, in other words, circling back to petroleum investments.