Published on

Thursday, January 25 2024

Authors :

Harold "Skip" York

“This would be so much easier if I wasn’t color blind”

Donkey in Shrek

So far, none of our analysis of hydrogen value chains depends upon the “color”, e.g., carbon intensity, of any hydrogen production process. However, as carbon costs change, the value of hydrogen in some applications also changes. This blog covers how the carbon intensity of hydrogen production might impact its value to end-users.

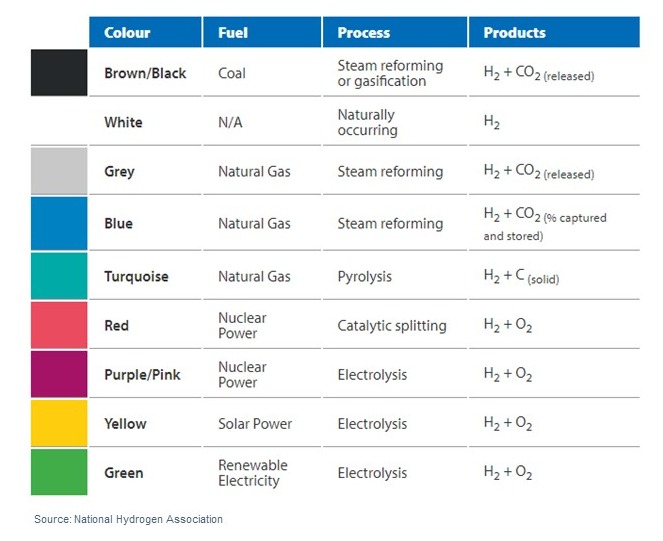

Recall from our first blog that almost all hydrogen is manufactured rather than extracted. There are several different production processes that typically are grouped by carbon intensity, which is differentiated by colors. As seen in Figure 1, the pathways to hydrogen are as numerous as the colors of the rainbows.

Figure 1: Various Hydrogen Production Pathways

The traditional approach to manufacturing hydrogen is using natural gas (“gray”) or gasified coal (“brown”) to feed a SMR (Steam Methane Reforming) unit. A SMR unit that captures its CO2 emissions is referred to as “blue”. Hydrogen produced by electrolysis is referred to as “clean”, with “green” specifically referring to using renewable electricity. However, within any given production process (color), there tends to be little differentiation in technology and thereby operating cost. For example, production by electrolysis is quite expensive today no matter what the “green” source of electricity is. The same high-cost headwinds are true for capturing and sequestering CO2 for blue hydrogen, but within blue hydrogen there might be some cost differentiation depending on the scale of sequestration operations and distance to it.

The competitiveness of different colors of hydrogen is a function of prices for natural gas, carbon, and power. As seen in Figure 2, gray hydrogen currently wins in jurisdictions with modest natural gas prices and no carbon cost (e.g., the US).

Figure 2: Market Conditions that Change Hydrogen Production Economics

Blue hydrogen is an arbitrage between the levelized operating cost of sequestration and the cost of carbon offsets. Based on current technology, blue hydrogen is competitive with gray when hydrogen prices are rising and carbon prices approach US$50/ton.

Green hydrogen becomes more competitive as carbon and natural gas prices rise, but power prices are low. Thus, a green hydrogen plant needs to be located where clean power generation is on the margin, renewable infrastructure is at scale, and ample availability of purified water as a feedstock. Green hydrogen must have competitive logistics in a market with high natural gas and carbon prices. Consider the case where low-carbon hydrogen is a substitute for natural gas in power generation. If electricity transmission lines between these markets exist, wheeling green power directly to that market saves the thermal inefficiency of converting power to hydrogen, shipping the hydrogen, and converting hydrogen back to power. If power transmission between the markets does not exist, the levelized cost (plus thermal efficiency loss) of green hydrogen must be cheaper than the levelized cost of a new transmission line.

Very few of today’s markets will satisfy the conditions necessary for low-carbon hydrogen to compete. Pursuing these projects today depends on either government intervention (e.g., the 45V tax credit in the US) or a view that industries that use hydrogen as a feedstock, rather than an energy source, will be willing to pay a premium to gray hydrogen as part of their decarbonization plans. Our next blog will take a closer look at projects overcoming critical challenges to commerciality.

TM&C is actively consulting with clients seeking to evaluate hydrogen investment opportunities. For more information about areas we can assist you and your organization in hydrogen or any other areas of the energy landscape, please reach out to us at contact@turnermason.com or give us a call at 214.754.0898.