Published on

Tuesday, May 17 2022

Authors :

John Auers

There is no more love coming from or going to Russia since they began their brutal invasion of Ukraine in late February than there was between SPECTRE and 007 in the classic James Bond thriller from the early 1960s. While repercussions of the invasion and subsequent sanctions imposed on Russia are being felt in a wide range of economic sectors, the petroleum industry and markets have been impacted in the most dramatic ways due to the size and global scope of the Russian petroleum industry. Because Russia is both a major exporter of crude, feedstocks and refined products, these impacts have shaken the very foundations of the entire petroleum supply chain and are likely to result in long-term shifts in trade flows and market dynamics through all sectors of the industry. While these shifts will be global, some regions have and will continue to experience more dramatic impacts; which, in the case of Europe in particular, will likely result in a vastly different outlook for the Continent’s petroleum and overall energy markets than were expected prior to the invasion on February 24. In the case of the U.S., which was the first major country to impose comprehensive oil sanctions, the effects have certainly resulted in some challenges, especially for refiners who have had to find replacements for Russian crude and feedstocks and gasoline blenders who had been importing Russian blendstocks. However, both producers and refiners have benefitted to a much greater degree from the increased demand for crude and products necessary to replace lost Russian barrels.

In a multi-part blog series, we will take a look at the impacts that the fallout of the Russian invasion of Ukraine has had and will have on refining markets. We start this series with a look at those impacts, both good and bad, on the U.S. refining industry and will follow up with similar blogs which focus on the impacts on refined products markets and refineries in other parts of the world, particularly Western Europe.

Tightening Global Refined Product Supply – Dramatically Higher Product Margins for U.S. Refiners

The biggest impacts on the U.S. oil industry from the Russian/Ukraine war have not been the direct effects of the sanctions imposed by the government, but rather the overall global shortage of refined products, particularly middle distillates, which has gotten worse since the invasion. Russia is a major exporter of middle distillates, which primarily flow into Europe. Although a significant volume of those exports continue to flow, we estimate that those volumes have been reduced by over 300 MBPD, with those reductions expected to grow as Europe continues to find replacements and moves toward formal embargoes of Russian barrels. This loss of supply adds to other factors which had already resulted in a globally tight middle distillate market prior to the Ukraine invasion. These other factors include a strong recovery in demand for both jet fuel and diesel as COVID-19 restrictions have been removed. Also, increased volumes of distillates flowing into the bunker market (as a result of the 2020 IMO low sulfur rules), and a significant loss of global refining capacity as over 3.5 MMBPD has been shuttered since 2019 (due both to COVID lockdowns and Energy Transition fears). High natural gas prices and issues with replacing Russian crude oil have also crimped refinery operations in Europe (a subject we will cover in more detail in subsequent blogs). As a result of this tightened supply/demand balance, middle distillate margins have soared to unprecedented levels and remain above $50 per barrel with no relief in sight. Gasoline margins have also increased significantly, recently reaching levels close to those for distillates. As we move into the summer driving season, we can expect these margins to grow further and exacerbate the distillate crunch as refiners shift some production toward gasoline. As a result of these margins, U.S. refiners will likely report earnings in 2Q which will dwarf the excellent earnings which they just reported for 1Q. Looking further out, while significant uncertainties exist in how the Russian/Ukraine conflict is resolved and in regards to many other market dynamics, we believe it is likely global refined product supply/demand will remain tight for quite some time. This assessment is based on our view that Russian refined product volumes will remain depressed and Energy Transition policies will negatively impact other product supply more than it slows demand growth.

Direct Impacts of U.S. Sanctions – Loss of Gas Oil and Heavy Feedstocks Are Most Significant and Refinery Specific

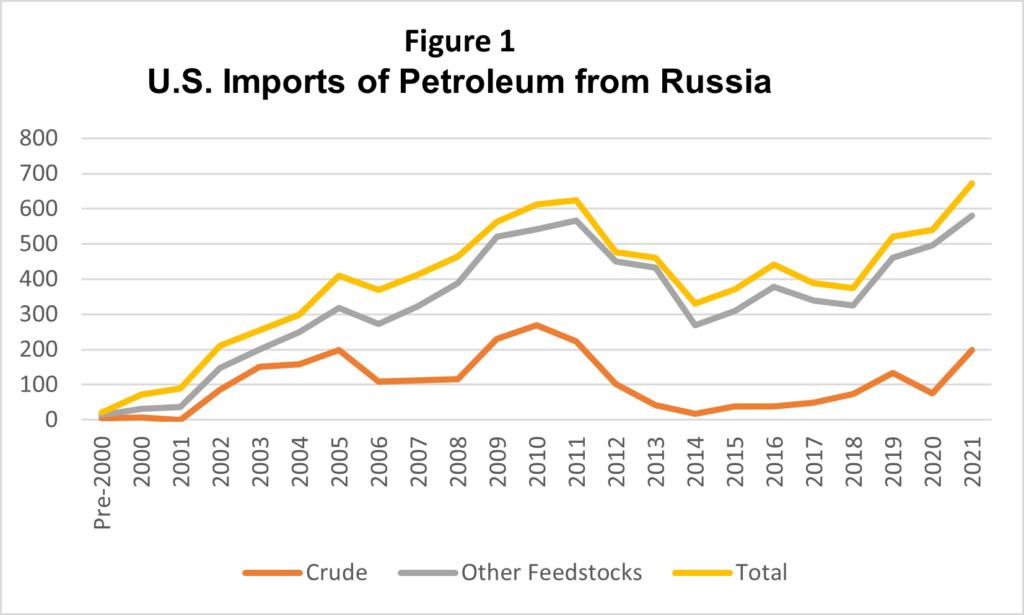

While the supply and margin impacts that the Russian invasion has contributed to are certainly the most significant effects, the sanctions imposed by the U.S. government prohibiting the import of Russian petroleum (in a move announced on March 8) has been substantive as well. Total imports of Russian petroleum totaled 672 MBPD in 2021 (the highest level ever) and have averaged 484 MBPD since 2010. Most of these imports were residual and gas oil feedstocks (382 MBPD or 56%), with the remainder being crude (199 MBPD or 30%) and products/blendstocks (92 MBPD or 14%). Figure 1, shows how these imports have trended over the past two decades.

While the total volume of Russian imports is relatively small considering total U.S. refinery throughput (>16 MMBPD) and product demand (about 20 MMBPD), they have been important in certain regions and at specific refineries. Noncrude feedstocks have made up not only the bulk of the Russian barrels imported into the U.S., but they are also “thinner” markets than crude and, therefore, harder to find equivalent replacements. On a regional basis, the East Coast has been the most dependent on Russian feedstocks. Including crude, 12% of total refinery throughput at East Coast plants has been imported from Russia, four times the proportion that refineries in the rest of the country processed. Certain deep conversion refineries on the USGC had also developed healthy appetites for Russian barrels (particularly noncrude heavier feedstocks such as M-100). In total, over 70% of total crude/feedstock imports from Russia (over 60% of total Russian imports) were sent to ten refineries, all but one of which were on the Gulf Coast or East Coast.

Table 1

| Refinery | Location | PADD | MBPD | |||

| Crude | Resid | VGO | Total | |||

| Valero | St Charles/Meraux | 3 | 7 | 78 | 19 | 104 |

| XOM | Baytown | 3 | 0 | 57 | 6 | 63 |

| Valero | Port Arthur | 3 | 0 | 28 | 13 | 41 |

| Valero | Corpus Christi | 3 | 13 | 0 | 27 | 40 |

| PBF | Delaware City/Paulsboro | 1 | 20 | 0 | 11 | 32 |

| Monroe | Trainer | 1 | 29 | 0 | 0 | 29 |

| Motiva | Port Arthur | 3 | 19 | 7 | 2 | 28 |

| XOM | Baton Rouge | 3 | 3 | 12 | 11 | 25 |

| Marathon | Anacortes | 5 | 24 | 0 | 0 | 24 |

| P66 | Bayway | 1 | 0 | 2 | 23 | 24 |

| Chevron | Pascagoula | 3 | 0 | 14 | 7 | 21 |

| Par Pacific | Kapolei, HI | 5 | 19 | 0 | 0 | 19 |

| Valero | Wilmington, CA | 5 | 12 | 0 | 7 | 19 |

| Other | PADD 3 | 15 | 31 | 9 | 55 | |

| Other | PADD 5 | 37 | 7 | 13 | 56 | |

| Total | 199 | 235 | 147 | 581 | ||

| PADD 1 | 50 | 2 | 34 | 86 | ||

| PADD 3 | 57 | 227 | 93 | 377 | ||

| PADD 5 | 92 | 7 | 20 | 119 | ||

Overall, U.S. refiners, even those that had been running significant volumes of Russian crude and feedstocks, appear to be successfully replacing those Russian barrels. This follows their successful experience with replacing Venezuelan imports (historically, a more substantial part of refiners feedslates, particularly on the USGC) when those barrels were sanctioned in 2019. The USGC refiners which have incorporated heavy M-100 barrels into their feedslates in order to help fill their cokers (as replacements for the lost Venezuelan barrels as well as declines in heavy crude supply from Mexico) have and will find replacements from several sources. These include increased volumes of high sulfur resid which have come on the market as a result of the 2020 0.5% S IMO rules, additional heavy crude coming from the Middle East as OPEC quotas are increased, and higher volumes of resid coming out of Mexico as PEMEX tries to force more crude through their ill-equipped refineries. This does not mean that there won’t be challenges and impacts. PBF has publicly stated that they aren’t currently able to reactivate their FCCU at their Paulsboro, NJ refinery (which was shuttered during the COVID lockdowns) due to the unavailability of gas oil feedstock. Other East Coast refineries are also challenged in replacing the lost Russian crude, a task which is made more difficult from the potential loss of CPC blend crude oil from Kazakhstan, which is currently facing potential force majeure related to the Russian/Ukraine conflict and increased competition from European refiners for barrels as they try to find alternatives to Russian barrels themselves.

Product imports from Russia have been very minimal, making up only an average of 55 MBPD over the last decade, with the 2021 level of 92 MBPD being the high watermark. Gasoline blendstocks (and a small amount of finished gasoline) make up the largest portion of these imports, accounting for about two-thirds of the total, and these are almost exclusively brought into the East Coast. While any loss of product in the tight supply/demand environment we are currently in has some impact, we believe replacing the lost Russian barrels is not a major challenge, as they account for less than 10% of total gasoline imports into PADD 1 and only about 2% of total regional gasoline consumption.

European refiners and the Continent’s crude and refined markets have been much more affected by the Russian invasion and subsequent pivot away from Russian crude and products, since they are much more dependent on imports from Russia. Within Europe, the impacts vary significantly by country and region (and even specific refinery), based on the level of that dependence and the ability to access barrels from other regions. In our next blog in this series, we will focus on both the current and longer-term effects the Russian/Ukraine situation is having in the European refining industry and markets and what steps are being taken by the different governments and companies reacting to those impacts.

Turner, Mason & Company Mid-Year Outlook

TM&C will be monitoring and analyzing refined product markets in detail over the next few weeks and providing an updated version of our Crude and Refined Products Outlook in August. Developments in Ukraine and the overall Atlantic Basin will play a very large part in how those markets evolve and our views on how they play out over the short, medium and long term will be incorporated into the Outlook. This Mid-Year Outlook will include a comprehensive price forecast for both refined products and crude in all the key U.S. and regional markets. An updated view of both product demand and refining capacity changes on a regional and global basis will be available, a detailed analysis of midstream and logistics developments and a look at how the evolving regulatory environment will impact all parts of crude and refined product markets.