Published on

Thursday, June 23 2022

Authors :

John Mayes

Administration Calls for Increased Refinery Production are Ill-Informed

On June 14, President Biden sent a letter to the executives of seven oil companies: Marathon, Valero, ExxonMobil, Phillips 66, Chevron, BP, and Shell. In the letter he chastised the companies for having high profit margins at a time of war and especially at a time of high prices.

“At a time of war, refinery profit margins well above normal being passed directly onto American families are not acceptable. There is no question that Vladimir Putin is principally responsible for the intense financial pain the American people and their families are bearing. But amid a war that has raised gasoline prices more than $1.70 per gallon, historically high refinery profit margins are worsening that pain.”

He also insisted that oil companies should take “immediate actions” to increase the supply of gasoline.

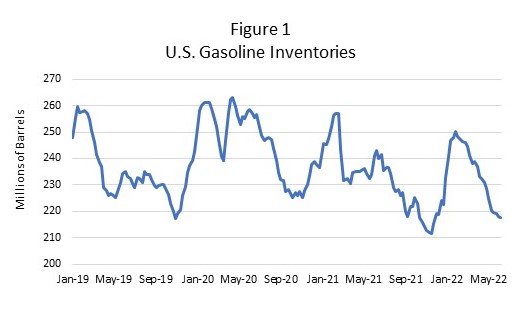

It is true that gasoline inventories are currently very low, particularly for this time of year (Figure 1). Inventories have been lower in the recent past, but these lower levels usually occur in November and at the end of the driving season. The summer driving season typically peaks on the 4th of July weekend.

In a press conference on June 22, President Biden again called on refiners to increase production. Is the refining industry doing all it can to maximize gasoline and distillate production?

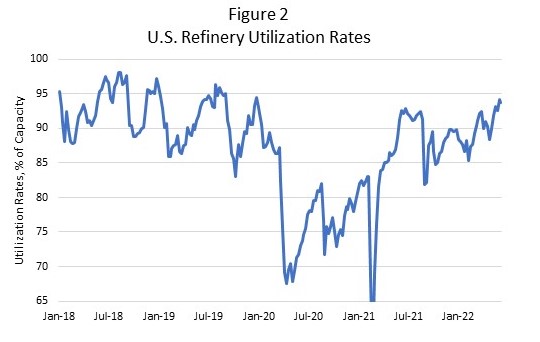

The Energy Information Agency (EIA) compiles data on the U.S. refining industry which is publicly available on its website. One of the many data sets compiled by the EIA is the utilization rate of the U.S. refining system. This is the actual crude oil charge rate divided by the operable capacity on a calendar day basis. The weekly U.S. utilization rates for 2018 onward are shown in Figure 2.

As can be seen, U.S. refinery utilization rates are approaching 95% and have been steadily rising to respond to the demand recovery coming out of the COVID pandemic. The steep downturn in early 2021 was a result of the exceptionally cold Arctic Blast period which shut down numerous Gulf Coast refineries.

In the current environment, every refinery in the U.S. is incentivized to maximize throughput and production of gasoline and distillates. Capacity utilization near 95% is possible for a period as refiners defer maintenance turnarounds and push their facilities within safe operating ranges. But system wide and individual facility operations at these levels are not sustainable. Pushing a refinery too hard can result in unplanned outages and be counterproductive.

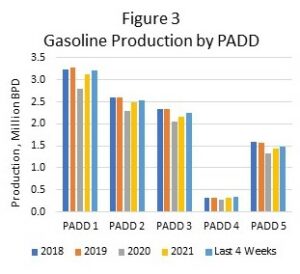

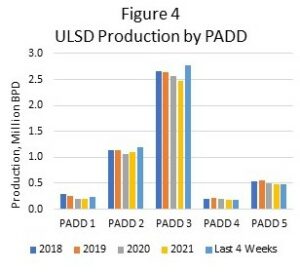

Figures 3 and 4 display historical production rates of gasoline and ULSD by PADD compared to those of the last four weeks. As can be seen, production of both gasoline and diesel is generally comparable to, or above, recent yearly averages despite the shutdown of approximately 2 million BPD capacity since the pandemic. The industry is clearly operating at its maximum capacity.

In addition to pushing utilization rates to near record levels, the refining industry has been proactive in leveraging investments in existing facilities for the production of renewable fuels. In the last decade the industry has invested several billion dollars in 15 renewable diesel facilities which have a total capacity of around 100 MBPD. An additional 12 facilities will be completed in 2022 which will add another 110 MBPD to the diesel supply. Cumulative investments for these and several planned brownfield and greenfield projects will total tens of billions of dollars. The petroleum industry has also invested in ethanol facilities which contributed to total U.S. ethanol production of almost one million BPD last year.

From canceling the Keystone XL pipeline to restrictions on fracking and drilling on federal lands, the U.S. government has been less than cooperative in stimulating production growth. Recently, governors of eight states have petitioned the EPA to eliminate the 1 psi ethanol waiver on E10 gasoline. TM&C estimates this will reduce gasoline production in these states by nearly 16 MBPD, a result of the reduction of blended butane and at least that volume gain of light naphtha and natural gasoline being backed out of the gasoline pool.

So, calls for the industry to take immediate action to increase production from where it is operating currently are ill-informed, short-sighted and fail to give the industry credit for how it has responded to this crisis in the wake of demand destruction during the pandemic and government policies which discourage production causing over 2 million BPD of U.S. capacity to be idled.