Published on

Monday, July 25 2022

Authors :

Cinda Lohmann

With the recent posting of the 2022 Draft Scoping Plan, the California Air Resources Board (CARB) is considering program alignment with this policy direction, including strengthening of the Low Carbon Fuel Standard (LCFS) program with additional reduction targets prior to 2030. In a recent public workshop, CARB hinted to potential considerations for upcoming amendments. We are finalizing a comprehensive assessment of the renewable fuels and feedstocks markets and the role the California LCFS Program plays in balances and prices, but the scoping plan may signal carbon credit price support could be forthcoming.

Draft Scoping Plan Sets the Direction for CA’s Suite of Regulatory Programs

In 2006, the California Global Warming Solutions Act of 2006 [Assembly Bill 32 (AB 32)] was passed, creating a multi-year program to reduce greenhouse gas (GHG) emissions for the state. CARB is required to outline a plan to achieve the GHG reduction targets. This is referred to as the AB 32 Climate Change Scoping Plan (scoping plan). CARB released a draft scoping plan in May 2022. This draft scoping plan, presented to the CARB Board in June, not only supports the current direction for achieving the 2030 GHG reduction targets, but also lays the foundation for achieving carbon neutrality by 2045 with carbon capture and storage through “natural and working lands and mechanical technologies” (CARB, 2022 Scoping Plan Documents, 2022).

Each version of the scoping plan leverages a suite of existing policies and programs to aid in achieving the objectives. The suite includes programs such as the LCFS, the Renewables Portfolio Standard (RPS), the Advanced Clean Cars Program, the Sustainable Freight Action Plan, and the Cap-and-Trade Program. As the 2022 scoping plan is finalized, these existing programs will begin to undergo review and, as necessary, proposed amendments will be made.

CARB Takes a Look at Various Contributors to LCFS Program’s Performance

On July 7, 2022, CARB held a public workshop to continue the informal discussions around the current success of the LCFS regulation and potential changes on the horizon. In preparing for this workshop, the staff reviewed, 1) stakeholder feedback from workshops held in 2020 and 2021, 2) internal assessment of current implementation trends, 3) the market response from 2018 through today, and 4) the draft scoping plan for signals to enhance the program.

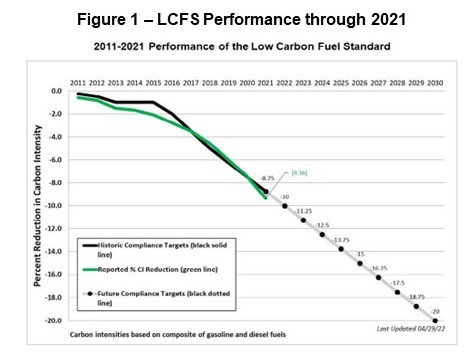

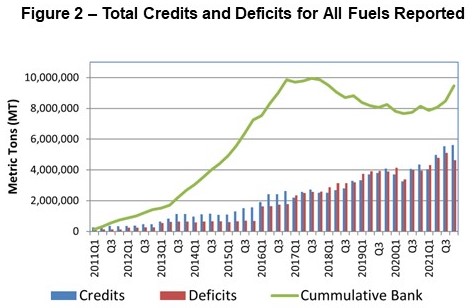

Currently, the LCFS regulation requires a 20% carbon reduction by 2030. As shown in Figure 1, actual reported carbon reductions are trending ahead of the compliance standard target through 2021. A 9.36% reduction was achieved at the end of 2021 versus a target of 8.75% reduction. Even though the compliance standard continues to decline annually, the credit generation has outpaced the deficit, resulting in a build in the LCFS Credit Bank as displayed in Figure 2.

Source: (CARB, LCFS Data Dashboard, 2022)

Source: (CARB, LCFS Data Dashboard, 2022)

This increase has been driven by growth in renewable diesel projects, reduced average carbon intensity of biomethane and electricity, and growth in the zero-emission vehicle (ZEV) fleet increasing electricity credits. In 2021 alone, alternative fuels have displaced over 2.7 billion gallons of petroleum fuel. Based on these trends, CARB is apparently thinking to re-evaluate the annual compliance targets and plan beyond 2030.

CARB Hints at Potential Amendments to LCFS

The LCFS is one of the programs the scoping plan relies upon to achieve the ambitious goals for addressing climate change. The current draft scoping plan is likely to be updated and brought before the Board in November 2022 for final approval. In anticipation of the Board’s approval, the LCFS Staff has begun to explore options to amend the LCFS program to align with the direction of the draft scoping plan. They will continue to monitor the policy direction in parallel with conducting informal workshops on potential regulation changes.

During the July 7 meeting, CARB hinted at ways the LCFS program may be amended to support the reduction and replacement of fossil fuels, accelerate the investment in low-carbon fuel production, and provide for long-term price signals to support the transition to ZEVs.

One of the key changes mentioned during the meeting was an update to the near-term targets prior to 2030. CARB laid on the table two different scenarios for which they are seeking the feedback from stakeholders: 25% or 30% reduction by 2030. Based on our assessment, any changes in the near-term targets would not occur prior to the 2025 compliance year. CARB is then looking at further reductions post 2030. Again, how aggressive the reductions are will depend upon the modeling of various scenarios in support of the scoping plan goals. How far out CARB will take the reductions is also being discussed. Should CARB decide to establish reduction targets to 2045, this may provide the necessary signal to investors.

CARB is also looking to align future LCFS incentives targeted at markets in most need of investment to displace fossil fuel consumption. They used the incentives for the electric forklifts as an example where LCFS incentives drove the desired outcome for this target market. They also spoke to consideration for phasing out credit incentives for mature low-carbon technologies. Again, the electric forklift sector was used as an example. But could CARB take this farther and start to phase out incentives for the mature market of the ethanol or biodiesel?

CARB will be evaluating the role the LCFS credits play to accelerate the deployment of ZEV refueling infrastructure with the existing light duty sector as well as medium / heavy duty vehicles. Consideration is being made for hydrogen refueling infrastructure as well as fast-charging infrastructure. Will credit generation periods be limited? This is something else that was mentioned during the workshop.

As with the 2018 amendments, CARB is evaluating new fuels which may potentially be subject to the regulation. These could include reportable hydrogen fuel and intrastate fossil jet fuel. Opt-in fuels such as dimethyl ether, methanol, and ammonia were also placed on the table. Even opt-in potential for zero-emission applications such as rail, agricultural equipment, commercial harbor craft and airport ground support equipment are being considered.

However, the biggest potential shift was highlighted during the discussion of potential limitations to crop-based feedstocks for biofuel production. What does this mean exactly? Could CARB update the CA GREET model for these biofuels and penalize crop-based feedstocks to address concerns with deforestation, food-to-fuel, or other non-desirable shifts being driven by market incentives?

These are all components which TM&C will be following closely over the foreseeable future as CARB begins to seek stakeholder feedback. We are finalizing a comprehensive assessment of the renewable fuels and feedstocks markets and the role the California LCFS Program plays in balances and prices. This assessment includes market forecasts and a full analysis of the various drivers that impact credit and deficit generation. For more of TM&C’s insight into the California Market, contact Cinda Lohmann (cindalohmann@turnermason.com) or Sam Davis (sdavis@turnermason.com).

References

CARB. (2022, June). 2022 Scoping Plan Documents. Retrieved from https://ww2.arb.ca.gov/our-work/programs/ab-32-climate-change-scoping-plan/2022-scoping-plan-documents

CARB. (2022, July). LCFS Data Dashboard. Retrieved from https://ww2.arb.ca.gov/resources/documents/lcfs-data-dashboard

CARB. (2022, July). LCFS Meetings and Workshops. Retrieved from https://ww2.arb.ca.gov/our-work/programs/low-carbon-fuel-standard/lcfs-meetings-and-workshops