Published on

Thursday, September 1 2022

Authors :

Eamon Cullinane

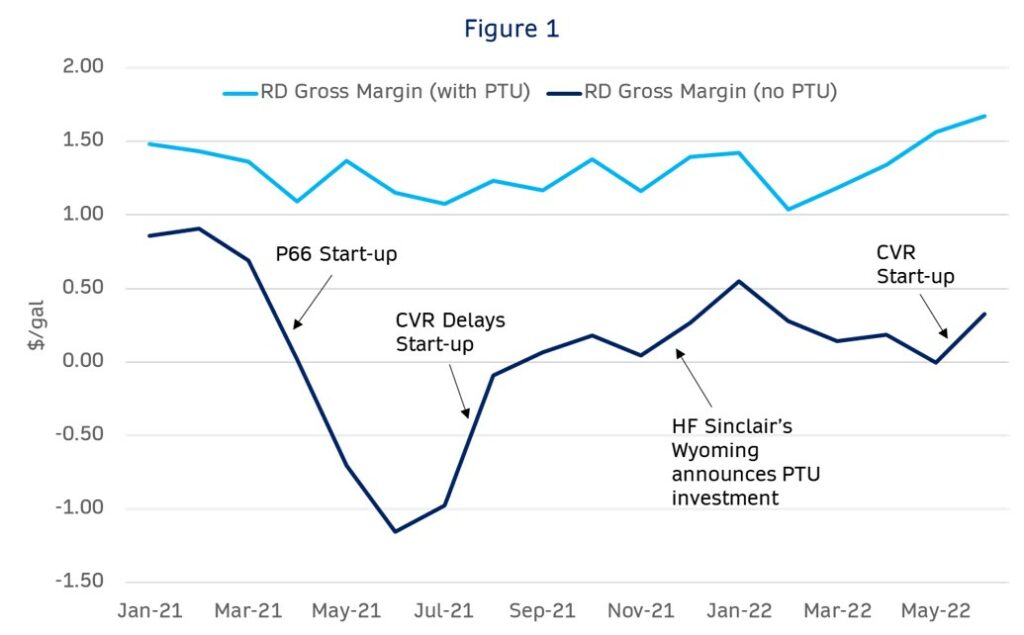

In the race for renewable diesel facilities to come online and capture incentives for low-carbon fuel markets, pressure has been building on the supply and pricing of the feedstock market for biomass-based diesel. To expedite start-ups, facilities such as Marathon Dickinson and P66 Rodeo began production without pretreatment units, requiring them to rely on food-grade refined, bleached, and deodorized (RBD) soybean oil. This put tremendous demand on this single feedstock resulting in increased price pressure and lower gross margins for facilities with no pretreatment units (PTUs).

CVR Energy (CVR) had to delay the start-up of its Wynnewood renewable diesel plant as margins were negative for non-PTU operations during the originally scheduled start-up. CVR CEO, Dave Lamp, said on August 3, 2021, “renewable diesel feedstock prices have increased considerably, particularly for refined, bleached and deodorized soybean oil, to a level where the economics do not make sense for us to complete the conversion at this time.” The plant has since started up as of May 2022, with economics having improved (Figure 1) and the company now pursuing the installation of a PTU which is slated for completion by 2Q 2023.

The PTU has now become essential for financing and more importantly justifying most future renewable diesel investments as it gives producers access to cost-advantaged feeds while helping to preserve hydrotreater catalyst life. It also allows for the greatest amount of feedstock flexibility allowing producers to quickly change slates based on market pricing and remain prepared for any potential developments of new advanced feedstock types.

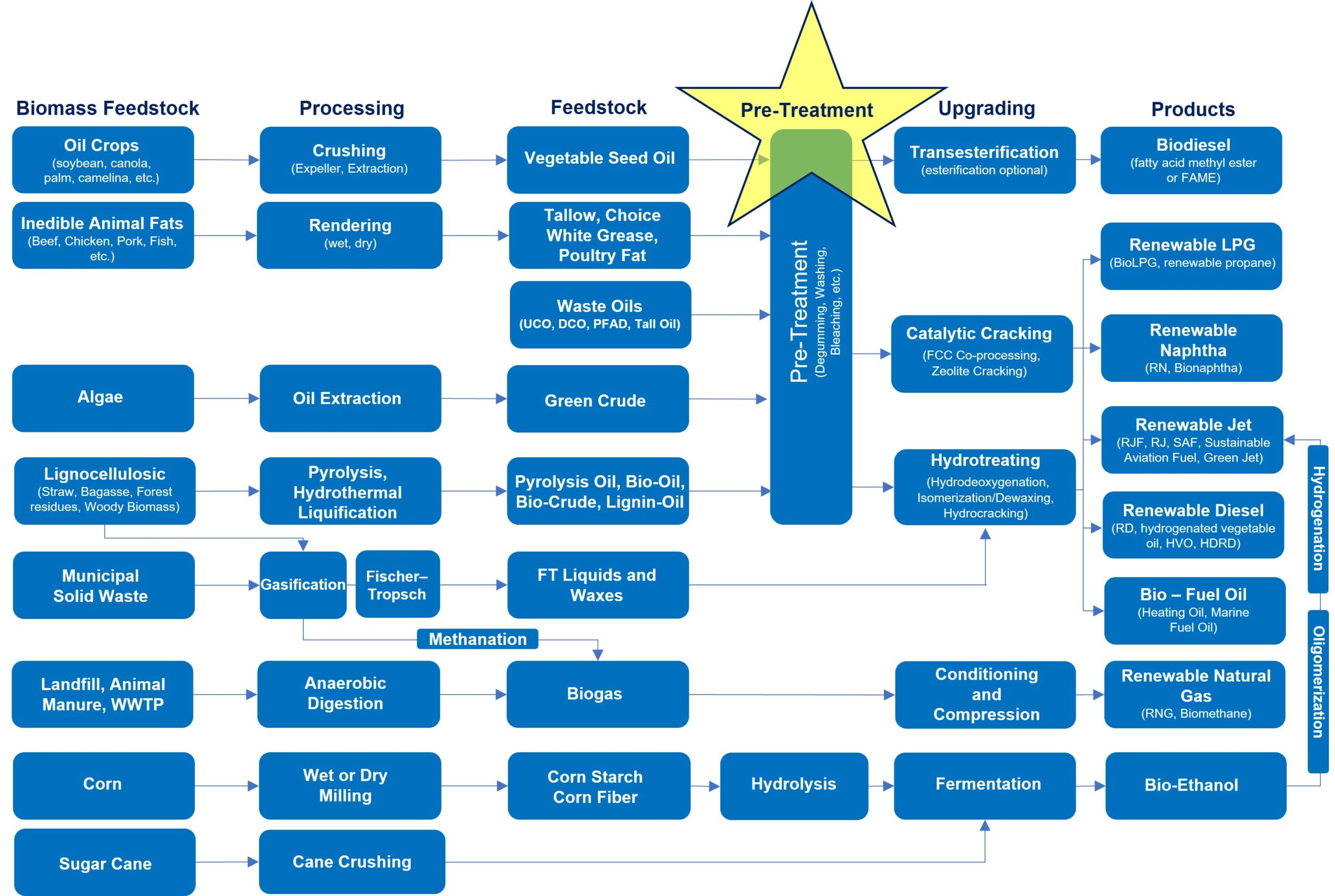

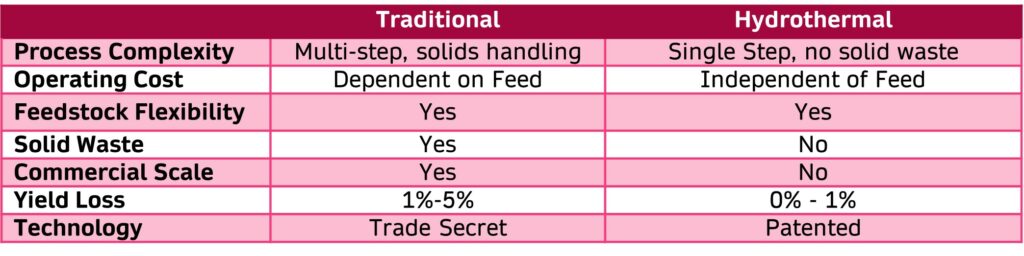

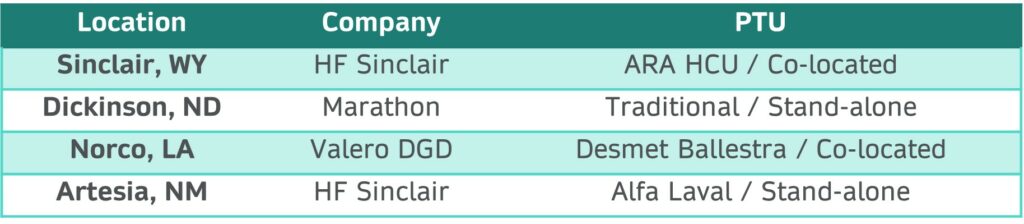

When it comes to deciding on pretreatment technology, producers have two options: the “traditional” set of unit operations (degumming, washing, adsorption) that have existed for decades or the novel Hydrothermal Cleanup (HCU) process patented by ARA (Applied Research Associates), with each having its advantages and disadvantages. Lastly, producers need to decide whether to construct the PTU as a stand-alone facility or co-located with the renewable diesel unit (RDU) operations.

Traditional or Hydrothermal

Regardless of the technology, PTUs are crucial in removing contaminants (solids, alkali metals, phospholipids (gums), nitrogen/sulfur, polyethylene, chlorides, moisture, etc.) that could jeopardize the RDU catalyst, metallurgy, and/or yield performance. Traditional pretreatment employs several combinations of processing steps including filtrations, polyethylene removal, degumming, washing extractions, and adsorptions/bleaching.

A typical traditional pretreatment process will have an oil yield loss ranging from 1% up to 5% depending on the feedstock properties and end target specifications of the pretreated oil. This loss originates from the following areas of the process:

| • | Degumming – Which removes phospholipids; | |

| • | Adsorbents (dry cake is not perfectly dry, will have some oil left over); | |

| • | Separation efficiency in the centrifuges (entrainment of oil); and | |

| • | Oil lost in wastewater emulsions. |

The production of solid waste in the form of sludge/filter cake necessitates the addition of powders/adsorbents and intermittent waste removal. The contaminants will be removed as solid wastes contained within filter bed and centrifuge outputs with some additional modest incremental demand on the WWTP. Alfa Laval, Crown Iron Works, and Desmet Ballestra are some of the main technology providers in this area. Note that early this month Alfa Laval completed the acquisition of Desmet Ballestra.

Hydrothermal Cleanup (HCU) patented by ARA offers a supercritical water-based, continuous single-step process, for feedstock cleanup with 0-1% yield loss by utilizing turbulent flow at high temperature and pressure. In this process, the “degumming” is handled via hydrolysis of phospholipids and there are no waste streams, resulting in a yield loss close to 0%. In general, the contaminants removed will be contained in the water effluent which can place substantial additional demands on the WWTP.

ARA does not currently have their technology operational at a commercial scale, but late last year Sinclair’s Wyoming RDU facility announced they will license ARA’s HCU technology for a 7,500 BPD PTU which they expect to have in the 1Q 2023. ARA has also announced two additional commercial units under construction and additional licenses signed.

Carbon Intensity

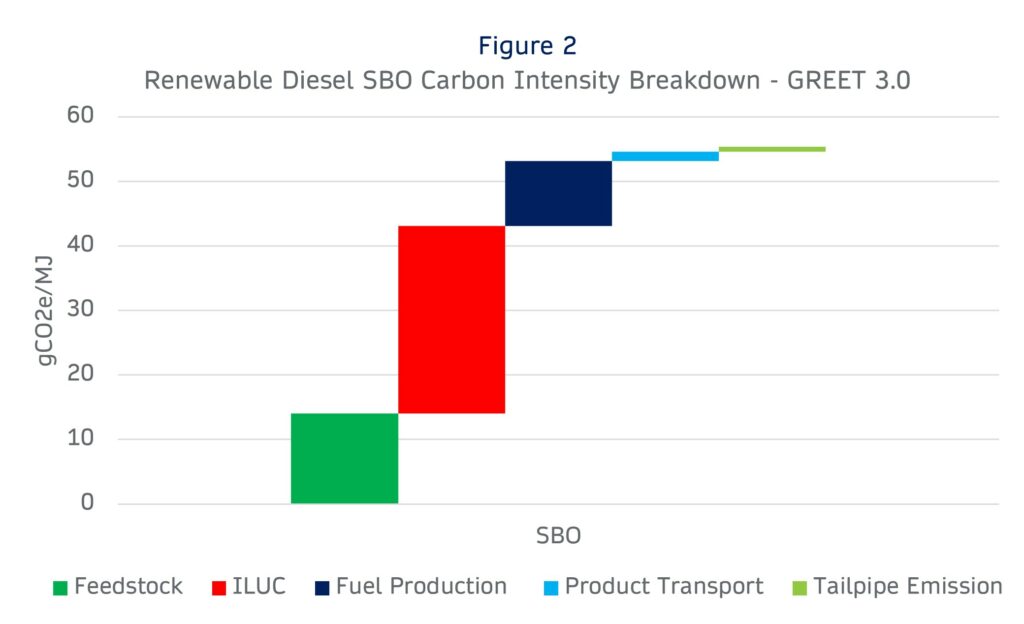

Another consideration is the carbon intensity impact of traditional versus hydrothermal processing and which technology might offer a producer an advantaged carbon intensity score; however, the actual impact of process technology on CI scores can be limited when you look at the entire life cycle analysis. In a typical soybean oil pathway into California, the fuel production component (PTU & RDU) of the life cycle analysis represents ~10 gCO2e/MJ (Figure 2), whereas pretreatment makes up 30-50% of those emissions. Thus, an advantaged PTU potentially might only see a 2-3 CI swing even if one process uses 50% less energy than the other.

Co-located or Stand-alone?

The decision to co-locate or build a stand-alone facility relies heavily upon the operators’ assets and locations. Marathon has opted to build stand-alone PTUs by converting biodiesel plants into pretreatment facilities (Beatrice and Cincinnati) which will feed their Dickinson and Martinez RDU facilities. Similarly, HF Sinclair has built an oversized PTU at Artesia to process volumes for both Artesia and Cheyenne RDUs, which is coming online now and expects to achieve full rate by the end of next month. While outside the U.S., Neste owns and operates a stand-alone pretreatment facility referred to as Sluiskil that is located in the Netherlands. The large remainder of currently operational units and those projects soon to come online in the U.S. have co-located the PTU with the RDU.

One of the most frequent questions that comes up concerning stand-alone PTUs is the concept of biointermediates. As a refresher, biointermediates are feedstocks that have been partially converted at one facility but are then processed into an RFS-qualified biofuel at a separate facility, which is restricted/limited under the current RFS regulations; however, the EPA has been clear that pretreatment does not alter the feedstock but instead simply removes impurities. Here is the specific list of “form changes” that would NOT result in the production of a biointermediate:

| • | Chopping biomass into small pieces, pressing it, or grinding it into powder; | |

| • | Filtering out suspended solids from recycled cooking and trap grease; | |

| • | Degumming vegetable oils; | |

| • | Drying wet biomass; and | |

| • | Adding water to biomass to produce a slurry. |

On July 1, 2022, the EPA finalized a ruling to allow for the use of certain biointermediates to produce qualifying renewable fuels. These provisions specify requirements that apply when renewable fuel is produced through sequential operations at more than one facility. There is no longer a broad definition of biointermediates; instead, there is a specific list of qualifying biointermediates that can be updated in the future. The list will start with the following:

| • | Biocrude (via gasification or pyrolysis); | |

| • | Free Fatty Acid (FFA) – does not include PFAD and is composed of at least 80% free fatty acids; and); | |

| • | Undenatured Ethanol (including ethanol solutions containing less than 95% ethanol.) |

Qualifying biointermediate production facilities will still not be able to send biointermediates to multiple renewable fuel production facilities and in addition these facilities will be required to participate in QAP and other enhanced compliance obligations.

Summary

Over the first two quarters of 2022, facilities with PTUs saw an average gross margin advantage of $1.12/gallon over those without. HF Sinclair stated back in June 2020 that their Artesia ~$200 million PTU investment (30% of total renewable diesel project capital expenses), would see a 10-15% IRR in the base case, but it’s likely the value of that investment has only increased in the face of tightening RBD SBO volumes. Regardless of the PTU technology provider, or decision to co-locate or stand-alone, the investment has become vital to unlocking stable cash flows in the increasingly competitive feedstock market.