Published on

Tuesday, November 17 2020

Authors :

John Mayes and John Auers

Around 500 B.C., the Greek philosopher Heraclitus stated, “The only constant in life is change.” Much more recently David Bowie sang about the same theme in his classic song, “Changes.” For the global refining industry, this may have never been more true than in 2020. The year began with a price war between OPEC and Russia which sent crude prices tumbling, followed closely by the COVID-19 pandemic which initiated a collapse in product demand, and then ended with a divisive U.S. election which could dramatically shift environmental and regulatory requirements for the industry. These changes have combined to significantly alter the financial outlook for many refiners around the world, and like all major changes, there will be new winners and losers. Clearly, the global refining industry is in the midst of upheaval.

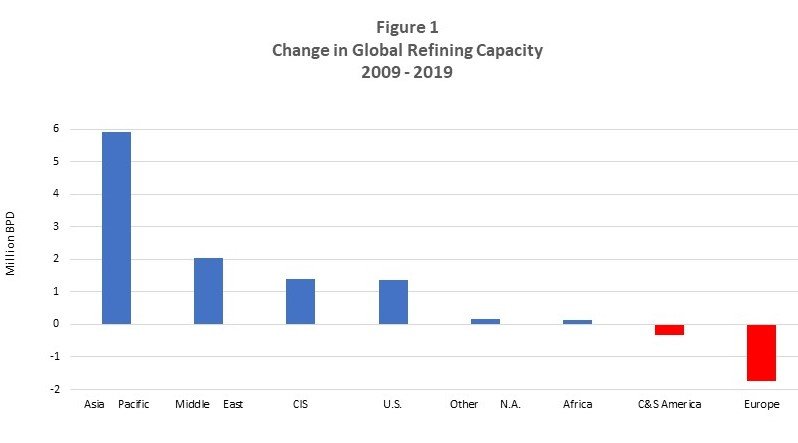

While great change may lie ahead, it is not as if the refining industry has been static in the last ten years. To keep pace with global demand increases, the industry has added nearly nine million BPD of new capacity in the last decade. These additions have not been evenly spread around the world however, with the largest increase (nearly six million BPD) being in Asia Pacific, which also had the lion’s share of the product consumption gains. The Asia Pacific growth represented two-thirds of the total global increase.

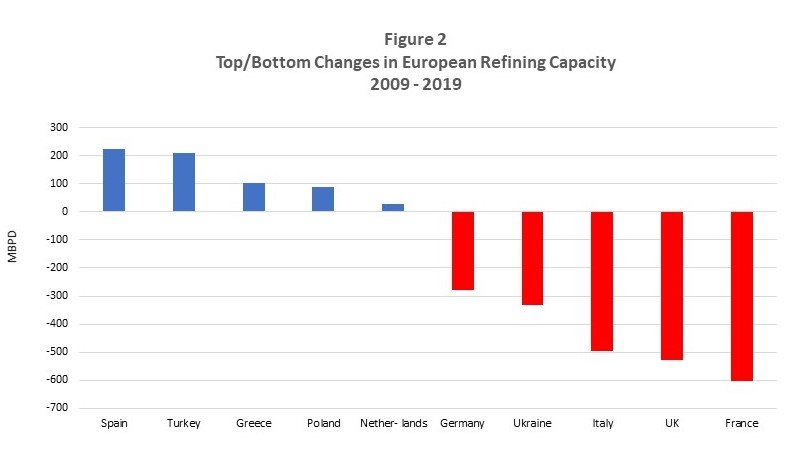

The loser in the global refining capacity race for the last ten years has clearly been Europe. The region’s refining capacity has declined by over 1.7 million BPD, a drop of nearly 10%. But even within Europe, the changes in refining capacities have not been equally felt. In spite of the 1.7 million BPD decline, seven countries in the region have increased capacity with Spain (225 MBPD) and Turkey (209 MBPD) leading the group. Gains were also seen in Greece, Netherlands, Norway, Poland, and Portugal.

The largest reductions in refining capacity have been in France, the UK and Italy, which averaged drops of nearly 550 MBPD. These reductions have decimated the previously dominant refining centers with drops in capacity of 33% in France, 30% in the UK and 20% in Italy; and this was before the outbreak of COVID-19 in 2020. Over 20 refineries in Europe have either closed entirely or undergone partial shutdowns in the last decade. While most were smaller facilities, the list includes several larger refineries, such as the 220 MBPD Petroplus plant in Coryton, UK, and the 153 MBPD Total La Mede, France facility which has been converted into a biofuels refinery.

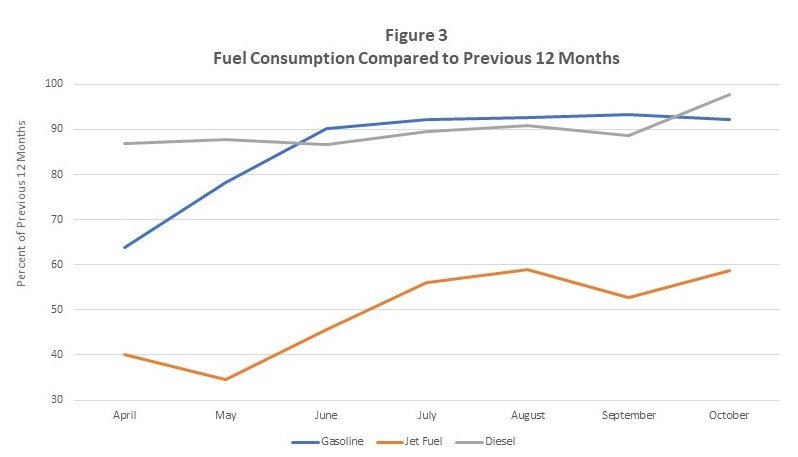

It is with this backdrop that has caused the COVID-19 pandemic to have such dramatic impacts, which were sudden and severe. In the month of April, U.S. product demand plummeted with gasoline demand declining to 64% from the previous 12 months while diesel demand fell to 87%. By far the greatest effect however, was seen in Jet consumption which fell in April to only 40% of the prior year while May registered a level of only 35%. Since the April/May plunge, a demand bounce back for gasoline has been quite strong, but with business travel continuing to be suspended and leisure travel also hampered by both fear and restrictions, demand for Jet fuel remains stubbornly low.

Despite the initially strong recovery in gasoline demand over the summer, it is somewhat disconcerting that U.S. gasoline demand has flattened out in the last four months at only about 93% of the level of the previous 12 months. While the introduction of a COVID-19 vaccine should help finally put pandemic related restrictions in the rear view mirror in 2021, gasoline consumption may never return to the pre-COVID levels, in large part due not to carryover impacts from the pandemic but from trends which were already taking hold prior to the virus outbreak. New lifestyle patterns, such as working from home and reduced leisure driving, combined with rising vehicle efficiencies will impede future gasoline demand growth. Diesel demand did not decline nearly as much as gasoline did and the October level was very close to that of the previous 12 months. This may be slightly deceptive however, given that we are now into the heating oil season when diesel demand typically increases. Demand for jet fuel has increased significantly above the April/May levels but the October demand was still below 60% of the prior year. Market estimates of jet demand are consistently low and many forecast that demand will not return to pre-COVID levels for several years.

It is with these issues that refiners are grappling as each attempts to determine the viability of their own facilities. Refiners in the U.S. have additional concerns in that the industry has become dependent on product exports to maintain crude run levels. As a result, U.S. refiners must not only assess the ability of U.S. demand to rebound but also prospects in numerous other countries, primarily in Central and South America.

Like in the U.S., petroleum demand reductions have been felt in countries around the world. Complicating the picture is the current “second wave” of COVID-19 which is pushing many countries back into lockdown modes. It is no wonder that there have been many announcements of planned refinery closures in the U.S. and the rest of the world.

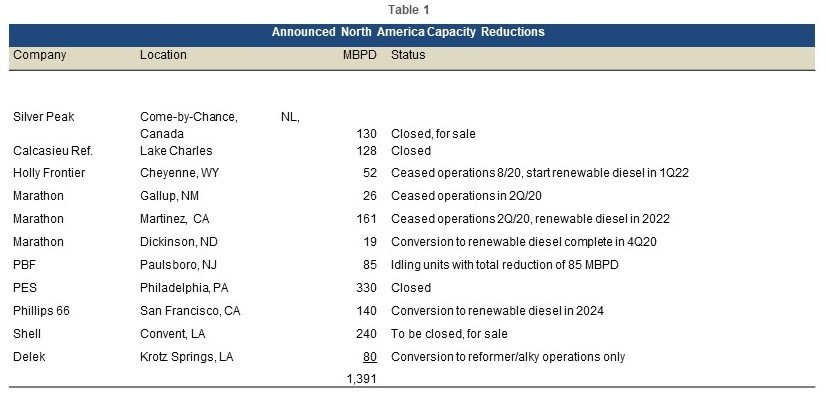

As with refinery construction projects, Turner, Mason & Company monitors and tabulates announcements of global refinery closures. In North America, 11 refineries (ten in the U.S.) have either shut down or made announcements as to their future closure over the last 18 months, most over the last few months. These eleven facilities have a combined refining capacity of about 1.4 million BPD. It should be noted that we have not included in this list some other facilities which have reduced operations temporarily or remain down for extended maintenance after recent hurricanes in the U.S. Gulf Coast. In each of those cases, the owners have plans to bring that capacity back as market conditions dictate.

Six of these refineries have already ceased operations and two additional plants have cut crude rates. Rather than convert the refineries into product terminals, as was typical in the past, many of the announced shutdowns involve conversions to renewable diesel facilities. These are the strategies for the Cheyenne, Dickinson, Martinez and San Francisco refineries. Depending on market developments, additional capacity in North America could also be shuttered, downsized or converted to different uses in the future.

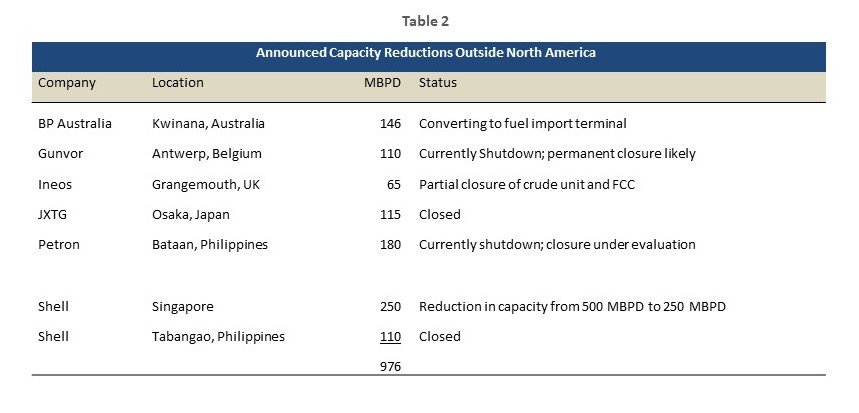

In the rest of the world, an additional seven refineries have announced plans to close, which have a combined capacity of nearly 1.0 million BPD. These plants are primarily in east Asia/Oceania and Europe. In addition to the refineries listed in Table 2, a number of other facilities are also under threat, most in the developed countries of Europe and Asia/Oceania. We have identified an additional seven specific plants, with a total capacity of nearly 750 MBPD which we deem to be at risk.

The refinery closure announcements are not only a reflection of the changing pattern of global petroleum product demand but also how different companies react to the evolution of the petroleum industry. Shell, for instance, has declared that it is making a fundamental retreat from the global refining industry and will only retain refining facilities which have integration with nearby chemical operations. This has resulted in the planned sale of five refineries which are not associated with Shell chemical plants. BP appears to be following a similar strategy and has emphasized its desire to reduce its carbon output.

In contrast to the plans of European majors such as Shell and BP, other oil majors, particularly U.S. based giants Exxon and Chevron, appear to be taking an opposite strategy and are increasing their refining capacities. Chevron recently acquired the Petrobras Houston refinery while ExxonMobil continues to advance plans to expand its Beaumont refinery to become the largest in the U.S. (although they have pushed back the planned start-up date by a year to 2023 as a result of COVID impacts). Both of these companies have extensive Permian Basin output and desire to process their own production at nearby facilities. Most refiners in the U.S. appear to be taking a middle ground approach and are adjusting capacity to better match changing demand patterns while taking advantage of favorable renewable diesel economics.

In this rapidly changing and very uncertain environment, Turner, Mason & Company is closely following developments related to the COVID-19 pandemic, the political/regulatory environment and the market impacts of each. We are also analyzing how those developments impact crude prices, differentials, product demand, crude production and ultimately industry margins and prospects, including decisions regarding facility closures. Some high level aspects of these analyses will be presented and discussed in blogs over the next few weeks and months. We will be incorporating the analysis in a detailed and comprehensive way in the next edition of our Crude and Refined Products Outlook (C&RPO) and Worldwide Refinery Construction Outlook (WRCO), both scheduled to be issued in early 2021. As always, the C&RPO will include a detailed forecast of both crude and refined product prices, product demand, refinery capacity changes, and a variety of other key industry parameters, while the WRCO provides a detailed and comprehensive look and assessment of all proposed refinery capacity additions and closures on both a worldwide and regional basis. For more details about these publications or other TM&C services, please visit our website at www.turnermason.com or give us a call at 214.754.0898.