Published on

Tuesday, March 24 2020

Authors :

John Auers and Robert Auers

The COVID-19 pandemic and Saudi/Russia oil war has so dramatically changed the world and in such a short time, that Jethro Tull’s late 60’s classic, “A New Day Yesterday” seems entirely appropriate to describe the radically different outlook for the petroleum industry that prevails today than just a couple weeks ago. In last week’s blog, our focus was on how the drastically lower absolute crude prices and product demand could influence refined product margins and refinery utilization. In today’s blog, we dig into how significant shifts in crude differentials, both quality and location based, will impact refiners. These shifts include: 1) significant changes in the Midland and Houston vs. Cushing relationships for WTI as storing barrels in Cushing becomes attractive, 2) a narrowing of the light crude domestic discount vs. Brent as the domestic production outlook deteriorates, 3) lower relative prices for Arab Medium and Heavy barrels and an overall relatively wider heavy/light spread due to Saudi pricing and production actions, 4) a narrowing of the WCS vs. Maya discount, and a variety of other changes in crude differentials. These shifting price relationships will impact U.S. refiners in a variety of ways and the impacts will vary depending on the location and processing capabilities of individual refineries. Some will be disadvantaged and others could see relative benefits. In many cases, refiners will be incentivized to change their crude slates. Another thing to consider in this very dynamic environment is that some of the shifts will be very temporary, while others could remain for a while and become even more pronounced in response to the effects lower prices will have on crude production. They will also be impacted by developments on the demand front, with the duration and magnitude of the COVID-19 pandemic and its impacts on U.S. and global economic activity of prime importance.

Saudi and Nigerian actions and their impact on U.S. Refiners

The supply and demand environment created by the twin “black swan” events of COVID-19 and the Saudi Arabian – Russian price war has led to some interesting crude pricing dynamics that will affect all U.S. refiners, but in different ways. First, Saudi Arabia cut April North American OSPs for all crude grades by $7/Bbl compared to March. This will be a direct benefit to the bottom lines of several refiners that already run substantial volumes of Saudi crude (mostly located on the East and West Coasts, but also including Saudi-owned Motiva Port Arthur) and may help offset some of the pain on the product side. Further, these price cuts may make Saudi crudes more competitive on the USGC, where they have largely been replaced by a mix of Gulf of Mexico crudes, LTO, and Canadian heavies. Nigeria followed the Saudi action by cutting prices for its light sweet Bonny Light and Qua Iboe crudes to $3/Bbl under Brent compared to a historical premium of $1-3/Bbl. This is also a benefit for struggling PADD I U.S. refiners who rely heavily on West African crudes due to the Jones Act, which makes shipping crude from the Gulf Coast too costly. The moves are unlikely to be enough to offset the rapid decline in product prices due to the COVID-driven demand collapse, at least until the current COVID-related lockdown begins to ease. When this does happen, increased crude demand (which would be driven by increased refined product demand) would likely allow these differentials to be narrowed, negating part of the benefit of higher product prices.

Lower prices, decreasing domestic production and impacts on U.S. refiners

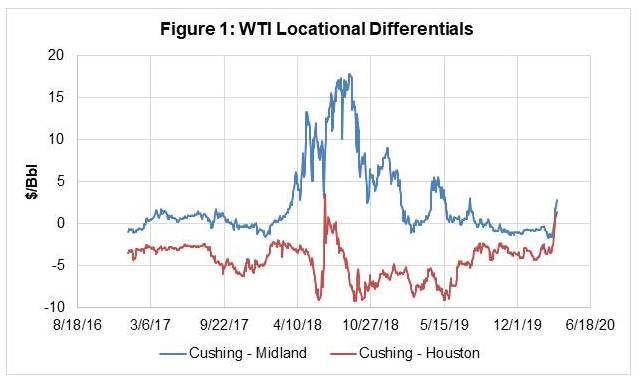

A negative impact for many inland refiners in PADD III and PADD II is the decrease in the relative discounts on U.S. and Canadian barrels they have enjoyed due to the expectation for production declines in the Permian, Bakken and other inland basins. Perhaps the most interesting development here has been the emergence of a Cushing Premium, a major disadvantage for Midcontinent refiners. Crudes in Cushing are generally priced at discounts relative to their counterparts on the USGC due to the export market (for light crudes) and USGC refiners (for heavy crudes) serving as the incremental outlets for barrels flowing into Cushing. However, demand for crude oil has obviously all but evaporated recently and incremental barrels must go into storage – something which is plentiful in Cushing with local tank farms only at less than 50% utilization (Tank on the USGC is more highly utilized at the moment). As tanks fill in Cushing, this premium can be expected to disappear as the incremental barrel will once again need to move to the Gulf Coast. Nonetheless, as U.S. production declines in the back half of 2020 and into 2021, there will be plenty of pipeline capacity from Cushing to the Gulf Coast, preventing this differential from widening too far and limiting the ultimate benefit to Midcontinent for an extended period. Figure 1 displays the WTI locational differentials.

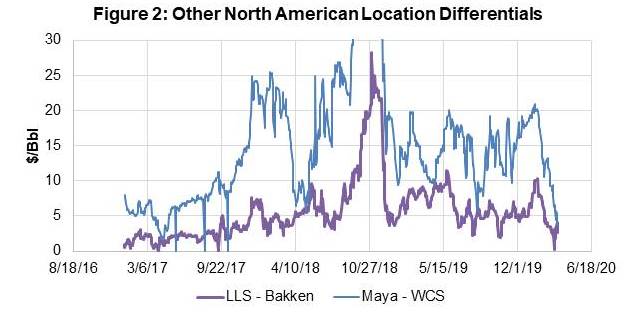

Similar to those shown with WTI, other locational differentials for North American crude have declined as well. This is a result of decreases in both downstream refiners’ demand for crude and (at least in the case of LTO) expected declines in the production. Both the LLS – Bakken (Clearbrook) differential and Maya – WCS differential have collapsed to levels below the marginal cost of transportation, decreasing (or eliminating) the feedstock cost advantage experienced by most Midcontinent refiners. This scenario is not sustainable over the long term, and we expect these differentials to at least partially recover over the next few months as inventories fill. These differentials are shown in Figure 2.

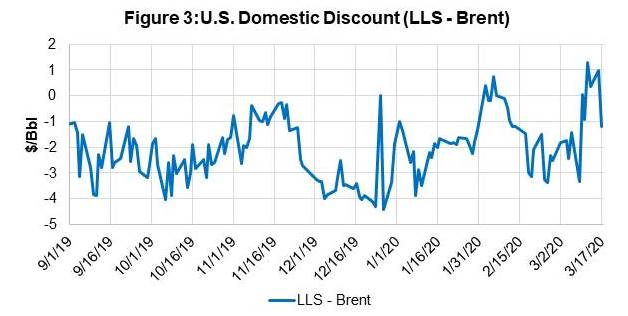

Similarly, due to the expected declines in U.S. production and the decreased demand for U.S. crude exports, the Brent-LLS differential has narrowed considerably (and actually reversed for a short period). Ultimately, this discount cannot completely disappear for an extended period of time, at least for the time being, as the incremental barrel of LTO production must be exported. As U.S. production falls, the required discount to move this incremental barrel will shrink, but it remains unlikely that U.S. production falls to a level where U.S. crude exports will not still be significant. Still, this narrowing differential decreases the advantage for USGC refiners running LTO relative to their international peers. Figure 3 shows the Brent-LLS differential.

Light/Heavy and Sweet Sour Differentials

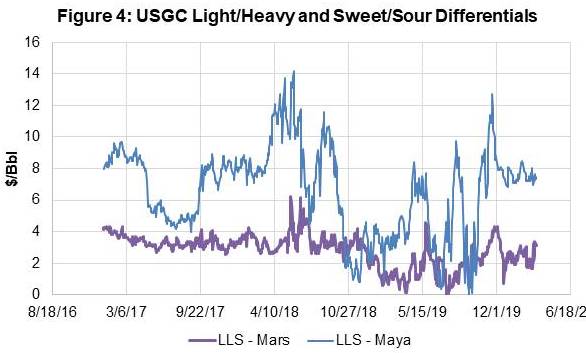

Through all the chaos, however, the absolute light-heavy differential (as measured by the LLS-Maya differential) has remained rather stable, with the % discount expanding significantly. Typically, as crude prices fall, the light-heavy differential declines along with them, maintaining a fairly consistent discount on a percentage basis. The light heavy differential was at historically low levels in 2019 and had increased moderately over the last few months due to IMO impacts. Most of the incremental supply will be medium sour Saudi Arabian barrels (Saudi Heavy and Medium), with declines largely coming from falling production of North American LTO. The incremental Saudi crude is of similar quality to many Gulf of Mexico medium sour grades (like Mars) and competes directly with them. As a result, the LLS-Mars differential has widened by ~$1.50/Bbl due to the price war and the Saudi OSP cuts mentioned earlier. This serves as a direct benefit to many complex USGC refiners who can take advantage of lower prices for medium and heavy sour crudes. Still, these moves are likely to provide little comfort to most USGC refiners, at least in the near term, as low product prices more than offset any crude cost advantage. Figure 4 shows these differentials.

In this rapidly changing and very uncertain environment, Turner, Mason & Company will be following developments related both to the COVID-19 pandemic and response and the OPEC+ price wars very closely. We will be analyzing how those developments impact crude prices, differentials, product demand, crude production and ultimately industry margins and prospects. Some high level aspects of these analyses will be presented and discussed in this blog over the next few weeks and possibly months. We will be incorporating the analysis in a detailed and comprehensive way in the next edition of our Crude and Refined Products Outlook (C&RPO), scheduled to be issued in the summer. As always, the C&RPO will include a detailed forecast of both crude and refined product prices, product demand, refinery capacity changes, and a variety of other key industry parameters. For more details about this publication or other TM&C services, please visit our website or give us a call.