Published on

Tuesday, January 28 2020

Authors :

Eamon Cullinane and John Auers

Leading up to IMO 2020 just about everyone predicted that the required increased flow of distillates into the bunker market would significantly boost distillate cracks. Well IMO 2020 is finally here and the shift to low sulfur bunker fuel is in full swing, but not only have we not seen the expected IMO bump in distillate cracks, prices have actually fallen to levels that has everybody (especially refiners) asking the question “why haven’t we seen the distillate crack spike?”.

Why were all the analysts wrong? Perhaps they weren’t, but maybe their timing was just off. In today’s blog we will explore some reasons for the current sluggish distillate prices, explore whether there is a change on the way and comment on whether refiners and marketers really can follow Steve Perry’s advice to “Don’t Stop Believin” in the IMO “bump”.

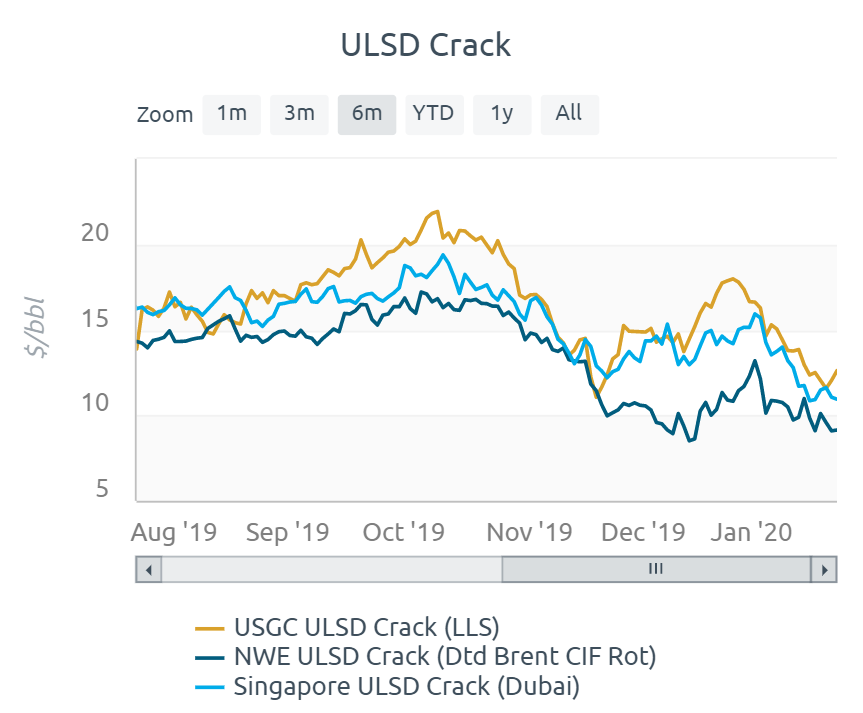

Looking at the ULSD Cracks across the major regions (USGC, NWE, Singapore) we see that the distillate market has just gotten worse since the start of the year and the initiation of the IMO rules. If we harken back just a few months ago, every major analyst was calling for big boosts in distillate cracks. The logical premise was that significant volumes of distillate would be necessary to replace the high sulfur fuel oil (HSFO) which had to be backed out due to IMO rules. Some of these predictions had distillate margins reaching as high as $40/barrel. This is certainly a far cry from the current $9-$12/barrel range seen across those major regions.

Source: IMO 2020 Tracker Tool

“It Goes On and On and On and On” – Bunker Demand

Certainly the main driver of the anticipated increased distillate demand globally was Marine Gasoil (MGO). The expectation that vessels would use MGO as the primary path to compliance with IMO 2020 hasn’t yet materialized and instead the majority directly switched to LSFO (residual fuel oil based). The original argument stemmed around compatibility issues with LSFO and or lack of supply. Neither of which has come to fruition.

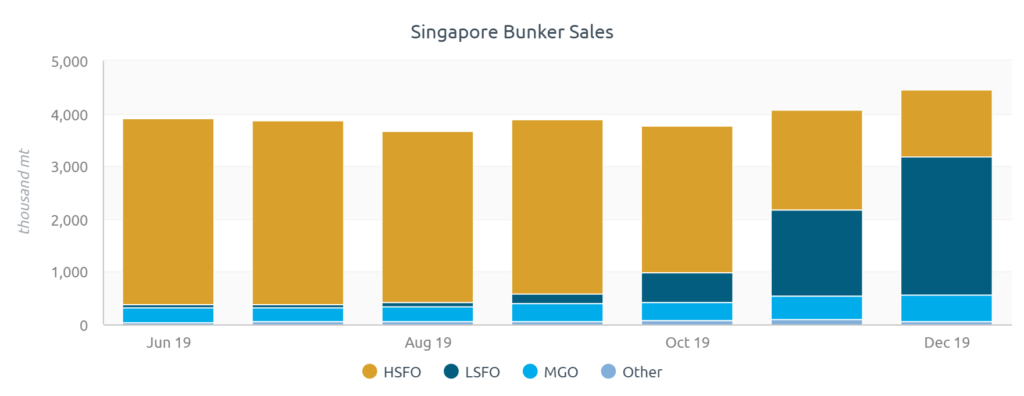

Instead decisions mainly focused on economics, where LSFO has been pricing at a discount to MGO and in the spirit of saving money, shippers have favored LSFO over MGO. The price discount was facilitated by a large stock piling of LSFO both on land and floating at major bunkering ports across the world. These ports wanted to be ready to supply compliant bunker fuel come Jan 1st, so they stockpiled for months leading up to the changeover. At the port of Singapore last month, LSFO represented ~59% of the sales while MGO only accounted for 11% (HSFO still represented 28.5%). Historically MGO has been 5-7% of bunker sales at the port, so really we have only seen a 4-6% increase in MGO use by vessels so far.

Source: IMO 2020 Tracker Tool

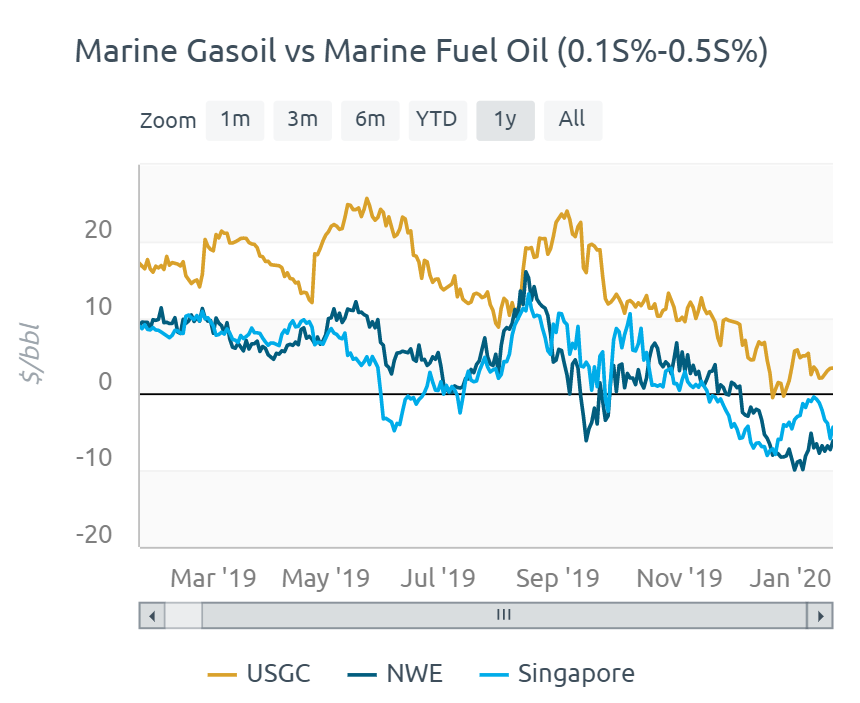

Source: IMO 2020 Tracker Tool

Another reason LSFO has become the go-to compliant fuel is because of its higher viscosity than MGO that aids in engine performance. MGO is less suitable for long voyages and is more likely to result in difficulties in the ship’s engine. Lastly, LSFO has more energy (BTUs) per barrel than MGO. This is a no brainer for a ship owner trying to get the most bang for their buck.

However, as stockpiles of LSFO have been run down, the discount to MGO has all but vanished. This could mean a delayed bump in demand of MGO if ship-owners decide to start buying the fuel as a result of the increase in LSFO price.

Source: IMO 2020 Tracker Tool

“Hiding Somewhere in the Night” – Warm weather kills heating oil demand

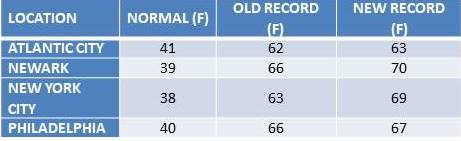

A major force on distillate demand is weather. Though localized, some of the historically large distillate consumers during winter months have seen slowdowns due to unseasonal warm weather. The winter weather in the U.S. Northeast has so far been very mild. Earlier this month on January 11th, some of the major cities in the tristate area hit record highs.

Source: National Weather Service

The same trend has occurred in Northeast Asia, again resulting in a lack of distillate demand. In the Japanese city of Sapporo, lack of cold weather and snow has resulted in the closing of ski resorts. According to the Japan Meteorological Agency, temperatures in Hokkaido have been 2.8 degrees warmer than average so far this winter.

According to Platts Analytics, December was 7% warmer than the 10-year normal for the three major OECD markets — Japan, Europe, and the U.S. – with a loss of about 330,000 b/d of oil-heat demand versus normal temperatures.

“He took the Midnight Jet Goin’ Anywhere” – But not lately, aviation traffic slumps

Another sector that drives distillate demand is aviation. Global air traffic growth dropped from 7.4% in 2018 to 4.2% in 2019. The reason for this drop is always a complex answer as the industry is tied to a lot of markets.

Global economic activity slowdowns tend to affect aviation, and the recent U.S.-China trade war has taken a toll on air cargo demand and freight volumes. The continuing protests in Hong Kong have piled on in slowing demand of Asia-Pacific airlines. More recently, while we can’t predict the length, magnitude or impacts of the Coronavirus on air travel, it is certain to have a negative impact on air travel and demand for distillate.

“Up and down the boulevard” – Other factors impacting distillate demand and prices

Distillate demand from a macro perspective has a lot of other factors including but not limited to the decreasing fleet of diesel cars in Europe paired with a general oversupply of distillate in the European market. Additionally, new flows of distillate from China following the decision by China’s Ministry of Commerce to allow independent Chinese refiners to participate in the export market has increased distillate supply into the global market. Lastly, a general slowdown in drilling activity also plays a hand in decreased distillate demand.

“Some will win, some will lose” – Closing Thoughts

Distillate demand and supply is an intricate and complex market with lots of end users. It’s difficult to understand distillate margins completely, but the aforementioned factors could very well be some of the major drivers of the current environment. If MGO uptake increases it could very well contribute to a surge in distillate margins.

Turner, Mason & Company continues to monitor developments in the IMO markets with our recently launched IMO 2020 Tracker Tool. We are updating our views along with our forecast of crude and product prices in the upcoming Crude & Refined Products Outloook which will be published to clients in mid-February. If you would like more information on this publication or for any specific consulting engagements with which we may be able to assist, please visit our website: https://www.turnermason.com and send us a note under ‘Contact’ or give us a call at 214-754-0898.