Published on

Tuesday, January 21 2020

Authors :

Eamon Cullinane

IMO 2020 is finally here and the shift to low sulfur bunker fuel is in full swing. In one of our past blogs, we discussed the options that exist to refiners to remain competitive with the implementation of the regulation. One of those options was changing your crude slate to a lighter/sweet mix.

Moving to a lighter, sweet crude slate and reducing fuel oil production all together may seem like the ideal approach, but switching to a light crude slate can be problematic for some refiners. A substantially lighter crude slate tends to overload the light component processing capacities, such as reformers, naphtha hydrotreaters, and isomerization units.

If you did manage to operate with such a light crude slate you would see lower yields on distillates at a time where the bunker market will draw from middle distillates putting pressure on supply across the world and giving refiners a bump in margins. To capture the increased margins, a refiner will want to continue to produce high yields of both compliant bunker fuel and distillate. What is needed to balance this condition is the processing of heavy, sweet crudes. These crudes hit the sweet spot (pun intended), by keeping the crude slate sweet while providing ample middle and bottom-of-the-barrel molecules.

In today’s blog, we will take a look at the options that exist across the globe for heavy, sweet crudes, and paraphrasing Aerosmith, those that will provide some “Sweet Emotion” for fuel oil producing refineries.

“Like it’s a real sure thing” – The Major Heavy, Sweet crudes

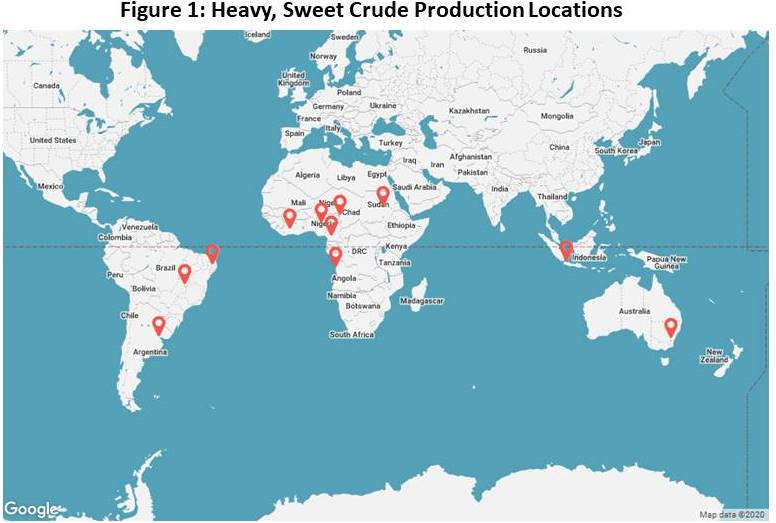

The vast majority of heavy, sweet crude comes from Latin America, West Africa, and Australia. In particular, over 80% comes from Latin America and West Africa alone.

Much of these barrels are processed close to where it is produced. Out of the close to 2 million barrels a day of total heavy, sweet crude production (about 2.5% of total crude), only about 500 MBPD is exported globally.

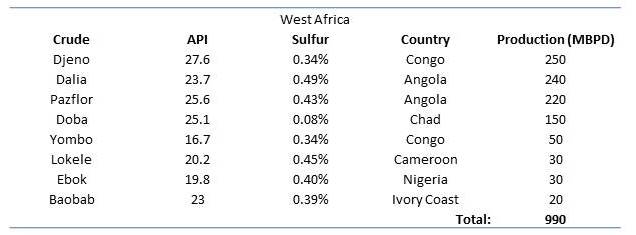

West Africa

The largest source of heavy, sweet crude comes from West Africa, accounting for almost 75% of all heavy, sweet exports globally (~350,000 BPD) and roughly a million barrels per day of production. A majority coming from the likes of Congo (Djeno), Angola (Dalia & Pazflor), and Chad (Doba). The republic of Congo’s only terminal, Djeno (majority owner Total), can handle VLCC’s.

Out of the 350,000 BPD that makes its way out of West Africa, almost a third (~115,000 BPD) is sent to China. Using term contracts on the crudes, China is able to reliably lock a good percentage of these heavy, sweet crudes. In particular, Huizhou refinery imports and runs a large amount of Dalia (~40,000 BPD). Other typical destinations include U.S. India, and Spain.

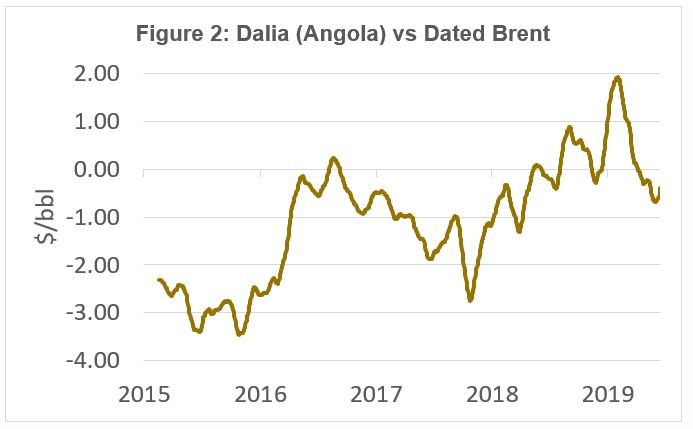

In 2019, Dalia was trading at a premium to Dated Brent where historically it has been discounted.

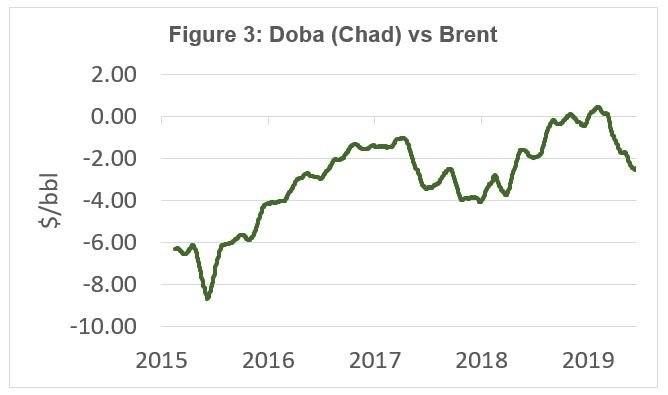

Historically, Doba has been a tough crude to process due to high acid content (~4.7 TAN) making it limited to refineries who have made investments in premier metallurgy; however, the acidity has been coming down over time due to new fields. ExxonMobil has the current Doba blend at a 1.39 TAN, which has allowed more refiners to take in Doba, especially simple topping refinery’s looking to quickly turn the crude into IMO-compliant bunker fuel.

Chad is a completely land-locked, so all Doba gets sent to the coast of Cameroon via pipeline and loaded by vessel for export.

Doba price differentials to Dated Brent have changed drastically over the last few years. In 2015, it was at a discount of over $8.00/bbl while more recently it was seen at a premium over Dated Brent.

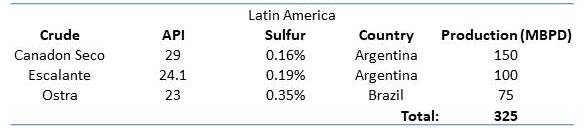

Latin America

After West Africa, Latin America is the next largest source of heavy, sweet crude, in particular, Brazil and Argentina. Out of the 325,000 BPD of production, around ~100,000 BPD is exported globally.

Argentina exports (of recent) have averaged ~60,000 BPD with the large majority grade being Escalante. Destinations include U.S. and China similar to West African crudes.

Brazil’s Ostra exports have been averaging ~40,000 BPD with similar destinations as Escalante.

Notably of recent, more and more of these crudes have made their way to the major bunkering ports (Rotterdam, Fujairah, Singapore) to help produce IMO-compliant fuel. UAE has been taking in large amounts at a few of their processing facilities to help supply complaint bunker fuel in Fujairah.

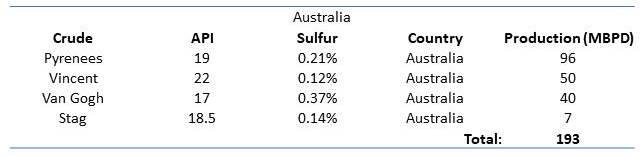

Australia

The last major hub for heavy, sweet crude is Australia.

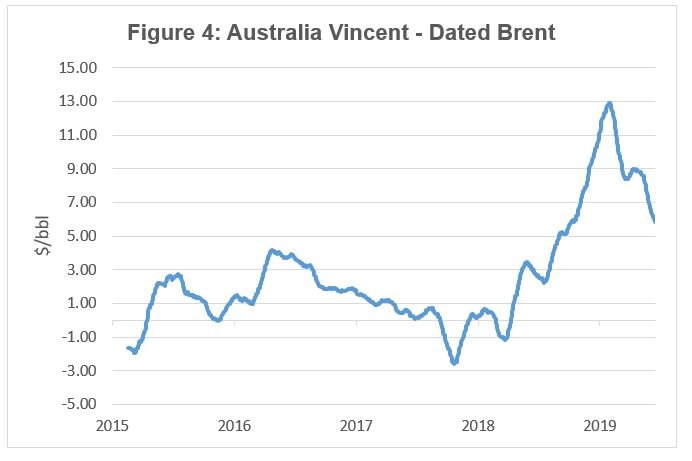

These crudes make up some of the most expensive crudes across the world and with the help of IMO 2020, they have seen extreme premiums. Vincent has reached premiums of over $10.00/bbl to Dated Brent of recent.

As with some of the other heavy, sweet crudes in the world, Australian heavy sweets are exported to countries like China and India; however, the pricing of these crudes has become so extreme that the typical destinations and buyers are starting to change. The combination of great qualities and limited supply has really driven the premiums on these crudes.

Exports over the last year have increased with the help of increased production in the Greater Enfield reservoir. Woodside Petroleum restarted the offshore production in July of 2019 which helped raise export volumes.

“But in all minor key” – Other Heavy, Sweet options

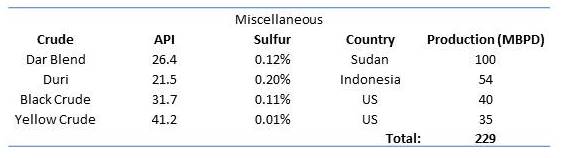

Beyond the three major regions (West Africa, Latin America, Australia), there exists a few more options of crudes ideal for IMO 2020.

Sudanese Dar Blend, which is produced in South Sudan, has been increasing in export volumes as more investments have been made on the production side.

Duri, out of Indonesia, has limited availability but remains a great option for IMO 2020 LSFO due to both its low sulfur and high flash point, making it almost on spec for bunker fuel without any processing.

The last two crudes out of the Uinta Basin in northeast Utah aren’t exactly heavy, sweet crudes. Even though they are categorized as medium crudes (31.7 and 41.2 APIs), they have an unusual amount of resid content (25-30% compared to 5% for crudes of similar API).

The Uinta Basin crudes are extremely waxy and almost completely solid at room temperature. It is because of this that logistics become the biggest concern. Local refineries in Salt Lake City have continued to profit and utilize the crude; but at some point, production will exceed local processing capability and investments to transport the crude elsewhere will be paramount.

The unique qualities of these crudes present many challenges for refineries beyond just the transportation issues. These include handling and storage difficulties, middle distillate blending problems and potential incompatibility with other crudes. As a result, new customers for these crudes will evaluate them with considerable caution and likely require discounts and “breaking/testing” periods before committing to significant volume purchases.

Closing Thoughts

Heavy, sweet crudes can act as a great solution to IMO 2020 for some refiners. The problem, however, is lack of supply. There is only so much production; and of that, only so much exported globally. Less than 3% of total production and only about ~1% of all crude exports are heavy, sweet crudes. Any additional production over the next few years will be marginal and not enough to change any market dynamics.

Because there is a lack of supply, refiners will instead try to procure light, sweet crudes with minimal fuel oil yields. Lighter and sweeter crudes will be able to reduce fuel oil yields and produce greater quantities of higher-end light products.

Turner, Mason & Company continues to monitor developments in the U.S. and global refining industry, including those that impact regional competitiveness. We address industry risks along with our comprehensive market views in our Crude & Refined Products and Worldwide Refinery Construction Outlooks. We published our most recent version of these reports in August and our next editions will be completed and published to clients in February & August 2020. If you would like more information on these, or for any specific consulting engagements with which we may be able to assist, please visit our website: https://www.turnermason.com and send us a note under ‘Contact’ or give us a call at 214-754-0898.