Published on

Tuesday, February 4 2020

Authors :

Sam Davis and John Auers

After a little more than a year into his presidency, Andres Manuel Lopez Obrador, known most commonly as “AMLO,” is already having a major impact on Mexico’s energy landscape. His administration has made a number of bold statements, promising to revive the country’s oil industry, fix its many problems and do it all with minimal help from the outside. Early on in his term, he made headlines by announcing the shutdown of pipelines connecting product terminals to retail stations, in an effort to diagnose and ultimately fix the growing problem of rampant fuel theft in the country. Shortly thereafter he announced plans for at least one major grassroots refinery and a goal of achieving self-sufficiency in refined products. A number of commercial agreements the administration felt were not in the best interest of Mexico have either been halted or reversed. Dismissals and resignations of key government agency personnel have also been a hallmark of AMLO’s tenure in office so far. As industry observers and analysts, we certainly expected his December 2018 inauguration to usher in a new era of change for Mexico and were wary of what it would mean for the future of the country’s energy reform policy, begun by the previous administration in 2013. There was hope in some quarters that AMLO would be more cautious in his move away from reform, but it appears at this time, that if anything, he is moving even more boldly in that direction. What will this mean for the country’s oil industry? We review his plans and promises and attempt to provide some possible answers to that question in today’s blog.

Promise of a new refinery

AMLO made headliners early into his presidency when he announced plans for the construction of a new 340 MBPD grassroots refinery at Dos Bocas in his home state of Tabasco with the goal of reducing rising refined product imports. The refinery, with an announced estimated cost of $8 billion is already facing a great deal of skepticism. Facility siting concerns from geological risks to existing port infrastructure along with independent cost estimates of the refinery approaching $15 billion are some of the reasons for concern. The refinery economics are also being challenged especially in a scenario whereby project financing comes exclusively from public resource funding. Last year, the rating agency, Fitch, further downgraded Pemex’s already poor ratings to junk status citing high leverage, large capital investment requirements, and exposure to political interference risk. This move came after Fitch had already downgraded Mexico’s sovereign debt. The downgrade poses significant funding challenges for the project but could be mitigated by a public-private investment partnership with majority share and control being given to outside investors.

Can Pemex execute?

For now, that does not seem likely given recent developments about opportunities being closed to outside investment and the focus on Pemex going “alone” on a project of this scale. AMLO announced that Pemex will now oversee construction of the new refinery, dismissing private sector suitors for the project. Last year, the government had invited international EPC firms with a proven track record of completing similar projects elsewhere to bid on building the refinery but were ultimately unsuccessful when these firms submitted bids that greatly exceeded AMLO’s $8 billion price tag for the facility and could not meet the government’s three-year construction deadline. AMLO is now claiming that Pemex could meet these cost and schedule targets which is fueling fresh doubts about the financial health of the cash-strapped state oil firm. Pemex has, for years, faced financial stress due to declining oil production, corruption and inefficiency, but in recent months the company has been going through particularly difficult times. In 3Q 2019, Pemex recorded a net loss of almost 87.9 billion pesos ($4.7 billion), while as of the end of that quarter the company’s debt stood at around $100 billion, making Pemex the world’s most indebted oil company. For now, it appears AMLO is still moving forward with refinery construction plans with reports of land clearing and site preparation activities progressing.

Has Mexico’s Supply/Demand Imbalance turned the corner?

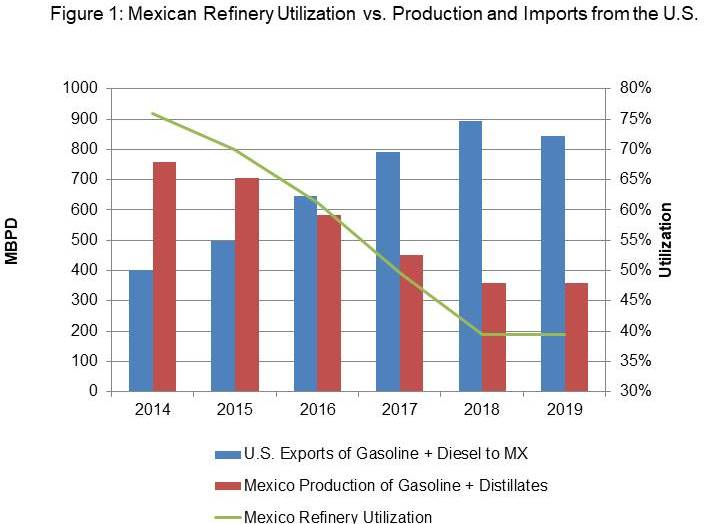

Refineries in Mexico produced about 360 MBPD of gasoline and diesel in 2019, relatively flat from 2018 levels (Figure 1). Gasoline and diesel demand last year was ~1.2 MMBPD leading to product deficits of 830 MBPD. Mexico’s product deficit has been increasing over the past five years, in line with declining domestic refining utilization, which averaged 40% in 2019. The country’s six refineries over that period of time have suffered from operational challenges leading to increasing imports of gasoline and diesel with the exception of last year when imports of both products declined from 892 MBPD in 2018 to 845 MBPD in 2019. Operational performance improved slightly last year with investments in maintenance programs helping to stabilize refinery utilization and also contribute to a 5% decline in imports; however, this may not be a sign of better days ahead as Pemex continues to grapple with limited capital to fund much needed maintenance programs at its refineries.

Midstream Investments still a bright spot

A bright spot in the Mexican energy landscape is the progress being made in the midstream space and the expectation for projects to move ahead, albeit slowly. Midstream infrastructure covering new marine and storage terminals along with pipelines are already underway. With growing demand in the Central and West Central regions, expanding logistics capabilities has become a focus for investments. Mexico’s Central and Western regions have 11 and 10 inland terminals, respectively, that are mainly supplied via pipelines, with fuel storage capacity in both regions of 2.5 million barrels of gasoline, diesel and jet fuel. Additional terminals are being built with three under construction in Western Mexico with a storage capacity of 1 million barrels and 12 terminals capable of storing 9 million barrels in Central Mexico. These projects, funded by private investments and not by Pemex, have a greater chance of success. Pemex announced a capital budget of only $60 million for logistics projects in 2019, making it difficult to undertake such projects on its own. In 2020, five marine terminals are expected to come online in Northwestern and East Coast of Mexico, allowing companies to ramp up fuel imports and further gain market share. The AMLO administration could help advance these and new storage projects by streamlining the regulatory process, assisting developers to gain social support and raising investment certainty with investors.

Closing thoughts – What should Mexico’s energy priorities be?

The mood and attitude in Mexico continues to be one of pessimism as many are left wondering if AMLO will fulfill his promise of low fuel prices, increased domestic refinery output, decreased product imports, tackling corruption and eliminating oil thefts. There are still many unanswered energy-related questions for AMLO on protection of national oil resources, protectionism of the domestic fuel market, tax adjustments and assurance to foreign investors investing in the Mexican energy infrastructure. Despite the fears of investing in the future of the Mexican energy market, many oil and gas companies are keeping a glass-half-full attitude as Mexico remains a country in dire need of new investments for new energy infrastructure and continued imports of refined products.

In closing, we offer the following thoughts:

Mexican refining investment should:

- Focus on increasing utilization/product uplift at lowest cost,

- Target specific refineries with a system-wide analysis warranted

- Leverage outside investment where possible through “farm outs” – H2 supply, sulfur recovery, utilities, etc., and

- Reconsider greenfield projects as they are probably not good use of scarce capital.

Midstream projects provide better investment opportunities by:

- Enhancing product import and distribution capabilities

- Improving the ability to import and deliver U.S. light crudes to Mexican refineries, and

- Offering best possibilities for attracting foreign investment.

Turner, Mason & Company Mexico Market Research

In our new market research focused on Mexico’s refining, midstream and retail sectors, we aim to bring clients our views on the market fundamentals driving Mexico’s downstream sector along with assessing market opportunities and risks in support of downstream reform under AMLO. Some of the insights we cover in the research offering are:

- How would a new refinery in Mexico, if ever built, along with competition from new and potential regional capacity expansions and start-ups – LBT St. Croix, Exxon Beaumont, Isla Curacao, etc., impact Atlantic Basin Refining Dynamics?

- How would Mexico’s refining profitability be impacted by its high output of fuel oil production in light of IMO 2020 low sulfur specification change?

- The midstream sector is the fastest growing and currently represents the greatest opportunity. The priority for refined products is the construction of terminals, but this continues to face major delays as the review and approval process is generally inefficient, and fraught with political red tape. How will the administration break free and move these projects along?

Please email us at contact@turnermason.com with any questions on content or information related to subscription.