Published on

Thursday, February 9 2023

Authors :

Eamon Cullinane

The notion of cryptocurrency has come quite far in a short period of time as it has developed beyond the original idea of a digital currency to now encompass a broader range of applications across various industries. The underlying blockchain technology provides a trusted, open-source, permissionless, immutable and verifiable way to move data on a decentralized network. This movement of data goes beyond transactional exchanges stored on a distributed ledger, but also includes computing in the form of self-executing protocols as first seen with the launch of Ethereum and smart contracts. In the last few years, we have seen these innovations target climate change with a particular focus on the voluntary carbon markets.

Voluntary Carbon Markets (VCM)

There are two types of carbon markets, compliance and voluntary. The compliance carbon markets are introduced by regulatory initiatives that mandate entities to participate and comply. Programs such as the California Low Carbon Fuel Standard or the Oregon Clean Fuels Program are examples of state-level compliance markets. These programs require GHG emitters to either reduce their emissions and/or purchase credits from entities that reduced or removed emissions. Voluntary carbon markets on the other hand offer entities (individuals, corporations, non-profits, etc.) the ability to purchase carbon offset credits to achieve emission reduction targets in a non-compulsory manner. However, a few compliance markets, such as California Cap and Trade & Washington Cap and Invest, allow entities to satisfy a portion of their obligation with voluntary carbon offsets.

Regardless of the carbon market type, the fundamentals are generally the same with the main goal of reducing or removing GHG emissions. There are a few key concepts for voluntary carbon markets:

Measurements, Methodology and Standards: Credits are denoted as $ per metric ton of carbon dioxide equivalent ($/MT CO2e). To generate credits, one needs to accurately calculate the emissions reductions of a project to that of a baseline. Standards and assumptions amongst life cycle analysis, emission factors, and other specifications are critical in accurately determining carbon emissions with reasonable assurance.

Additionality: In discussing carbon offset projects, it is required that the project would have never been executed in a business-as-usual circumstance and that the additional revenue received via the credit market is what ultimately drove the project into existence. This establishes that baseline, as mentioned, that is used as a comparison to establish incremental emission reductions.

Permanence: The project’s emissions reductions need to be permanent and cannot temporarily reduce or delay future emissions.

Validation and Verification: The projects need to be validated by an independent 3rd party to assess and confirm emission reductions. Routine verification, monitoring, and reporting should take place to ensure the continued validity of the project.

Credit Issuance, Sale/Purchase, and Retirement: Lastly, a project will be issued carbon credits should it meet all the necessary criteria. Those credits can then be bought and sold in the market until they are “retired” and their environmental attributes are claimed by an entity.

One major difference between the compliance and voluntary markets that has been clear over the last few years is the credit value as compliance markets often trade over $100/MT while voluntary credits trade closer to an average of $3.0/MT.

Tokenization

Voluntary carbon projects and credits undergo verification and listing on a few major centralized registries (Gold Standard, Verified Carbon Standard (Verra), American Carbon Registry (ACR), and Climate Action Reserve (CAR)). These registries act as the authority for setting the standards that project developers need to abide by to generate credits. In a traditional sense, once credits have been generated, sold, and retired it marks the end of that particular credit’s life.

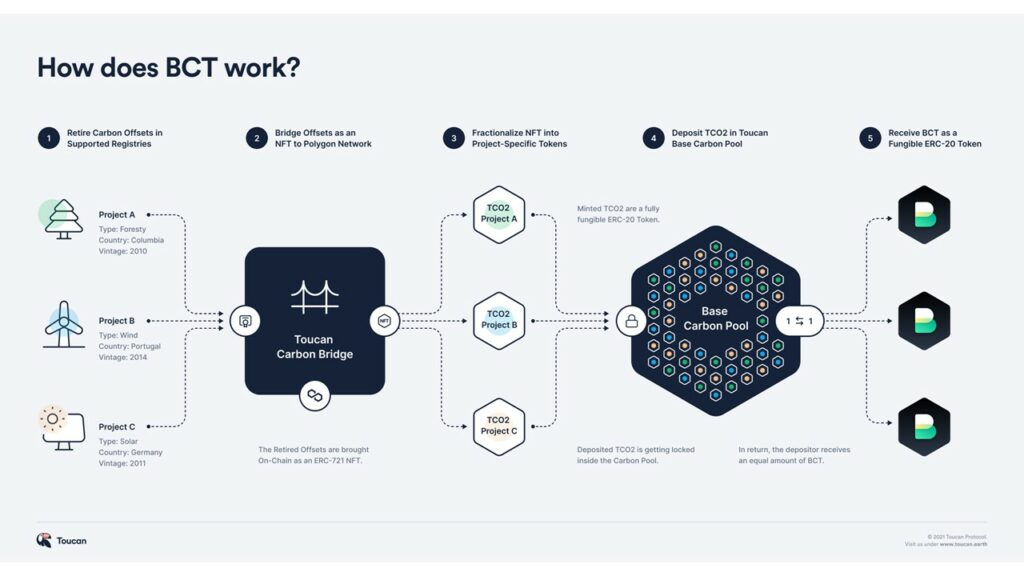

Enter the tokenization movement in which credits on registries are bought, retired, and then bridged to a blockchain in the form of tokens. Tokenization in this case means bringing the carbon credits on-chain, enabling the carbon reduction asset to be freely transferred, exchanged, or stored away in accordance with a set protocol. This is strictly a one-way process as tokens cannot be unretired and brought back to the registry. Here is a flow diagram of that process:

Source: Toucan

Why does tokenization help? Major arguments include liquidity, accessibility, price transparency, avoidance of double counting (where two parties claim the same carbon removal or emission reduction), and/or fractionization of the credits.

Sweeping the Floor

KlimaDAO is a fork of the infamous OlympusDAO project that represents an approach of what is known as protocol-owned liquidity tokens that help to solve some of the issues of past decentralized finance (DeFi) projects. KlimaDAO as a new wave of DeFi Technology had a mission to “sweep the floor” when it came to voluntary carbon credits. The idea was to incentivize the purchase of carbon credits on the carbon registries (i.e. Verra), retire, tokenize, and sell/burn the tokens. This ultimately would create a shortfall of carbon credits on the market and signal to emitters to reduce emissions with the cost of offsets being high while also allowing emission reduction projects to move forward on the strong price signal.

The project kicked off in October 2021 and gained momentum fast. Billionaire Mark Cuban shined a light on the project and was claiming to be purchasing $50k worth of tokenized carbon credit offsets (BCT) every ten days. In the next few months, the voluntary markets were upended as demand for credits skyrocketed sending prices upward.

A critical assumption of this approach was that there was a small pool of low-quality carbon offset credits that once purchased would then allow the high-quality projects to increase in price. However, the increase in traded volume allowed dormant projects that had been unable to previously sell their low-quality carbon credits an entirely new market of buyers. These projects were known to be bad actors that provided little or no verifiable emission reductions.

Then in May 2022, Verra announced a complete ban on entities trying to tokenize carbon credits originating from their registry while KlimaDAO pricing collapsed. In August 2022, Verra released a request for public consultation on how to proceed with engaging third-party crypto instruments and tokens in the future. That comment period has closed and on January 17th, 2023 Verra released a summary of the comments it received.

Moving Forward

Verra received input from 71 stakeholders across all aspects of the industry offering up helpful commentary and possible solutions in hopes of making tokenization a reality. It’s clear that the cryptocurrency industry is not backing down from its mistakes, but rather learning and attempting to progress forward. Perhaps the voluntary carbon markets can look to the compliance markets for guidance, whether it be with the use of credit clearance mechanisms, price caps, or project credit generation sunsets. While enhancements on the measurement and verification side could come in the form of hardware solutions (IoT devices) to help bring increased data integrity to these projects. This past month The Guardian released the results of an investigation into Verra’s carbon offsets and found that “more than 90% of their rainforest offset credits – among the most commonly used by companies – are likely to be “phantom credits” and do not represent genuine carbon reductions.” Does tokenization solve any real problems the voluntary carbon market is facing?