Published on

Thursday, April 24 2025

Authors :

Harold "Skip" York - Chief Energy Strategist

“Another one gone, another one gone, another one bites the dust”

Queen in The Game

On April 16, 2025, Valero notified the CEC (California Energy Commission) of its current intent to idle, restructure, or cease refining operations at its refinery in Benicia, California (VLO-Benicia) by the end of April 2026 and is evaluating strategic alternatives for its other California operations. This blog discusses implications of how California might continue to supply its gasoline market should this refinery cease operations. With refinery closures, California is continuing to move from a net exporter to a net importer of gasoline, which will bring higher prices and more volatility.

Basis for Decision

According to the CEC, the Benicia refinery has a crude capacity of 145 mbd, producing about 90 mbd of gasoline, and is the sixth largest refinery accounting for about 10 percent of the state’s refining capacity. Valero also operates a refinery in Wilmington (85 mbd), as well as its fuels marketing business. In connection with evaluating its strategic alternatives, Valero will take a pre-tax impairment charge of $1,100 million for its Benicia and Wilmington refineries. This amount is the recognition of expected asset retirement obligations of $337 million.

The company cited high operating costs driven by California’s climate and energy policies as part of the basis for its decision. The refinery employs over 400 people with the city now facing potential impacts on employees and local businesses. The city government intends to work with Valero to clarify the timeline of the proposed changes.

Putting this closure in context

Valero’s decision to shut Benicia comes on the heels of three other refinery closures and conversions in the state: Marathon-Martinez (2020), Phillips 66-Rodeo (2024), and Phillips 66-Los Angeles (2025). With the closure of Benicia, California will have 7 fuels refineries, about 1/3rd of the refineries in the state in 2000.

Gasoline demand in California is declining at an annual rate of 0.9%, with demand declining twice as fast in the Bay Area than in the LA Basin.

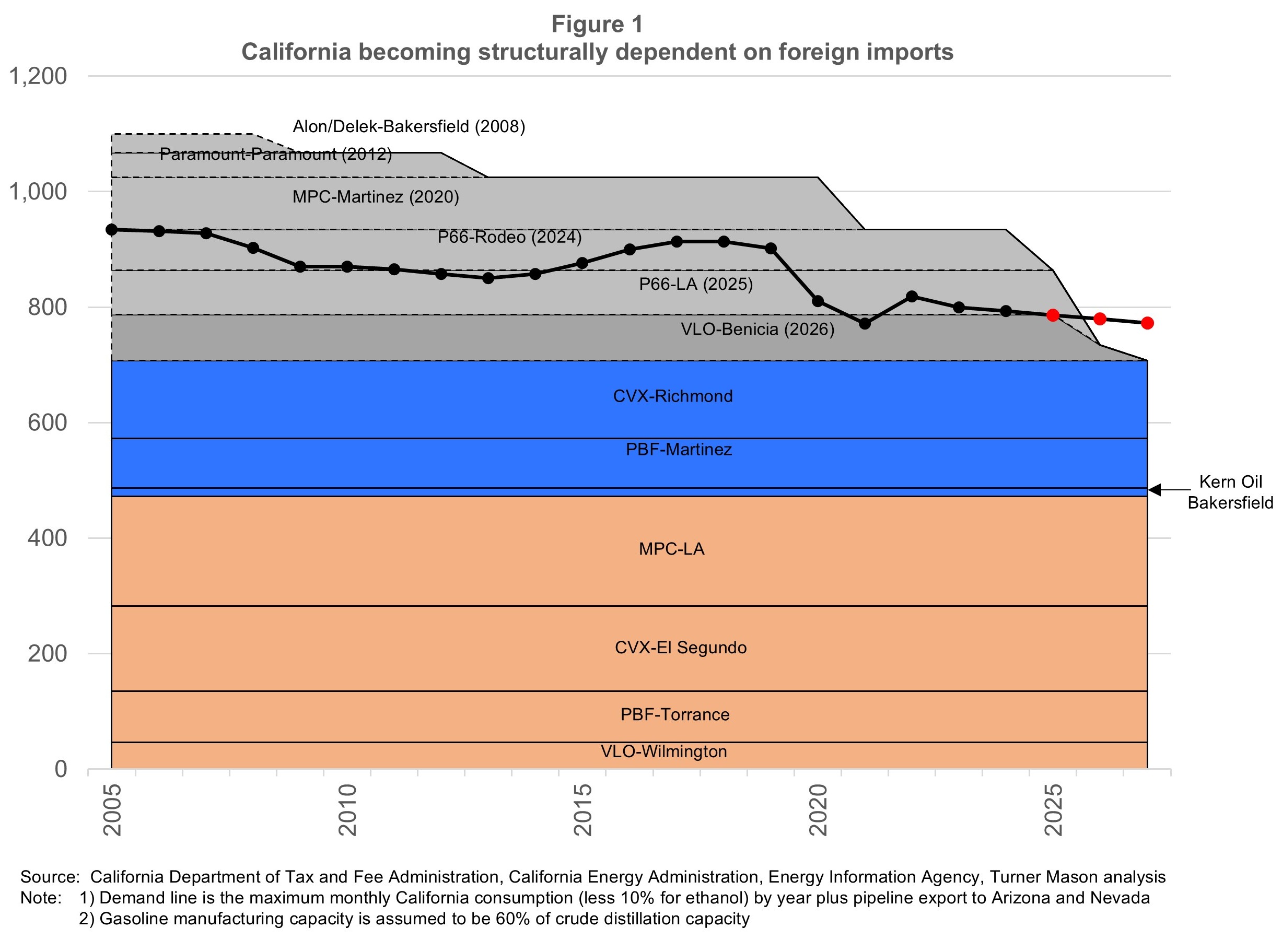

We updated the chart below from our prior blog on the closure of the Phillips 66 – Los Angeles refinery (“And then there were eight”) to show the California gasoline supply-demand balance. The demand line reflects the monthly maximum consumption (less 10% to account for ethanol) plus gasoline pipeline movements to Arizona and Nevada for each year. We extended the line to 2027 (represented by the red dots) by assuming California’s gasoline demand continues to decline at 0.9% p.a. and out-of-state pipeline movements remain constant.

The horizontal bars reflect the gasoline production capacity of each refinery based on a simple assumption that 60% of a refinery’s crude distillation capacity can be converted to gasoline. The grey bars reflect refineries that already have closed or repurposed and we added P66-LA and VLO-Benicia to this stack. The blue highlighted refineries are in northern California and the tan highlighted refineries are in southern California.

If VLO-Benicia closes, then by 2027 California would run a gasoline deficit of about 65 mbd (9% of demand) assuming no refineries in maintenance and without unplanned outages. The state will become dependent on constantly importing volumes of gasoline from as far away as Asia, the Middle East, or Europe.

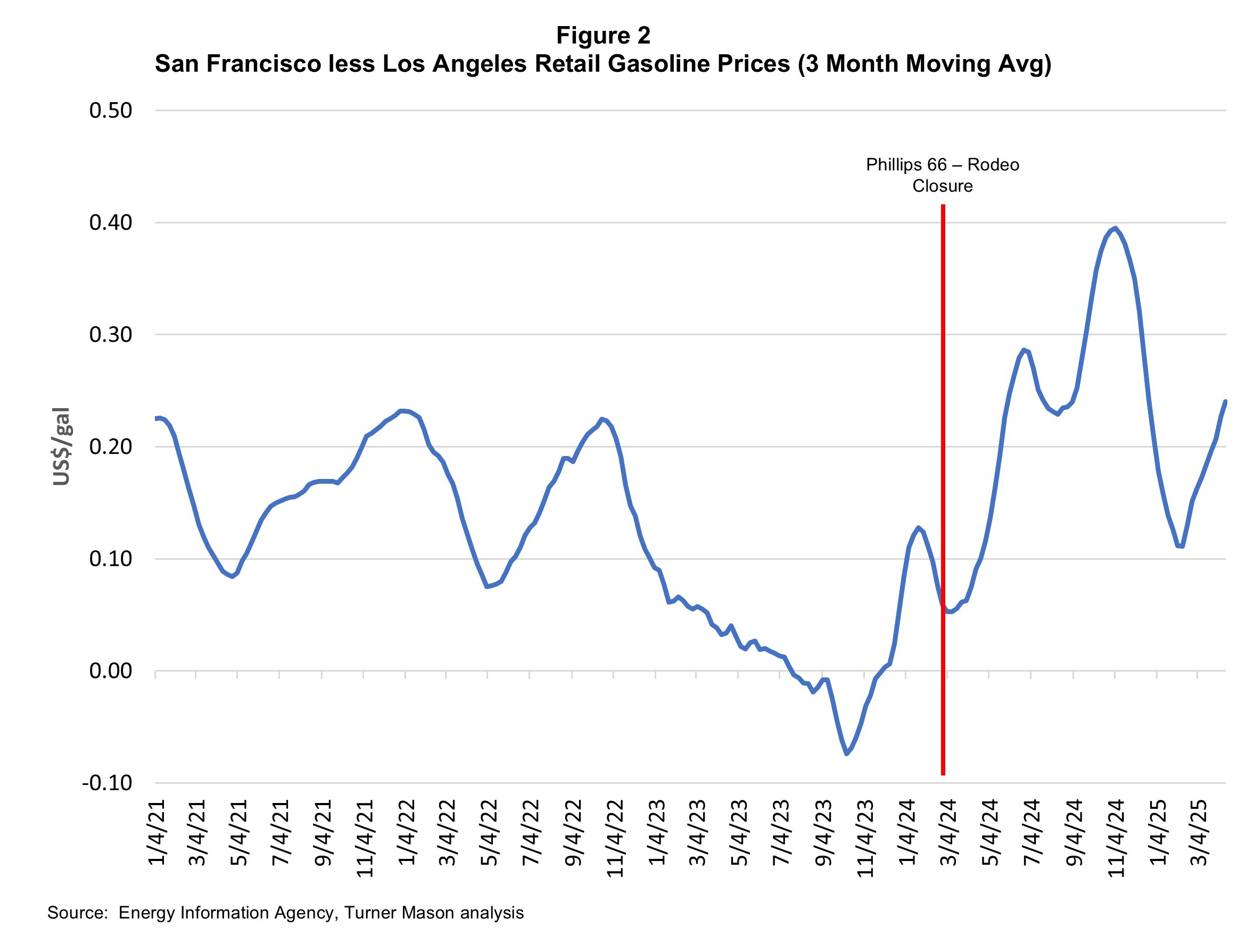

Within California, historically, the northern refineries produced more gasoline than local demand, with the balance moving to southern California to help balance the state. That northern excess production volume has been shrinking with the closure of the Marathon and Phillips 66 refineries. The implication is that the price of gasoline in San Francisco relative to Los Angeles has moved from roughly parity to a premium since Phillips 66-Rodeo ceased operating as a petroleum refinery.

As California moves to a structural gasoline deficit, the links in the supply chain get longer. The sailing time is at least 30 days and the longer the supply chain the greater the risk of disruptions (e.g., weather, shipping disruption, refinery outages, geopolitical events).

The likelihood of higher product prices that are more volatile increases as the deficit window widens. Product vessels are smaller (with higher unit costs) than crude oil tankers. The smaller product vessels also mean an increase in harbor traffic with the resulting congestion increasing demurrage costs. This geographic risk is exacerbated by California choosing to have a gasoline grade that is not fungible with other reformulated gasoline in surrounding markets.

California is at risk of additional refinery closures

In June 2024, TM&C completed a Transportation Energy Supply Chain Infrastructure and Investment Study (TESCII) on the state of California. We analyzed the stability of the existing road liquid transportation fuel supply chain and risks to its viability in the future. The key insights from our analysis were: (1) California crude oil production is in sharp (15% p.a.) decline which could impact refinery domestic crude supply, (2) crude oil pipelines are approaching closure risk due to minimum volumes, (3) growing marine movements may eventually reach limits, and (4) policymakers should look at the cumulative impacts of several policies rather than treating each in a vacuum.

In the study, we surmised that it was not a question of “if”, but “when” refiners could be forced into difficult decisions such as the one Phillips 66 made last year and Valero is now making.

A link to the Executive Summary of our study can be found here.