Published on

Tuesday, April 28 2020

Authors :

By Robert Auers and John Auers

As refiners looked toward 2020, many had dreams of growing margins driven by a continuation of strong global economic activity supplemented by an expected IMO boost to product margins and widening of heavy crude discounts. Unfortunately, the COVID-19 pandemic has turned those dreams into nightmares, with the unprecedented drop in petroleum demand from the COVID lockdowns forcing refiners to move into a purely survival mode. With overall global demand falling by as much as 30% (and even higher in the U.S.), refiners are having to slash throughputs and even shut down refineries as we discussed in our blog series over the last three weeks. They are also having to scramble to cut costs, defer capital projects, raise cash reserves and expand lines of credit, and in some cases sell assets such as PBF’s decision to monetize the hydrogen plants located at their five refineries. Demand for some products, especially gasoline and jet fuel, has fallen faster and harder than for some others such as diesel and asphalt, and these differences are also making operating decisions more difficult for refiners. Probably the biggest challenges refiners face is the uncertainty associated with how long the current lockdowns will last and beyond that, what the residual impacts on demand will remain even as restrictions are removed. We will discuss those subjects in today’s blog as we channel the classic CCR tune, “Up Around the Bend,” and attempt to “peek” at what lies around that “bend” in regards to petroleum demand.

When we consider the potential trajectory of a general economic and oil demand recovery, there are obviously several factors at play, including the pace of government actions to remove restrictions, the attitudes and responses of the general public to the reopenings, the damage done to businesses and the general economy as a result of the shutdowns, and of course trends in COVID-19 results (infections and deaths). Regional considerations are also important, as both the spread of the disease and the pace of reopening will vary significantly both across the U.S. and around the world.

When talking about economic disruptions, we often like to use letters of the alphabet to describe the patterns exhibited by the markets leading into and coming out of those disruptions – with V, U, W, and L, being the most common “shapes.” Certainly, when it comes to product demand, the front half of this disruption is unprecedented and is as close to vertical (as in an L) as we have ever seen. Economic activity and oil demand fell almost overnight in the U.S. after lockdown decrees were issued by federal, state and local governments in mid-March (dropping by 7 million BPD/30+% from the week ending March 13 to the week ending April 3 according to EIA weekly estimates). Over the past couple of weeks, petroleum demand appears to have bottomed, both in the U.S. and around the world. With “reopenings” beginning across Europe and in some parts of the U.S., we should start to see some gradual increases in economic activity and resulting petroleum demand. However, these reopenings will be slow (and regional) and many businesses and individuals may also be reluctant to return to normal activities even if the government allows them to do so. A recent CBS News poll, shown below as Figure 1, illustrates these attitudes. Nonetheless, we note that polls such as this represent opinions only at a specific point in time, and those opinions can change very quickly, especially if COVID infection and mortality rates do not “bump.” In any case, the recovery will certainly be slower than the decline (leaving out the V and U patterns), but we do foresee steady increases in demand as the reopenings gather steam (assuming no COVID relapse or return in the Fall), with the NIKE “swoosh” perhaps the most likely representation of the trajectory. However, some residual effects could remain, especially in regards to certain products, and these could impact demand of those products well into the future.

Gasoline

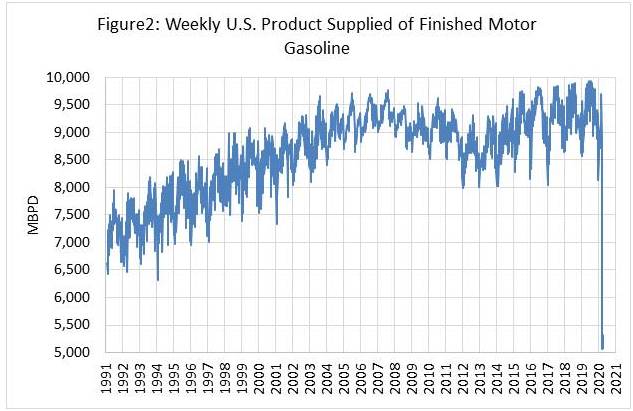

The most significant impact on petroleum demand (considering both the absolute and relative levels of decline) thus far has been in the gasoline market. Gasoline demand has declined by almost half, averaging under 5.2 MMBPD during the first half of April (according to EIA weekly supply estimates, which can be subject to significant revisions) vs. 9.6 MMBPD through the first half of March 2020 and 9.4 MMBPD in April 2019. In fact, the last four weeks represent the lowest four weeks of U.S. finished gasoline consumption since the EIA began tracking the weekly product data in 1991. Moreover, as gasoline accounts for nearly 50% of U.S. petroleum consumption and nearly 60% of U.S. refinery production of transportation fuels (even as refineries were generally already operating in “max diesel mode”), the impacts of this demand cliff have been drastic on the U.S. refining industry, particularly in the inland PADDs, which do not have access to export markets. Figure 2 displays this weekly demand data.

With restrictions fully implemented by late March, it appears as though gasoline demand has bottomed in the U.S., with the latest weekly data (for the week ending April 17) actually rising by almost 5% from the previous week. This appears to be true in much of Europe and other parts of the world as well, and certainly Chinese demand has risen significantly since it bottomed back in February. As a number of U.S. states begin relaxing restrictions this week and especially on May 1, these increases should grow larger and gradually accelerate as the reopening processes become ever less restrictive and spreads geographically to other states. We do, however, feel it is unlikely that U.S. gasoline demand will return to where it was before the lockdowns any time soon (or even ever) for several reasons. First, U.S. gasoline demand reached an all-time high in 2017 at 9.62 MMBPD and has declined slightly each of the last two years. We were already forecasting a slow erosion of gasoline demand (with the pace of these demand declines accelerating later this decade due to a general stagnation of vehicle miles travelled, increasing vehicle efficiencies, and, to a lesser extent, increased use of alternatives). While low prices will obviously encourage more driving and provide little incentive for consumers to switch to more fuel-efficient vehicles or alternatives, the general economic slowdown and continued virus fears will discourage driving to some extent. Further, many people will likely continue to work from home due to lingering virus concerns in the short term. Additionally, the longer term trend of more people working from home will likely accelerate as many companies and employees assess the potential benefits with regards to cost savings, quality of life, and potentially even increased productivity due to the reduction in commute times. On the other hand, many marginal transit riders may avoid transit for some time and choose to drive instead to avoid possible virus exposure, though this is unlikely to be sufficient to offset the negative demand forces discussed above.

The rest of the OECD is likely to follow a similar pattern in this regard. Gasoline demand was already declining in developing countries (except for Europe, where de-dieselization is driving a medium-term increase gasoline demand). In the developing world, gasoline demand has obviously been impacted in the short term, but will continue its long-term growth trajectory as we move past the current lockdowns and the economic recovery begins.

Jet Fuel

While gasoline demand has been most impacted in terms of absolute demand destruction, jet fuel demand has been impacted the most on a percentage basis, falling by nearly two-thirds as a result of the crisis, from ~1.75 MMBPD before the crisis to ~600 MBPD currently in the U.S. Similar trends have been seen in other countries as most air travel has been grounded across the globe. Fortunately, most jet fuel can be blended into diesel (the demand for which has been less-affected). Still, many refiners are limited in the amount of jet fuel that can be shifted into the diesel pool due to constraints with regards to flash point and/or hydrotreating capacity. While some jet fuel demand is likely to return as COVID restrictions ease, this demand is likely to return more slowly than that for gasoline. International travel restrictions will likely remain for some time and many people will simply be wary of flying due to lingering virus concerns. Further, air travel is somewhat of a luxury good (both in terms of business and personal travel) and is likely to be curtailed simply as a result of a slowing economy. Lastly, many businesses are likely to re-evaluate the “value add” of their business travel, potentially permanently providing a “drag” on jet fuel demand. On the positive side, jet fuel is less vulnerable to replacement by alternatives than either gasoline or diesel, and the desire and ability of people in developing countries for air travel will grow as economic growth returns.

Diesel demand

Diesel demand had been somewhat of a bright spot for refiners as it had been the least affected by the COVID lockdowns. However, demand has started to drop more sharply in the last couple of weeks in the U.S., falling by ~25% from pre-crisis levels and leading to lower prices (even dropping below gasoline on futures markets in recent days) and inventory builds. The early resiliency was due largely to continued agricultural, industrial, and freight demand, which were less impacted than driving or flying. On the other hand, diesel demand related to upstream drilling activity has obviously fallen precipitously (and continues to decline) and freight demand has begun to fall more as well as general economic activity slows. Going forward, diesel demand will likely be slower to recover than gasoline as demand typically trends with economic activity (more so than prices), and the broader recovery is likely to take some time. Further, demand relating to the U.S. drilling activity will continue to decline in the short term and be slow to recover because of the oversupplied crude market and resulting low price environment. Nonetheless, diesel remains well positioned longer term, as low prices will likely slow the penetration of alternatives and long-term economic growth will again lead to growing demand, especially in developing economies.

Turner, Mason & Company will continue to closely monitor developments related to the COVID-19 pandemic, the progress made by states and countries to reopen their economies, crude supply/demand dynamics, and all other events that could impact the various segments of the oil industry. We will continue to comment on our changing views on all these issues in coming blogs over the next several weeks and incorporating our updated market forecasts into our next edition of our Crude & Refined Products Outlook which will be published to clients in late July. If you would like more information on this publication or for any specific consulting engagements with which we may be able to assist, please visit our website: https://www.turnermason.com and send us a note under ‘Contact’ or give us a call at 214-754-0898. Please stay vigilant during these uncertain times and make good and informed decisions on personal interactions and hygiene practices.