Published on

Tuesday, May 5 2020

Authors :

Eamon Cullinane and John Auers

In what was the most highly anticipated event to occur in the bunker industry, in the last decade, IMO 2020 is now but a memory of the past as COVID-19 has taken center stage. The pandemic has caused an unprecedented drop in petroleum demand and in doing so; the price of crude has declined to record levels while dragging down product prices. The contracting economy has hit the shipping market hard as demand slips creating less need for vessels to import or export goods from the major economic powerhouse countries. In the midst of this collapse, the IMO High Sulfur Fuel Oil (HSFO) carriage ban went into effect on March 1 where a vessel can no longer have HSFO on board unless the ship has a scrubber. In today’s blog, we will review what has taken place in the bunker market since the beginning of the year, focusing on the impacts that have been observed with regards to pricing, compliance, and vessel scrubber installations.

“Fire in the Sky” – Market Dynamics

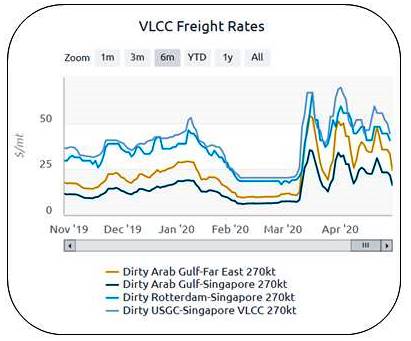

The combination of drastically decreased demand resulting from COVID-19 lockdown measures and the fallout between Saudi Arabia and Russia in March with regards to extending OPEC+ supply cuts resulted in a nose dive for crude pricing globally as the world became awash with excess crude. Usually, as the price of crude falls, this directionally results in decreasing bunker demand and lower freight rates across the board. However, in this case, the crude spot pricing went low enough where the market went into deep contango. At this point, traders went looking to store all the crude that no one needed and started filling up land-based storage. Once all these outlets filled up, the next logical play became floating storage. Traders started using vessels to store the crude which resulted in a spike of freight rate costs.

Source: IMO 2020 Tracker Tool

Source: IMO 2020 Tracker Tool

In the chart above, we can see the first spike in January as a result of the trade sanctions that the U.S. placed on China. Eventually, rates returned to normal by the end of February. Then in late March, you can see additional spikes as the floating storage play gained momentum.

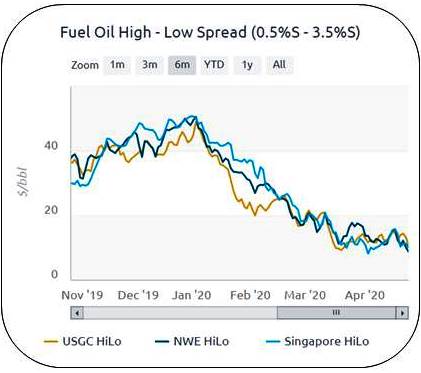

In January, we saw the spread between Low Sulfur Fuel Oil (LSFO) and HSFO reach over $50/bbl in some of the major bunkering regions with HSFO cracks at record highs. However over the last three months, we have seen that spread narrow to less than $15/bbl in all the major regions as LSFO pricing has continued to weaken.

Source: IMO 2020 Tracker Tool

Source: IMO 2020 Tracker Tool

At such a low spread, it isn’t crazy to think that some ship owners might be switching from HSFO to LSFO at some ports even if they have a scrubber installed. In large part, this is driven by fuel availability, as at many ports HSFO can be rather difficult to procure.

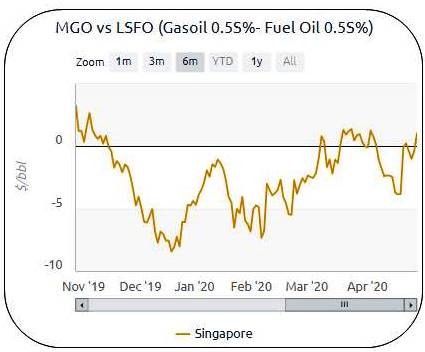

Also at the start of the year, LSFO was at a premium to Marine Gas Oil (MGO) and for good reason. Large marine engines are generally designed for heavy fuel oils, which have a higher viscosity than MGO and provide more optimal engine performance and reliability. From an economic standpoint, MGO has a lower energy density (BTU’s per volume), making it less valuable on a per barrel basis and also less suitable for long voyages. Despite these tangible advantages, the spread has vanished in recent weeks and the two are currently trading close to parity on a volume basis.

Source: IMO 2020 Tracker Tool

Source: IMO 2020 Tracker Tool

This has resulted in an uptick of LSFO usage and a decline of MGO consumption. Much of the relative strength in diesel prices has been related to the slower decline in diesel consumption during the lockdowns. However, as we discussed last week, diesel demand is now starting to fall faster and could take longer to recover, especially if the economy remains in recession even after reopening. This would depress diesel prices overall and create a widening discount for MGO relative to LSFO (and a potential increase in consumption).

Compliance

As the shipping industry battles with COVID-19, they have been keen to call upon force majeure clauses in contracts, yet compliance with IMO 2020 across the industry has remained strong. In Q1 2020, Maritime Port Authority of Singapore (MPA) reported over 95% of ships called at the port were in compliance having conducted a total of 326 inspections. It also seems all the failed inspections came from ships that previously burned HSFO and had residue in the heels of their tanks.

However, in the UK all inspections have temporarily been suspended to minimize the spread of COVID-19. Britain’s Maritime Agency said, “In terms of enforcing IMO 2020 and ultimately MARPOL Annex VI requirements, as we have suspended port state control inspections, this also means that the checking of compliant fuel has been suspended.”

Inspections (in part) require a lot of interactions and touching of surfaces that could potentially spread the virus so a majority of ports are trying to limit this risk. MPA actually suggested that ship crews should receive daily temperature checks and all nonessential activities for the time being should be limited.

Scrubbers

The idea of social distancing has also made its way to the shipyard. Some analysts are seeing a slowdown in scrubber installations leading to a building back-log as the shipyards limit personnel and implement rules that have inevitably decreased efficiency. Beyond the installation delays, the economics justifying scrubbers rather than just using LSFO have significantly declined as we noted earlier. At the January HSFO vs. LSFO spread of over $50/bbl, installing scrubbers to capture the HSFO discount certainly seemed like a winning strategy. However, with that spread dropping to less than $15/bbl it no longer looks like a great investment given the relatively high capital cost of a scrubber. In fact, a lot of companies that had once been planning to retrofit their fleets with scrubbers are cancelling the whole idea as they look to cut costs and preserve cash in light of the uncertainties of the current economic environment. Of course, the very fact that scrubber penetration has slowed down should pressure HSFO discounts to widen and eventually provide incentives for ship owners to reconsider scrubbers, although the timing and magnitude of this is hard to predict and dependent on a variety of other market factors.

Turner, Mason & Company will continue to closely monitor developments related to the COVID-19 pandemic, the progress made by states and countries to reopen their economies, crude and refined product supply/demand dynamics, and all other events that could impact the various segments of the oil industry. We will continue to comment on our changing views on all these issues in coming blogs over the next several weeks and incorporating our updated market forecasts into our next edition of our Crude & Refined Products Outlook which will be published to clients in late July. If you would like more information on this publication or for any specific consulting engagements with which we may be able to assist, please visit our website: https://www.turnermason.com and send us a note under ‘Contact’ or give us a call at 214-754-0898. Please stay vigilant during these uncertain times and make good and informed decisions on personal interactions and hygiene practices.