Published on

Tuesday, June 23 2020

Authors :

Robert Auers

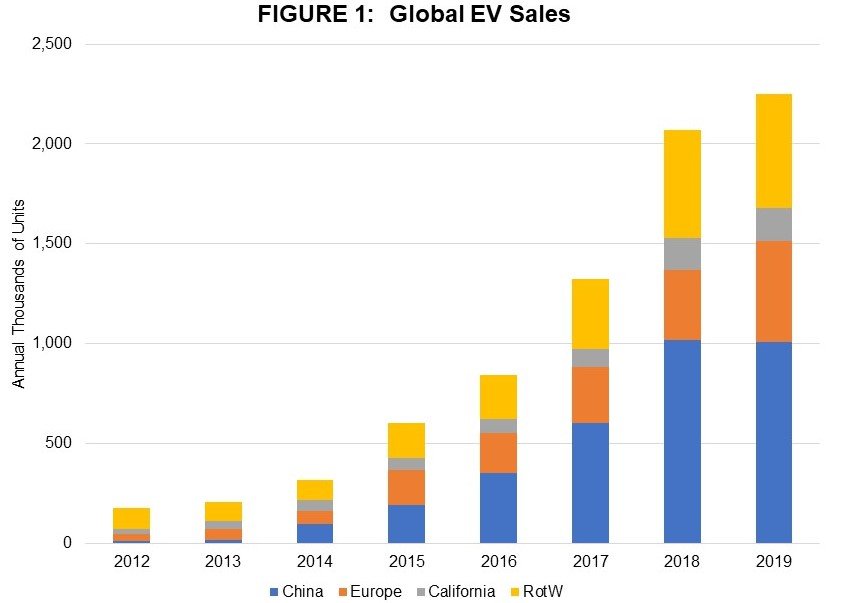

For the past two weeks, we have been discussing the short-term outlook for petroleum demand. Today, we are focusing on one important longer-term demand threat – Electric Vehicles or EVs. Global EV growth slowed to 9% in 2019 after averaging nearly 60% per year for the 2014-2018 time period. Growth will likely be slightly negative in 2020 due to weakness in overall vehicle sales, but should increase beginning in 2021, particularly as the EU undertakes stricter emission regulations that massively favor EVs. Still, we remain cautious regarding the longer-term future of EVs for several reasons – the first being the EV sales are still driven primarily by subsidies and incentives, and, as a result, sales are concentrated in select markets. Europe has notably enacted new strict CO2 requirements for vehicle manufacturers that provide strong incentives to increase EV sales, as EVs are treated as zero-carbon alternatives to ICEVs (which they are not) by the new regulations. We will not repeat the more detailed analysis that we performed last year, but EVs are still not close to internal combustion engine vehicles (ICEVs) in terms of total cost of ownership and likely will not come close for some time (without subsidies). In markets with minimal EV incentives, EV sales have struggled to get off the ground. In Australia, for instance, EV sales have remained well under 1% of total new vehicle sales despite a wealthy populous and relatively high retail gasoline prices (approximately 1.5 USD per gallon above those in the U.S.). Figure 1 shows global annual EV sales since 2012; however, going forward, will we all soon be (as sung in the 1984 Phillip Oakley hit) “Together in Electric Dreams,” or are we still “miles and miles away” from that goal?

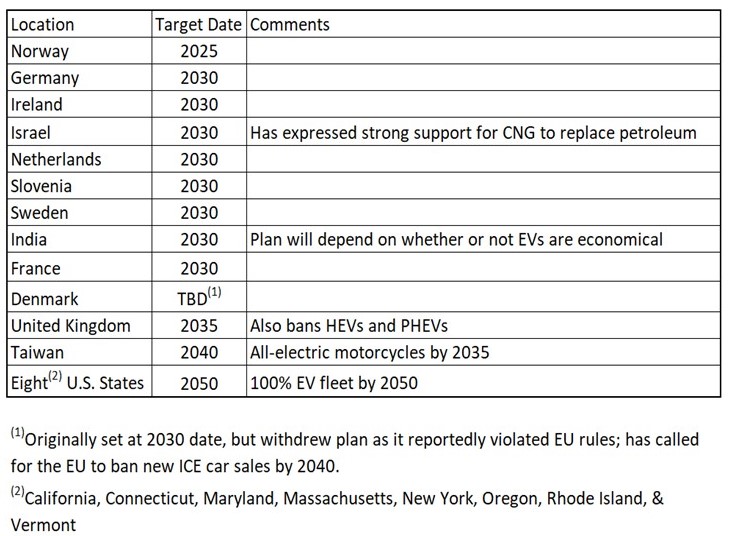

“Miles and Miles Away” – Proposed EV Bans

Still, going forward, governments across the globe retain glorious outlooks for EV sales growth and many have set dates for outright ICE bans with target dates mostly ranging between 2025 (for Norway) and 2040; however, except for the Norwegian target of 2025, the bans remain at least 10 years out in the future – leaving plenty of time for changes to be made if needed. Any change in political will and/or public opinion over that time could mean a shift in policy. Further, many of these proposed bans are ambiguous toward, or explicitly allow, the continued sales of PHEVs and traditional hybrids, the latter of which most consumers do not think of as “EVs.” Finally, India’s proposed ban is explicitly dependent upon economic feasibility – some that most of the other fail to address, but will be forced to once the implementation date draws closer. Table 1 details some of these proposed bans.

Table 1: Proposed ICE Bans

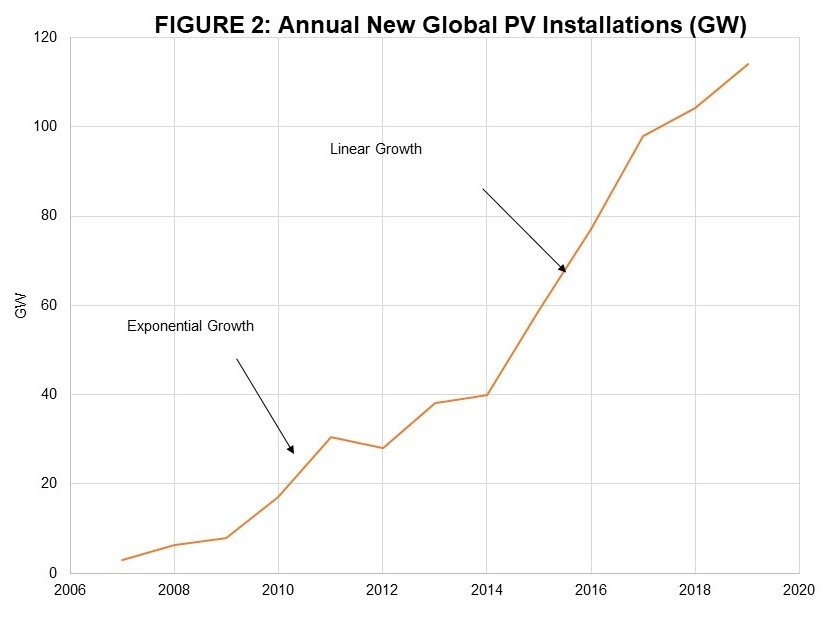

“However far it seems” – Forecasting future trends

While EVs currently constitute only 2.5% of global passenger vehicle sales, subsidies have been palatable. However, we suspect that as the burden of subsidies continues to increase, governments will be forced to react, not only because the cost of the subsidies will become too high, but it will also become evident that increased EV adoption will have nothing more than a nominal effect on CO2 emissions. This may result in a situation at least partially similar to that of Solar photovoltaic (PV) installations. Through 2011, global PV installations were growing at an exponential rate and many experts forecasted that this trend would continue indefinitely. However, due to a variety of factors (including some loss of support from the Chinese government), growth stalled and what was once exponential growth eventually turned into linear growth. We suspect a similar situation to emerge with EVs. Figure 2 shows global annual PV installations.

“I Just Close my Eyes” – Ignoring the Real Environmental Impact of EVs

Finally, as mentioned before, EVs (particularly full BEVs) do not represent the “low-hanging fruit” in terms of reducing CO2 emissions – the primary stated goal of most of those that push for an all-EV future. We have previously calcualted that, at the current U.S. electrical grid CO2 intensity of ~850 lbs CO2/kW-hr, a traditional Prius hybrid and a Standard Range Tesla Model 3 have roughly the same “carbon footprint” over an assumed 200,000 mile vehicle lifetime. Even if overall U.S. electric grid CO2 intensity were reduced to 500 lb/kW-hr, the Model 3 would only provide ~20% reduction in term of lifetime “carbon footprint” by our calculations. These calculations are, of course, subject to several assumptions, but we believe these to be reasonable estimates. Moreover, transportation only accounts for ~16% of global CO2 emissions (as shown in Figure 3), and passenger vehicles only account for a portion of this 16%. This means that EVs represent a high-cost way to marginally reduce CO2 emissions in a sector that only accounts for a small fraction of global CO2 emissions. As this fact becomes more widely acknowledged across the globe, pushback against EV subsidies and incentives may increase.

In conclusion, even as we expect EV sales to continue to grow, the current dominant position of ICEs is unlikely to be impacted in a major way for quite some time on a global scale. As a result, we do not expect EVs to exert major downward pressure on petroleum demand through at least 2030. Light duty transportation, which is the only real promising application for EVs to date, accounts for only about 25% of global petroleum demand. Further, EVs accounted for just 2.5% of global new vehicle sales in 2019 and account for only ~0.8% of light duty vehicles on the road today. By 2030, we expect EVs to account for 13% of total new light-duty vehicle sales, but still make up only about 6.5% of total cars on the road. Even if 2030 EV sales were double our current forecast (or 26% of 2030 new car sales), EVs would still likely account for less than 10% of the total global vehicle fleet in 2030.

Assuming that all types of light duty vehicles are proportionally replaced by EVs, we could expect EVs to decrease global demand by ~1.6 MMBPD in 2030 (using our base case sales forecast). However, the average EV tends to be smaller than the average ICEV, meaning that the actual impact on demand is lower – likely around 1 MMBPD in our 2030 in our estimates. As an example, a consumer is more likely to replace a Prius or Civic than an F-150 with an EV. Since trucks and SUVs consume more fuel than EVs, the effects of EV ownership on demand will be diminished compared to what it might seem at first glance. By 2040, we expect EVs to account for ~16% of the total vehicle fleet globally – reducing global demand 2-3 MMBPD compared to where demand would be with zero EV penetration, a relatively small amount compared to our expected total petroleum demand of over 111 MMBPD in that year.

Increasing efficiencies (including increasing sales of traditional hybrids in the light-duty vehicle market), on the other hand will have a much larger effect on demand growth going forward. Importantly, efficiency does not only reduce demand from light duty vehicles, but from almost all combustion-based petroleum demand. Efficiency continues to improve in heavy duty vehicles, airplanes, trains, and ships just as it does in light duty vehicles.

We also note that the shift toward SUVs and trucks continues globally, with the market share for trucks and SUVs reaching 39% in 2019, up from just 22% in 2014. We do not see much evidence to indicate that this trend will slow significantly or reverse, and this demand tailwind will serve to mitigate some of the headwinds from increased EV penetration and improving vehicle efficiencies.

Turner, Mason & Company will continue to closely monitor developments related to the COVID-19 pandemic, with a focus on how those developments might impact petroleum supply, demand, prices and the overall outlook for refiners and other segments of the oil industry. We will be commenting on our changing views on all these market trends in coming blogs over the next several weeks and incorporating our updated forecasts into our next edition of our Crude & Refined Products Outlook which will be published to clients in late July. If you would like more information on this publication or for any specific consulting engagements with which we may be able to assist, please visit our website: https://www.turnermason.com and send us a note under ‘Contact’ or give us a call at 214-754-0898. Please stay vigilant during these uncertain times and make good and informed decisions on personal interactions and hygiene practices.