Published on

Thursday, March 7 2024

Authors :

Eamon Cullinane - Director, Renewable Energy Market - ecullinane@turnermason.com

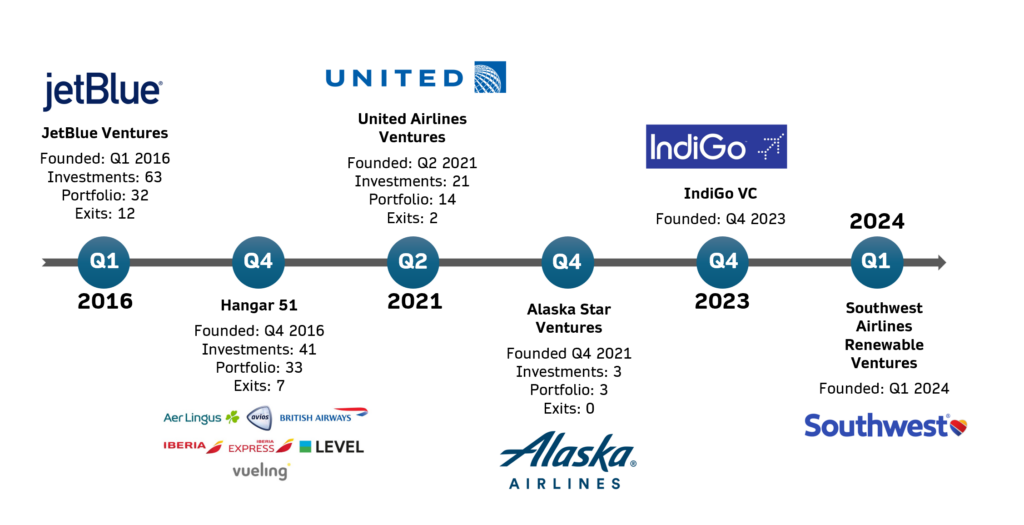

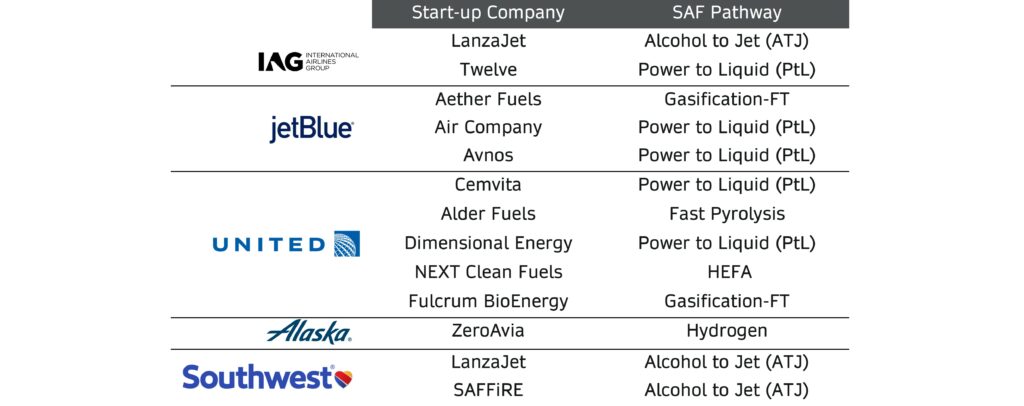

Corporate Venture Capital (CVC) has seen a lot of momentum in the airline industry with the likes of JetBlue, United Airlines, Alaska Airlines, and Southwest Airlines all having now launched venture capital arms within their organizations. Focused on sustainability, these CVC’s are searching for innovative technologies and start-ups that could help the parent airlines achieve their net-zero goals. This is a tall order in an industry that can’t be immediately electrified and will likely rely heavily on liquid hydrocarbons for the foreseeable future. Faced with an uphill battle, Airlines have taken matters into their own hands to find and fund market disrupters in a line of work where up to 90% of venture-backed start-ups fail.

Corporate Venture Capital (CVC) has seen a lot of momentum in the airline industry with the likes of JetBlue, United Airlines, Alaska Airlines, and Southwest Airlines all having now launched venture capital arms within their organizations. Focused on sustainability, these CVC’s are searching for innovative technologies and start-ups that could help the parent airlines achieve their net-zero goals. This is a tall order in an industry that can’t be immediately electrified and will likely rely heavily on liquid hydrocarbons for the foreseeable future. Faced with an uphill battle, Airlines have taken matters into their own hands to find and fund market disrupters in a line of work where up to 90% of venture-backed start-ups fail.

While venture capital has historically been the dominant player in start-up funding, corporate venture capital has continued to expand its presence in recent years. Given the rising popularity of CVC, from the perspective of a Sustainable Aviation Fuel producer start-up in need of capital, which source of funding is preferred? What factors will this depend on and why?

Cost of Capital

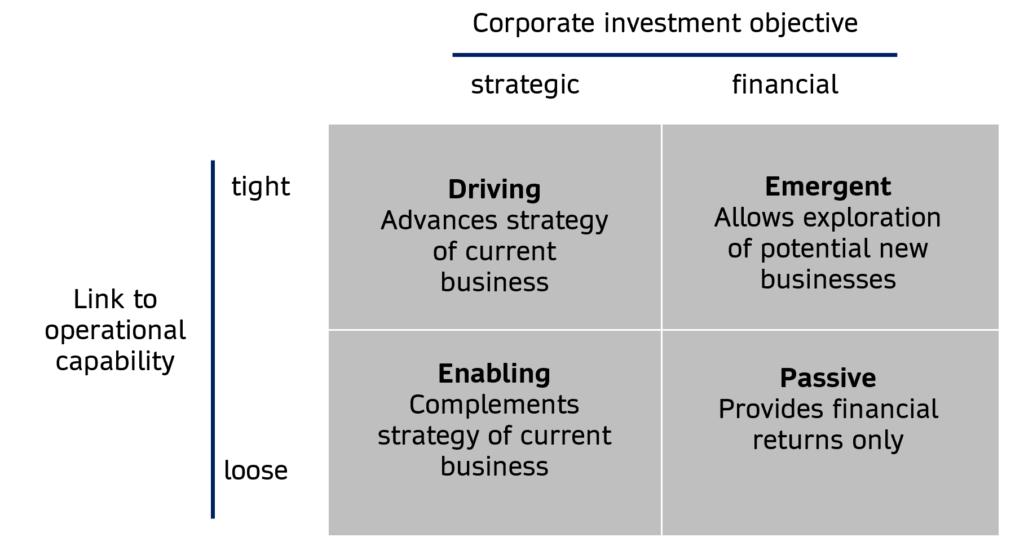

A CVC investment strategy can be divided into two general categories, financial or strategic. The strategic approach can further be divided into either driving (advances current business) or enabling (complementary to current business). In the case of sustainable aviation fuel producers, these investments would be considered strategic-enabling.

Recent studies have shown that a CVC will likely pay an investment premium over traditional VCs when employing a strategic objective. We can reason the CVC is willing to give up more than a VC in this case if the CVC believes the investment will allow them to have access to new technology that will ultimately benefit their bottom-line business while a VC cannot realize these strategic synergies. Note that these deals aren’t always cash for equity. In the case of Alaska Airlines with ZeroAvia, Alaska Airlines gave them a physical airplane for engine retrofitting testing in return for equity. Something a traditional VC would not have immediate access to as a resource to bargain.

Fund Performance

A start-up looking at funding from either CVC or VC should also consider the past performance of each entity as they make a decision. In the case of a well-known airline corporate (i.e. United Airlines), a start-up might view the historical performance of UA as indicative of the CVC performance. However, often the venture capital part of a corporation might be a separate branch run by a different set of managers and is generally not governed by the corporates board of directors. A start-up should consider how well the venture capital portion of the business has done rather than the firm as a whole. That being said, the endorsement effect alone from a company such as United Airlines in the SAF space can help bring legitimacy to the start-up and set it up for future success. VC firms can also bring this effect but to a lesser extent.

Resources

Resources can also be a differentiating factor in making the decision. In terms of financial resources, both the CVC and VC are well equipped and differences only stem from the cost of financing as discussed earlier. A start-up must then evaluate other resources such as expertise, market knowledge/intel, complementary resources, network, and assets. This will be case-specific and up to the start-up to evaluate its needs and find the right partner to help satisfy them. Airline CVCs also present an additional risk factor in the event of a changing environment of the company’s main business line. When the COVID pandemic hit, airlines struggled in profitability which resulted in a decrease in investments of their venture arms. In times like these, the start-up could face a fight for resources or divergence of common interest from the corporate airline.

Industry & Technology

The needs of a SAF start-up are also a reflection of the industry they are trying to disrupt. Production of liquid fuels takes large amounts of capital, well-integrated supply chains and large-scale facilities. In such an asset-heavy industry, it would be very difficult for the start-up to do this alone and achieve real-world testing. They may prefer to partner with a CVC that has established experience in fuels production. In that light, these airline CVCs are not the optimal choice for partnerships. Instead partnering with large scale fuel producers like Diamond Green Diesel (Valero), P66, and Marathon would bring greater benefits to the start-ups. Delta Airlines might actually be the best positioned out of any company in this category as they can leverage their ownership of the Monroe Refinery.

Governance

Start-ups should also consider the governance structure they intend to have with the CVC or VC. Often a corporation can prove to be slow and administrative with various layers of politics at play. Corporates will tend to have rigid procedures and standardized operating practices that ultimately may slip over into the relationship with the start-up. Whereas a traditional VC can potentially offer more autonomy and freedom for the start-up to experiment and innovate.

Misappropriation

We can also ascertain from the start-up perspective that they may require a CVC premium to be paid to compensate for the inherent risk involved in dealing with a corporation that could potentially be considered a competitor. This risk could be related to an increased likelihood of misappropriation. However, the actual risk is likely extremely low given the narrative from interviews with CVC managers that claim only one instance of this type of behavior can destroy a firm’s reputation. This is often called reputation spill-over in which prospective start-ups will now have a negative view of the partnering firm. A potentially larger factor for why the start-up might require a premium over an independent VC is the fact that working with the CVC might limit collaboration opportunities with competitors of the CVC. The start-up will see this as a downside and require a better deal (i.e., more capital for less equity) in comparison to a traditional VC where this would not be an issue. Note that these SAF start-ups are fuel producers which ultimately are not direct competitors of airlines.

Exit Strategy

The general narrative in exit strategy is that CVCs want to acquire the start-up and VCs want to sell their stake in the start-up. “CVC funding is also an excellent direction for startups looking to be acquired.” (KPMG). This is often referenced as one of the benefits for start-ups to select CVC funding over VC funding. The argument is that start-ups financed by CVC will experience higher rates of acquisitions and the actual mechanics of the integration of the corporate and its venture is streamlined having already had a successful strategic relationship. However, the data doesn’t support that argument, as only 3% of CVC investments will lead to an acquisition by the corporate investor. Regardless, since exit acquisitions represent a rare occurrence, start-ups should not consider exit strategy differences when reflecting on the decision between VC or CVC funding.

Conclusion

The financing process represents a crucial part of the development of a start-up and can very well play a large role in its future success. Given the choice between receiving funding from a traditional venture capital firm or a corporate venture capital, a start-up must consider factors such as the strategy of the CVC or VC, the cost of capital, past performance and resources of the CVC/VC, and governance dynamics while ignoring misappropriation risk or exit strategy acquisition benefits as these are insignificant.