Published on

Tuesday, November 24 2020

Authors :

John Mayes and John Auers

Last week, we discussed the wave of refinery closures that have taken place around the world as a result of the demand destruction caused by the COVID lockdowns. One region we didn’t mention was the Caribbean, an area that has certainly seen more than its share of closures, although these preceded the pandemic and were related to other issues. Among the causes of the decline in Caribbean refining capacity in recent years are market challenges, poor management, and the inherent disadvantages of operating refineries in an island environment. These disadvantages include high energy, capital and maintenance costs, difficulties in finding and retaining skilled professionals and operators, and even the ever-present threat of hurricanes. Despite these issues, Caribbean island refineries also have some strengths, and attempts are being made to restart several of the shuttered facilities in the region. These potential restarts, if successful, would also play an important part in regional and Atlantic Basin wide product supply/demand balances. In a two-part blog, we go “Back to Island(s)” as Leon Russell would say, and examine where each of the restart efforts stand. In today’s first part, we’ll focus on the most advanced attempt, the ongoing efforts to start up the Limetree Bay Ventures (LBV) St. Croix refinery.

Once the home of some of the largest refineries in the world, the Caribbean has seen its four largest facilities close over the last several years. While the specific reasons for the closures differed in each case, they were generally related to some of the issues identified in the opening of this blog. Refineries in St. Croix, Trinidad, Aruba, and Curacao, which together once had a total capacity well over 1 million BPD, remain idle, but various investors are exploring opportunities to restart all four of these facilities. Because many of the issues associated with the refineries closing in the first place remain and, as a result of questionable maintenance and current condition, the restarts are likely to be difficult and certainly costly. The demand destruction caused by the pandemic-related lockdowns and restrictions have also negatively impacted the economic prospects of each of the facilities in fairly significant ways. Each of the sites, however, remain a critical component of the economies of the islands where they are located. As a result, local governments are making major efforts to incentivize and support potential investors in their efforts to bring these shuttered refineries back to life. This is certainly true of the largest of the four, the LBV St. Croix refinery, which has received significant support from the Island government which has helped incentivize investors to pour billions of dollars into the facility over the past few years to bring it to the verge of coming back to life, with start-up efforts proceeding as we write this blog.

Limetree Bay/St. Croix

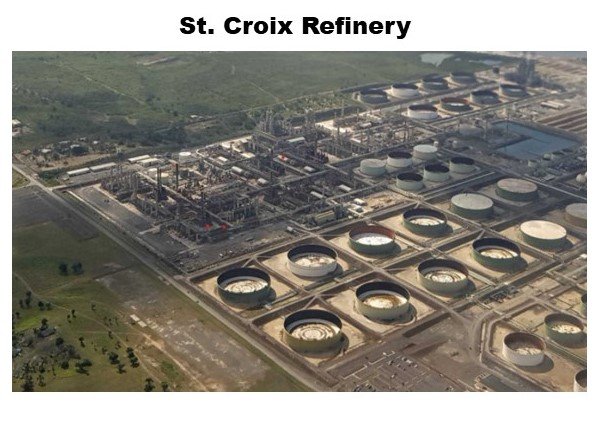

Located in the U.S. Virgin Islands, the St. Croix refinery was originally constructed in 1966 by the Hess Oil Company. By 1974, the facility had been expanded to 650 MBPD and was one of the largest refineries in the world. In 1998, Hess and Petroleos de Venezuela (PDVSA) created the HOVENSA JV to operate the refinery, which was subsequently upgraded with the capability of processing large volumes of heavy Venezuelan crude oil. The world class refinery enjoyed significant success for a number of years, but market shifts and increased competition from advantaged USGC refineries led to a shutdown of the plant in 2012. The facility continued to be operated as a product terminal until 2015 when the entire operation was shuttered. The terminal consists of 167 tanks with a combined capacity of 34 million barrels. After initial attempts to sell the facility failed, a sale of the site was eventually made in November 2015 to Limetree Bay Terminals (which eventually became Limetree Bay Ventures), a joint venture of ArcLight Capital Partners and Freepoint Commodities.

While initially operating the facility as a terminal, LBV also planned to restart some of the processing units at the St. Croix refinery to take advantage of the growing demand for low sulfur marine fuel oils which were expected from the 2020 International Maritime Organization regulations. The company obtained $1.25 billion of financing in 2018 with the expectation of resuming operations in 2019 at a planned crude rate of 210 MBPD. Startup costs were initially estimated at $1.4 billion.

The restart of the refinery, however, has not gone according to plan, which is not uncommon for the complex activity of restarting an idled refinery. Recent estimates place the refurbishing costs at around $2.7 billion, nearly twice the original estimate, due to extensive corrosion issues. Much of the incremental capital has been supplied by EIG Global Energy Partners which has recently obtained majority control of the LBV partnership. There have been repeated delays in the planned startup which is still described as imminent. Instead of restarting in a reasonably lucrative 2019 market, the delays have pushed the potential startup into a pandemic-induced environment of plunging global product consumption.

A key component in the restart of the St. Croix refinery is the role of BP. The international major was to supply all of the feedstocks and manage product offtakes. According to insiders, BP can unilaterally end the agreement at the end of 2020 if the refinery is not achieving agreed-upon operating targets. With the dramatic change in market conditions, BP likely has a strong incentive to exit the agreement if the opportunity arises.

Complicating the startup process for St. Croix is the necessity to settle a $5.4 million penalty for violations of the U.S. Clean Air Act and comply with revisions to a 2011 consent decree with the Justice Department.

Whether the refinery can successfully restart and more importantly continue to operate, remains in doubt while its economic value is even more troubling. As we discussed in last week’s blog, numerous refineries around the world have, or are planning to close as a result of the sharply lower product consumption levels caused by the pandemic lockdowns. On the other hand, the shutdown of the Philadelphia Energy Solutions (PES) refinery in 2019, the recently announced cutbacks at the PBF Paulsboro facility and the increased likelihood that the Come-By-Chance refinery in Newfoundland will not be restarted, all lead to a tightening supply/demand balance in the Atlantic Basin and increase corresponding opportunities for St. Croix. However, the potential exit of BP and the start-up problems being encountered, in addition to the uncertainties regarding demand recovery are major challenges to LBV’s abilities to take advantage of those opportunities. All we can say at this point is stay tuned – the next few weeks and months will be critical not only to the prospects for the St. Croix refinery, but also the important impacts that a restart would have on the overall Atlantic Basin product supply environment. Similar things can be said about the other three idled Caribbean refineries and their individual prospects, which we will discuss in next week’s blog.

Turner, Mason & Company is continually monitoring developments in regional and global petroleum markets and assessing how they will impact the industry. Considering the dynamic events impacting the petroleum industry (IMO, COVID-19, trade wars, low carbon standards, EV incentives, sanctions, OPEC policy, etc.), the future landscape of the petroleum industry is as uncertain as ever. TM&C not only executes regular and comprehensive studies of the industry, such as our Crude and Refined Products Outlook (C&RPO) and World Refinery Construction Outlook (WRCO), but also one-off studies focusing on specific issues. We also use the findings of these studies and our expertise to assist clients in all segments of the petroleum supply chain in specific and focused consulting engagements. For more information on our subscription studies or our consulting capabilities, please call us at 214-754-0898 or visit our website at turnermason.com.