Published on

Tuesday, September 8 2020

Authors :

Robert Auers and John Auers

Last week, we looked primarily at our outlook for petroleum demand and how that will affect the refining industry going forward. This week, we turn our focus to the other major side of the equation affecting refining margins – supply. We’ll look first at refining “supply” – that is, current refinery utilization and our outlook for new refinery construction and closures. After this, we’ll take a look at crude supply and how developments here will affect not only the global market, but the regional effects it will have as well.

Refining Capacity and Utilizations

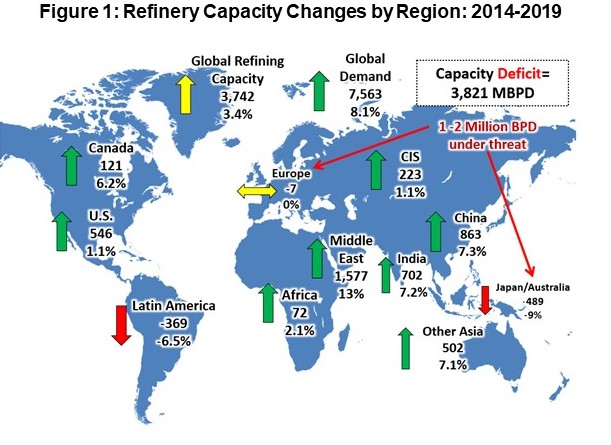

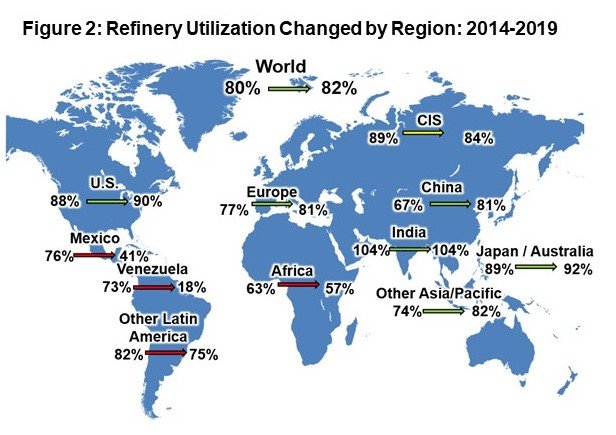

Over the past ten years, U.S. refiners have become increasingly dependent on exports, particularly to Latin America, to place products. Fortunately, refiners in Latin America, particularly Mexico and Venezuela, have had a tremendous amount of trouble both building new refineries and, more importantly, operating their existing facilities at reasonable utilization rates. We note that these struggles have not been the result of a lack of spending in the industry, as numerous large projects have been announced, including COMPERJ in Brazil, Manabi in Ecuador, and, most recently, Dos Bocas in Mexico. The final of these, of course, is still a major priority of the Lopez Obrador Administration, but it is unlikely in our view that anything resembling the proposed refinery will ever be completed. Figures 1 and 2 show the changes in global refining capacity and utilization, respectively, by region from 2014 until 2019.

Africa, has similarly struggled to build new refining capacity over the same time period and African refinery runs have actually decreased by nearly 150 MBPD since 2014, despite regional demand growth of over 300 MBPD. Thus far, the U.S. has not been able to take advantage of this market, with most imports coming from Europe and the Middle East. However, continued African demand growth and the possibility of more refinery closures on the European continent may present an opportunity for U.S. refinery to increase exports to Africa over the next one-two decades. Figure 3 displays historical U.S. product exports to Latin America and Africa.

Given the expectations for long-term gasoline demand decline in the U.S. and limited distillate demand growth (much of which will be met by renewable diesel), U.S. refiners will need to find new export markets if refinery crude runs are to increase. U.S. refiners have been aided, for now, by the shutdowns (and planned shutdowns) of several key U.S. refineries, most notably Marathon Martinez and Gallup, Phillips 66 San Francisco, and HollyFrontier Cheyenne. The 135 MBPD Calcasieu refinery in Lake Charles, LA, has also closed, though the shutdown is, for now, expected to be temporary with a restart planned for next year. This is coupled with several refinery closures in Europe and Asia/Oceania and the possibility of further closures of weaker plants across the globe unless margins quickly recover. Of note, Shell has already permanently closed its 110 MBPD refinery in the Philippines and Refining NZ and Viva Energy are seriously considering the closure of their 135 MBPD and 128 MBPD refineries in New Zealand and Australia, respectively. Similarly, JTXG has announced that the permanent closure of its 115 MBPD Osaka plant is planned for October 2020. In Europe, Gunvor’s 115 MBPD Antwerp refinery and Total’s 93 MBPD Grandpuits refinery are at extreme risk of permanent closure, while several other plants across the continent remain at high risk as well. As a result, PADD V refiners, in particular, will be able to, at least temporarily, decrease their dependence on exports (which have become increasingly important there over the past 5-10 years), while refiners on the Gulf Coast may be able to expand into new markets in Africa and compete less with European refiners for Gasoline supply into PADD I.

Crude Supply

The Pandemic has, of course, completely changed the trajectory of U.S. (and global) crude production. Domestic production was originally impacted primarily by shut-ins, falling from nearly 13 MMBPD in March to just 10 MMBPD in May 2020. Production then recovered to over 11 MMBPD for July and August (by our estimates), but has now resumed its downward trend as a lack of drilling and completion activity has resulted in legacy declines far outpacing production from new wells. We currently expect U.S. production to bottom around April 2021, but this is predicated on an increase in activity by the end of this year driven by increasing crude prices. However, if WTI remains below $45 through the end of 2020, this turnaround in U.S. production could be extended further into the future. Longer term, we expect U.S. production to resume its upward trajectory as U.S. crude production growth is critical to meeting global petroleum demand growth in the medium term, but the timing and pace of this growth remains uncertain.

In the rest of the world, OPEC+ curtailed production by an unprecedented 9.7 MMBPD in response to the pandemic, but has since eased official curtailments to 7.7 MMBPD through the end of 2020. Overproduction by some countries in May and June has actually led to higher official cuts of 8.1 and 8.3 MMBPD in August and September, respectively.) Official policy for 2021 has not yet been decided, but it is expected that cuts will be eased further as global demand recovers and inventories draw.

In the medium term, we expect the net result of these regional changes in crude production will be a relative decrease in U.S. crude production (compared to pre-pandemic expectations) with these lost barrels being replaced by medium and heavy sour Middle Eastern barrels. This should create a wider light heavy differential, with the possibility of IMO 2020 providing a further boost. This dynamic would obviously bode well for complex USGC refiners and present further challenges to light crude refiners throughout the U.S., Europe and rest of the world.

Turner, Mason & Company is continually monitoring developments in the global petroleum markets and assessing how they will impact the industry. Considering the dynamic events impacting the petroleum industry (IMO, COVID-19, trade wars, low carbon standards, EV incentives, sanctions, OPEC policy, etc.), the future landscape of the petroleum industry is as uncertain as ever. TM&C not only executes regular and comprehensive studies of the industry, such as the Crude and Refined Products Outlook and Worldwide Refinery Construction Outlook, but also one-off studies focusing on specific issues. We also use the findings of these studies and our expertise to assist clients in all segments of the petroleum supply chain in specific and focused consulting engagements. For more information on our subscription studies or our consulting capabilities, please call us at 214-754-0898 or visit our website at turnermason.com.