Published on

Tuesday, September 17 2019

Authors :

John Mayes

Turner, Mason & Company will issue its latest edition of the Worldwide Refinery Construction Outlook (WRCO) this week. This bi-annual publication details all announced global refinery constructions projects in the next five to six years. Whether it’s simply an expansion of a single processing unit or the addition of an entirely new refinery, TM&C chronicles the project and records all relevant information; such as the expected completion date, the capacities of the processing units, the location of the site and owners of the project, and other important details. We also make estimates of the crude qualities which will be processed and the likely product yields which will result. This recent edition details information on 225 announced global refining projects which include 87 new refineries and with a cost of over $700 billion. If all of these projects were completed, they would add nearly 21 million BPD of additional global crude refining capacity.

The data for each refining project is gathered from publicly available sources, including press reports and corporate announcements (from owners and vendors), corporate financial filings, governmental agencies, and a variety of other reporting entities. Where appropriate and allowable, data obtained by TM&C from nonpublic sources and our own professional judgment and knowledge are used to supplement and adjust the publicly reported information.

History indicates most new announced projects never actually get built. Some projects have no funding foundation and are announced with the hope that interest in the project will generate financing capabilities. Some projects are announced for political reasons and have only a minimal commercial justification. Others simply represent the hopes and dreams of developers. Because of the relatively low track record of announced projects actually becoming a reality, TM&C assess a Probability Index of each project as to its likelihood of construction.

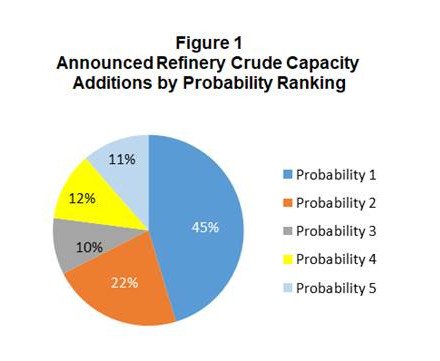

Each project is given a Probability Index based on a scale from one to five with Probability 1 representing a very low probability of completion (0 to 20%) and Probability 5 representing a project which is already under construction or highly likely (in our judgement) to be completed (80% to 100%). Numerous criteria are used in this evaluation (in addition to actual project progress) such as economic rationale for the project, the financial standing of the project, ownership and owner’s ability to fund or finance the project, regional crude and product balances and the past performance of the participants. Figure 1 displays the percentages of projects which fell into each probability category in our current outlook.

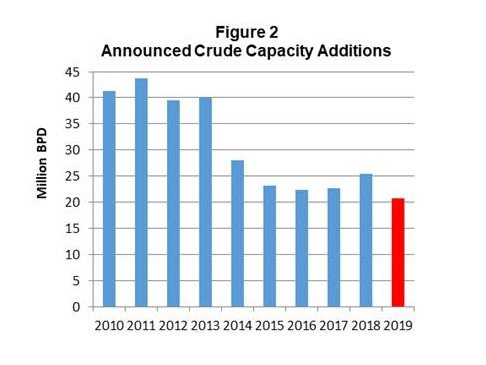

Stimulated by the high margin environment of the Golden Age of Refining (2005-2008), an unrealistic number of refining projects were announced during that period. With a lag time of five or more years, these projects were to come on stream during the robust construction period of 2010 through 2013 (Figure 2). The collapse of margins in the Great Recession (2008 and 2009), however, caused a sharp downturn in Announced Projects. This resulted in the decline of capacity additions in 2014 through 2016. For the last five years, the outlook has averaged slightly under 23 million BPD of crude capacity additions compared to over 41 million BPD in 2010 through 2013. The current forecast of announced projects is the lowest in the last ten years.

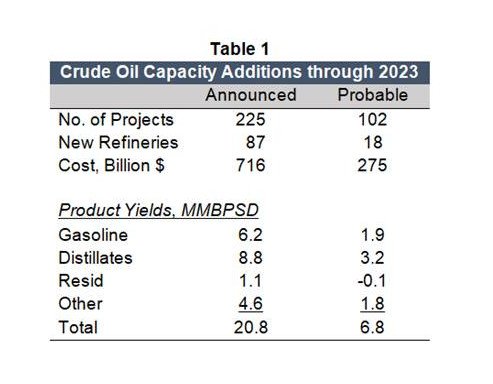

While there have been 225 Announced refining projects which are scheduled to be completed from 2019 through 2023, less than half of these are likely to be built. If all of the Announced projects were to be constructed, they would increase the current global refining capacity of 100.0 million BPD by nearly 21 million BPD. This increase, combined with the expected Natural Gas Liquids (NGLs) and alternative fuels growth, is several times greater than the forecast for global product demand growth.

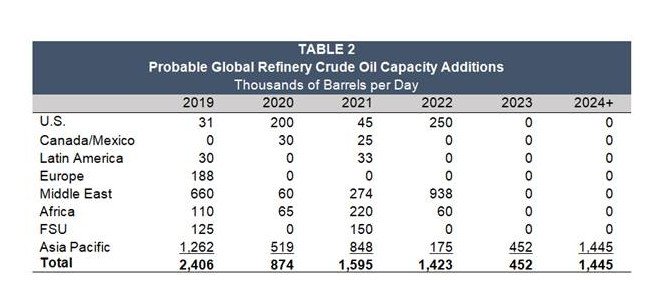

For this reason, we have developed a second list of construction projects which we feel will be built and have a Probability Index of three or higher. Our list of Probable projects pares the 225 Announced projects down to 102 projects which will add 6.8 million BPD of actual new capacity growth. Assuming an 85% utilization rate on the incremental capacity, these additions would increase global crude requirements by 5.8 million BPD by 2023. Actual refining growth during this period will vary from this, however, due to refinery closures and capacity creep. The summary results of both construction lists are shown in Table 1.

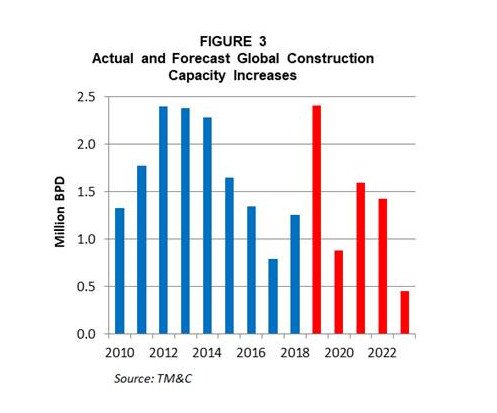

The growth in world refining capacity is often out of sync with global petroleum demand growth. The elevated refining margins which typified the Golden Age of Refining stimulated numerous refiners to expand in capacity. The resulting construction boom of 2012 through 2014 (Figure 3) saw actual annual capacity additions of 2.35 million BPD. This level of construction far exceeded growth in petroleum demand and kept global utilization rates at low levels (although outright capacity declines were mostly avoided due to various refinery closures). The resulting lower refining margins during this period caused capacity additions to decline sharply during 2015 through 2017. This retraction in construction pushed utilization rates to their highest levels since the Golden Age.

Less than 800 MBPD of refining capacity was added in 2017, while global demand rose by more than 1.4 million BPD. Construction rebounded last year with a level of ~1.25 million BPD.

In continuation with the current upward trend, additional completions will be particularly strong in 2019 at a level of over 2.4 million BPD, the greatest increase in over a decade. The largest of these projects is the Aramco refinery in Jizan, Saudi Arabia (400 MBPD), the Hengli Petrochemical and Zheihiang Petrochemical/Aramco facilities in China (both 400 MBPD) and the Petronas/Aramco plant in Johor, Malaysia (300 MBPD). Capacity additions in 2020 through 2022 will decline to historical levels at 1.3 million BPD. For 2023, only 452 MBPD of increases are currently planned. It is likely that more additions will be announced in the next two years and this number will increase. Nonetheless, we expect a general downward trend in refinery construction going forward, in line with declining demand growth. The expected capacity additions by region are shown in Table 2.

Currently, global refinery utilization rates are relatively high which provide a stimulus for good refining margins. The very high level of refinery project completions in 2019 however, could easily jeopardize this situation. While individual refining projects can be tracked and their impacts estimated, refinery closures are generally announced with little to no lead time. The level of refinery shut downs in recent years has been relatively low but is expected to increase with the implementation of the new IMO bunker regulations in January of 2020. This balance between new refinery project completions and refinery closures will ultimately determine actual global refinery utilization rates and their impacts on refining margins. This topic is evaluated in greater detail in our latest edition of the WRCO along with an analysis of global product exports by geographic regions.

To learn more about the latest edition of the WRCO and other products by TM&C, log onto our web site at turnermason.com or call Shanda Thomas at 214-754-0898.