Published on

Tuesday, December 8 2020

Authors :

John Mayes and John Auers

For the global refining industry, 2020 has been an exceptionally tumultuous year. As we’ve discussed in our blogs over the last few weeks, the COVID-19 pandemic induced a collapse in the consumption of petroleum products which has resulted in the closure of numerous refineries around the world. Along with the announcements relating to shutting down existing facilities, the pandemic is also impacting the completion schedule of projects under construction or in the design and planning phase. Of course, we are still not over the pandemic and its economic impacts on the refining industry and what the world looks like when we do finally put COVID into the rearview mirror is a major unknown. When we think about the future, Jethro Tull’s classic, “A New Day Yesterday” comes to mind. Although it is not easy to predict what that “New Day” looks like, it is very important to try to make that attempt. This requires an understanding of the forces that will shape petroleum supply and demand and how those forces have changed as a result of the developments which we’ve seen in 2020. In today’s blog, we will outline TM&C’s efforts and profile the publications and research products which contain those analyses and forecasts.

Turner, Mason & Company (TM&C) monitors and analyzes worldwide refinery projects on an on-going basis in connection with our biannual Crude and Refined Products Outlook (C&RPO). This effort includes assessing the probability of each announced project and incorporating the impact of projects we believe will be completed on regional and worldwide crude and refined products supply/demand balances. Only those projects that we believe will be completed in the time horizon of our current outlook are listed in our C&RPO.

Our Worldwide Refinery Construction Outlook (WRCO), however, contains a comprehensive listing of all announced refinery expansions and additions regardless of the likelihood of completion. The biannual publication of our WRCO coincides with the release dates of our C&RPO.

Methodology

The data for each refining project is gathered from publicly available sources, including press reports and corporate announcements (from owners and vendors), corporate financial filings, governmental agencies, and a variety of other reporting entities. Where appropriate and allowable, data obtained by TM&C from nonpublic sources and our own professional judgment and knowledge are used to supplement and adjust the publicly reported information. Data on project ownership, location, crude and downstream unit capacities and construction costs are tabulated along with any additional information used to evaluate the projects.

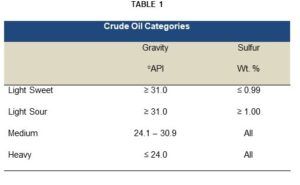

As mentioned previously, we also  estimate the product supply impacts of each regional project. Products are grouped into four categories: gasoline, distillates, residual fuel, and other products. Yields are estimated based on the specifics of each project, including downstream unit capacities, estimated crude slate compositions, regional product demand drivers, etc.

estimate the product supply impacts of each regional project. Products are grouped into four categories: gasoline, distillates, residual fuel, and other products. Yields are estimated based on the specifics of each project, including downstream unit capacities, estimated crude slate compositions, regional product demand drivers, etc.

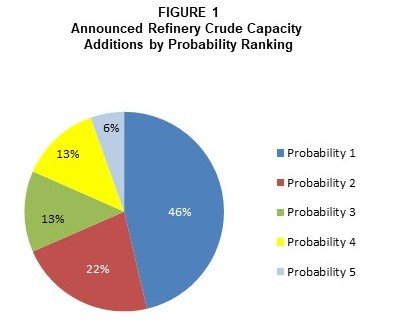

Using the criteria described below, we determine a ranking for each project based on our assessment of the probability of its construction. Each project is given a Probability Index based on a scale from one to five with Probability 1 representing a very low likelihood of completion (0

to 20%) and Probability 5 representing a project which is already under construction or highly likely (in our judgement) to be completed (80% to 100%). Numerous criteria are used in this evaluation (in addition to actual project progress) such as economic rationale for the project, the financial standing of the project, ownership and owner’s ability to fund or finance the project, regional crude and product balances and the past performance of the participants. Figure 1 displays the percentages of projects which fell into each probability category in our most recent WRCO.

to 20%) and Probability 5 representing a project which is already under construction or highly likely (in our judgement) to be completed (80% to 100%). Numerous criteria are used in this evaluation (in addition to actual project progress) such as economic rationale for the project, the financial standing of the project, ownership and owner’s ability to fund or finance the project, regional crude and product balances and the past performance of the participants. Figure 1 displays the percentages of projects which fell into each probability category in our most recent WRCO.

In addition to our Probability Index, the comprehensive list of worldwide projects includes other project data, such as costs and individual processing unit capacities. We evaluate all projects that are sourced from crude oil, condensate, or bitumen. It does not include biofuel or alternate fuel (CNG, LNG, etc.) projects, but it does include condensate splitters and fractionators. The time horizon for our outlook is generally five to six years. Beyond that period, most projects are poorly defined and subject to significant revisions or cancellation before the parties become fully engaged. Projects which have a ranking of three or higher are included in our C&RPO. As shown in Figure 1, these higher probability projects comprise only 32% of the total announced crude capacity additions.

Our data Tables are aggregated into eight geographic regions: U.S., Other North America, Central and South America, Europe, Middle East, former Soviet Union (FSU), Africa, and Asia Pacific. The U.S. is further subdivided into the six Petroleum Administration for Defense Districts (PADDs). There are also several summary Tables which summarize and total the data by year and by downstream processing category.

Current Findings

While the announcements of refinery closures and delays in completing ongoing projects are still continuing at a rapid pace, it is evident there is a major realignment developing in the global refining industry. Permanent, partial or complete closures have already been implemented or announced in 19 refineries around the world which have a total capacity of nearly 2.5 million BPD. This shift is likely to create the first global decline in refining capacity since 1992.

While refinery closures are generally publicly announced, often for legal and contractual reasons, ongoing project deferrals or even cancellations often are not. The largest project in the U.S. is the expansion of the ExxonMobil refinery in Beaumont, Texas. The current 369 MBPD facility will be increased by 250 MBPD to become the largest refinery in the U.S. Officially, ExxonMobil had planned to be completed with the project in 2022, but current reports now indicate this will not occur until 2023. ExxonMobil has not confirmed this revision, and the reports of the delay are derived from local Beaumont sources. Our most recent editions of the Outlooks in February had already indicated a completion date of 2023 due to rumors of potential construction delays.

Even greater uncertainty surrounds the potential restart of the EIG Global Energy Partners refinery in St. Croix. As discussed in our blog from two weeks ago, the restart is encountering numerous delays and may not meet required agreed-upon operating targets at the end of 2020. This could allow BP, which was to supply all of the feedstocks and market the products, to exit the agreement. Given the current state of refining margins however, a restart of the St. Croix refinery may not be justified. The strategies being taken by ExxonMobil and EIG/BP are being evaluated in numerous other refining projects worldwide.

Not all regions, however, are planning on reducing refining capacities, particularly in high growth economies. The demand recovery has been more robust in India with average crude runs at 86% of capacity in September and are likely to hit 90% in November. By December, Indian crude runs are expected at around 100% of capacity. This surge in demand is not only impacting current run rates but also future expansion plans for the industry. Indian Oil Minister Dharmendra Pradhan has recently announced plans to nearly double Indian refining capacity by 2030. This forecast is verified by our own last C&RPO which details 14 projects in India which will add nearly 1.8 million BPD of capacity by around 2025. Indian capacity increases now surpass those of China.

In the current rapidly changing and very uncertain environment, Turner, Mason & Company is closely following developments related to the COVID-19 pandemic, the political/regulatory environment and the market impacts of each. We are also analyzing how those developments impact crude prices, differentials, product demand, crude production and ultimately industry margins and prospects, including decisions regarding facility closures. Some high-level aspects of these analyses will continue to be presented and discussed in blogs over the next few weeks and months. As discussed in today’s blog, we will be incorporating the analysis in a detailed and comprehensive way in the next edition of our Crude and Refined Products Outlook (C&RPO) and Worldwide Refinery Construction Outlook (WRCO), both scheduled to be issued in early 2021. As noted, the C&RPO will include a detailed forecast of both crude and refined product prices, product demand, refinery capacity changes, and a variety of other key industry parameters, while the WRCO provides a detailed and comprehensive look and assessment of all proposed refinery capacity additions and closures on both a worldwide and regional basis. For more details about these publications or other TM&C services, please visit our website at www.turnermason.com or give us a call at 214.754.0898.