Published on

Tuesday, May 11 2021

Authors :

Robert Auers

On May 7, 2021, Colonial Pipeline Company learned it was the victim of an apparent ransomware attack. This led the company to proactively shutdown essentially all of the 2.8 MMBPD Colonial Pipeline system that extends from the U.S. Gulf Coast to New York Harbor for delivery of refined products to states all along the U.S. East Coast (PADD 1). Cybersecurity and geopolitical implications from this attack continue to be assessed by U.S. federal agencies, but crude and refined products markets have “weathered” this incident fairly well thus far with relatively minor price impacts. However, refiners, marketers and traders are bracing for potential supply and operational disruptions should the pipeline continue to remain down for an extended period of time. This blog focuses on product supply sources into PADD 1, potential alternative sources in the event of a protracted shutdown, and what we can expect next should supply disruptions become pronounced.

Colonial Pipeline and the PADD 1 Supply Picture

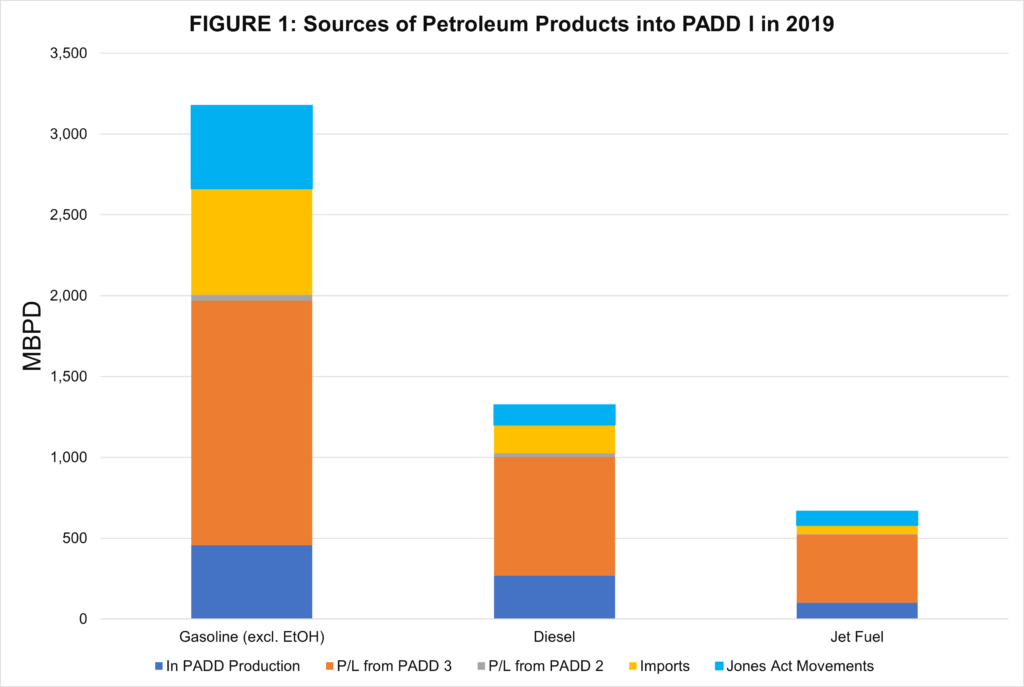

The majority of PADD 1 (excluding Florida) has long been dependent on two major pipelines to meet a large portion of regional demand – the 700 MBPD Plantation pipeline (completed in 1942) and the ~2.8 MMBPD Colonial pipeline (completed in 1964). Over the past 14 years, PADD 1 has become even more dependent on these two pipelines in spite of the fact that in-PADD demand had declined by ~5% even before COVID hit. These pipelines have expanded slightly, and PADD 1 refining capacity has been cut by more than half (from 1,689 MBPD in 2007 to just 818 MBPD today). Figure 1 displays supply sources for gasoline, diesel, and jet fuel into PADD 1 in 2019 (Pre-COVID).

Of the PADD 3 to PADD 1 pipeline movements, approximately 80% occur on Colonial, with almost all the rest on Plantation. Most of Florida cannot be supplied by pipeline, and instead is primarily supplied by Jones Act tankers from PADD 3 (shown in light blue on the chart above), so pipeline dependency on most of the East Coast is even higher than implied in Figure 1. Plantation terminates in the Washington, D.C. Metro area, leaving most of the Northeast highly dependent on Colonial.

Jones Act vs Imports

As mentioned previously, Florida is primarily supplied via Jones Act tankers from PADD 3 but could alternatively be supplied by imports. Given its close proximately to PADD 3 refining centers, economics have typically led Jones Act tankers to be the transportation method of choice. However, given the increased distance to the Northeast and the high cost of Jones Act transportation, incremental Northeast demand has typically been met with foreign imports, mostly from Canada and Europe. Notably, Europe provides the majority of gasoline imports, but minimal diesel and jet imports, due to the fact that Europe is long gasoline but short diesel. The U.S. East Coast has historically provided a place for European refiners to “dump” excess gasoline blending components, especially lower octane ones. Still, Jones Act vessels do typically provide a small amount of product to the Mid-Atlantic and New England states, particularly during periods of unexpected outages. One recent example was the shutdown of PES, when Jones Act volumes were able to quickly ramp up to help mitigate the product shortage. Still, there is limited supply of Jones Act vessels available to transport additional barrels and the Jones Act fleet could not come close to making up for the loss of Colonial. Therefore, foreign imports must ramp up, inventories must draw down, and/or Jones Act waivers must be granted to make up for lost supply in the event of a protracted Colonial shutdown.

Current Situation vs. 2019

While PADD 1 demand, particularly for jet fuel, remains lower today due to the effects of COVID-19 and resulting restrictions, refining capacity is ~400 MBPD lower than it was in early 2019 due to the aforementioned closure of PES in June 2019 and rationalization at PBF’s Paulsboro facility in late 2020, leaving the PADD almost as dependent on domestic and foreign imported product as it was during the first half of 2019. Pipeline movements of products from PADD 2 to PADD 1 have increased during this time, with the partial reversal of Buckeye’s Laurel pipeline to Altoona, PA in October 2019 and the beginning of natural gasoline transportation on Energy Transfer’s Mariner East pipeline system in April 2021. But these two pipelines, together, are only transporting ~60 MBPD of product and blendstocks (C5+) to PADD 1.

Historical Example

The most significant previous Colonial outage took place in September 2016, when Colonial Line 1 (~1.3 MMBPD capacity, which is typically dedicated to gasoline) was shut down for 12 days. During this outage, some gasoline shipments were diverted to other Colonial lines, replacing diesel and jet shipments there. This outage occurred in Alabama, meaning the main line could still operate at full capacity along the East Coast, so the implications were not as great as the current outage is potentially. During this outage, there were no Jones Act Waivers granted and East Coast demand was met by drawing down inventories and increasing imports and Jones Act shipments, without any major supply shortages or price spikes. Inventory drawdowns during this partial outage accounted for over 50% of increased supply to consumers, with PADD 1 inventories drawing by 9 MM Barrels during a total supply outage of ~15 MM Barrels, meaning a long-term outage, even just a partial one, on Colonial is likely not sustainable. Still, given enough time, Atlantic Basin (and even global) trade flows could shift, but this is not a small endeavor, unless the Jones Act is waived.

The current outage is a complete outage, thereby reducing supply by ~2.8 MMBPD, rather than just the 1.3 MMBPD seen in 2016. The outage, thus far, has lasted approximately four days and the exact timing of a restart is still not certain (as of this publication), though Colonial plans to utilize a phased approach to the restart and believes they can have service “substantially restored” by the end of this week. As of now, supply has mostly been met by inventory drawdowns while imports and Jones Act movements ramp up. So far, no Jones Act waivers have been issued (to our knowledge), but the issuance of at least some waivers here could go a long way toward preventing a major supply crunch if the Colonial outage persists. If Jones Act waivers are not issued and we experience a protracted outage on Colonial, real supply shortages could emerge in PADD 1. However, traders do not seem to currently expect major issues from the current outage, assuming Colonial is able to restart within the given time frame. The majority of New England, New York, New Jersey, and Southeast Pennsylvania would be most at risk from supply outages given their lack of alternative supplies, and with the dependence of the entire East Coast (excluding Florida) on Colonial, most of PADD 1 could be implicated. Again, Jones Act waivers (allowing foreign flagged vessels to transport product from PADD 3 to PADD 1) could go a long way towards mitigating problems, especially if the Colonial outage is extended.

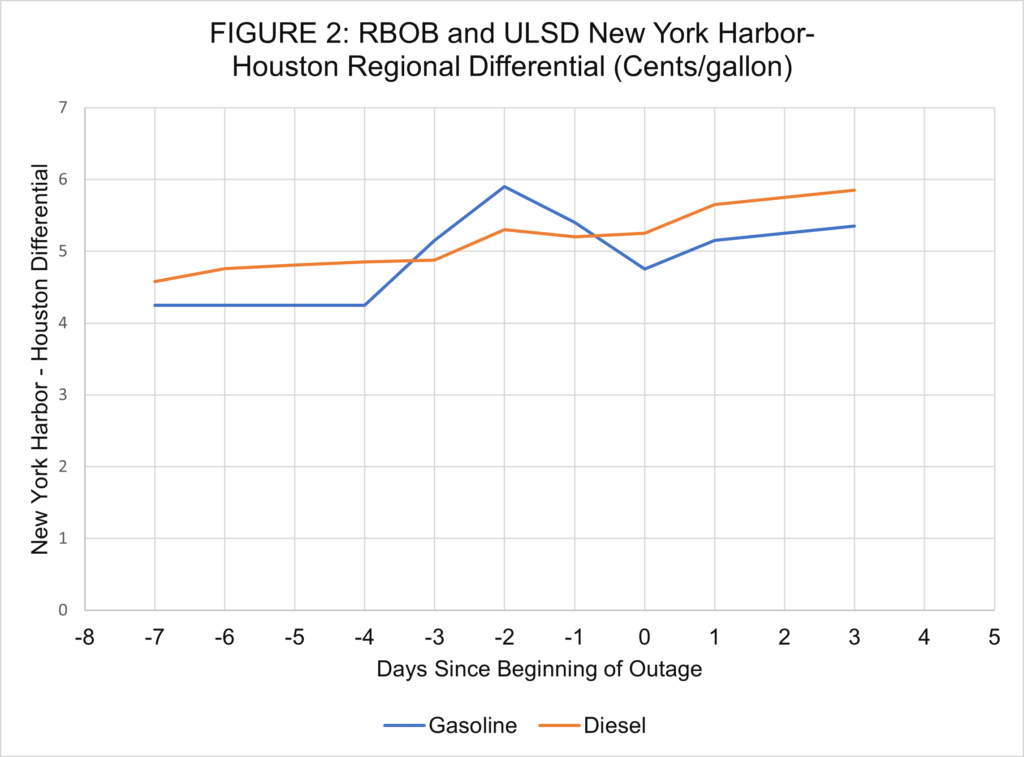

Figure 2 shows the impact of the current outage (thus far) on product differentials between New York Harbor and Houston in cents per gallon, indicating the current outage seems to have had minimal impact thus far. Initial intraday price movements showed a larger impact, but the expectation for Colonial to restart by this weekend seems to have calmed the markets. However, a further extension of the outage could pose bigger problems in both PADDs which could lead to more dramatic moves in the price differential.

The Colonial Pipeline shutdown could eventually also have an impact on U.S. Gulf Coast refineries run rates. The loss of the ability to transport 2.8 MMBPD of refined products for an extended period would create problems for refineries in PADD 3. Refineries themselves have limited storage capacities and depend on regular outbound movements to maintain steady crude processing rates. Initially, inventories in third-party storage terminals in Texas and Louisiana are likely to increase rapidly as refiners scramble to find alternative dispositions for their products. But some, notably Valero, have chartered oil tankers to store and/or transport Gulf Coast refined products because of the outage. As these local terminals fill however, other refiners may be forced into chartering vessels for floating storage or reduce crude processing rates.

Turner, Mason & Company will continue to closely monitor developments related to the Colonial Pipeline outage with a focus on how those developments might impact petroleum supply, demand, prices and the overall outlook for refiners and other segments of the oil industry. Our recently launched GLOBAL DOWNSTREAM MARKET OUTLOOK tracks developments in the global refined products landscape and our views on the evolving market trends are incorporated in our latest publication release. If you would like more information on this publication or for any specific consulting engagements with which we may be able to assist, please visit our website: https://www.turnermason.com and send us a note under ‘Contact’ or give us a call at 214-754-0898.