Published on

Tuesday, October 6 2020

Authors :

Robert Auers and John Auers

It seems that the petroleum industry just can’t catch a break these days with demand challenges from COVID-19 related restrictions continuing to linger and politicians blaming climate change and, by extension, hydrocarbons for every natural disaster from forest fires to hurricanes and other extreme weather events. While demand has already recovered substantially from the COVID-19 impacts (and we expect this trend to continue) policy proposals to restrict hydrocarbon use to combat Climate Change are becoming a bigger and bigger threat to the industry. The latest and potentially most threatening to the U.S. refining industry is the Executive Order issued by California Governor Gavin Newsom two weeks ago calling for the total phaseout of the sale of new internal combustion engine powered passenger vehicles (ICEVs) within the state by 2035. Reaction to this proposal has been swift from both sides, with industry groups coming out strongly against the policy, presenting strong legal, economic and technical arguments challenging such a drastic move, while environmental groups are cheering and calling for other states and the federal government to follow suit. But how big a threat to the industry is Governor Newsom’s proposal?

Certainly, it would be a big deal considering California has historically led the U.S. in gasoline consumption (only very recently being surpassed by Texas) and accounts for about one-tenth of the total volume of gasoline consumed in the country. California refineries, which have been threatened for years by the strict regulatory environment and stagnant demand in the state (which helped lead to the recent shutdown of Marathon’s Martinez facility and the planned shutdown of Phillips 66’s Rodeo/Santa Maria complex) would feel the most pain. However, if the policy catches on in other regions or is pursued by the federal government (a very real possibility in a Biden/Harris Administration) the impact would be national and even global. On the other hand, 2035 is a long way off, with many elections, market developments and technological breakthroughs taking place between now and then (not to mention the changes and “loopholes” likely to be included in any final version of actual legislation). Certainly, the arguments against the substance of the proposal are real and substantive, some of which we discussed in last week’s blog in providing a counterpoint to BP’s pessimistic 2020 Energy Outlook. We will expand further on these in today’s blog as we contemplate whether Governor Newsom is “California Dreamin” or whether the refining industry truly is headed for “Such a Winter’s Night.”

The Executive Order – What’s in It (and what’s not)

The order states that CARB shall develop and propose “Passenger vehicle and truck regulations requiring increasing volumes of new zero-emission vehicles sold in the State towards the target of 100 percent of in-state sales by 2035.” It also includes a goal that 100% of heavy trucks and busses “sold and operated” in the state be zero emissions by 2045. However, it goes on to state that CARB “shall act consistently with technological feasibility and cost-effectiveness.” This last statement, which is often omitted in reporting regarding the order, obviously provides an easy out for any future government that may be in power to back-track on this order without absolutely disregarding it. Further, the Newsom Administration will be long gone by the time the order is set to take effect, leaving the heavy lifting of implementation to someone else. Perhaps most importantly, as we discuss below, it is unlikely to be cost-effective or even feasible for California to move to 100% zero emission vehicles by 2035.

We’ve Seen it All Before

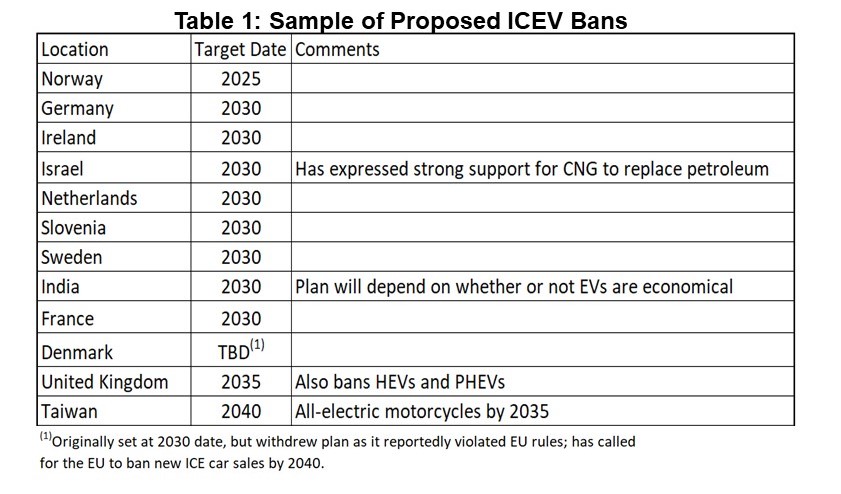

A host of countries across the globe have already set targets for 100% EV adoption, with most target dates set between 2030 and 2040. The details of these proposed mandates vary widely by country. For example, some explicitly include or exclude traditional hybrids as “EVs”, but most are silent on the issue. Israel has expressed strong support for CNG as a transportation fuel and India’s proposal is explicitly dependent on the economic feasibility of the plan. Finally, and perhaps the most important issue is that, except for Norway, but consistent with the California proposal, none of the bans are set to take effect before 2030. This allows ample time for the implementation dates or technical details of the plan to be changed (allowing hybrids, for example), delayed or even abandoned altogether. Table 1 shows a noncomprehensive list of proposed ICEV bans across the globe.

The Arguments Against an ICE Ban

Perhaps the most important argument against an ICEV ban is the limited environmental benefit that it would actually provide. Given the makeup of the current California electric grid, which has a CO2 intensity of ~500 lb. CO2/MW-hr., a full battery electric vehicle (BEV) reduces CO2 emissions by ~25% relative to a traditional hybrid by our estimate. While this reduction is significant, it is far from 100% and certainly not truly “zero emissions,” even though there are no emissions directly from the tailpipe. Moreover, it has become increasingly difficult to continue to add renewables to the California electric grid as they have proven to be unreliable and unpredictable when needed most (as dramatically highlighted by the recent brownouts), making further reductions in the CO2 intensity of the state electricity grid more difficult. Further, the availability of charging infrastructure and consumer preferences, particularly for people who do not have a home garage, are likely to be major impediments to universal or even significant EV adoption. An important real live example is Norway, where despite subsidies that make EVs significantly cheaper than ICEVs, well over 50% of new vehicles sold in 2019 still contained an internal combustion engine (including PHEVs). This is, presumably, because many consumers do not have access to home-charging and/or do not want to deal with long-charging times on longer trips. Finally, as EVs require much longer refueling times than ICEVs, EVs would require more fueling infrastructure than ICEVs, particularly along long-distance routes to properly serve demand. While the build-out of this infrastructure is feasible on a long enough time scale, the goal of meeting the time frame laid-out in the California executive order would, at best, be extremely challenging to achieve. We could go on to name numerous other obstacles to the California proposal, including its actual legality, but will leave those to another time as we hope that “all the leaves don’t turn brown and the sky doesn’t become grey’ for the U.S. refining industry.

Turner, Mason & Company is continually monitoring developments in the global petroleum markets and assessing how they will impact the industry. Considering the dynamic events impacting the petroleum industry (IMO, COVID-19, trade wars, low carbon standards, EV incentives, sanctions, OPEC policy, etc.), the future landscape of the petroleum industry is as uncertain as ever. TM&C not only executes regular and comprehensive studies of the industry, such as our Crude and Refined Products Outlook and Worldwide Refinery Construction Outlook, but also one-off studies focusing on specific issues. We also use the findings of these studies and our expertise to assist clients in all segments of the petroleum supply chain in specific and focused consulting engagements. For more information on our subscription studies or our consulting capabilities, please call us at 214-754-0898 or visit our website turnermason.com.