Published on

Tuesday, September 1 2020

Authors :

Robert Auers and John Auers

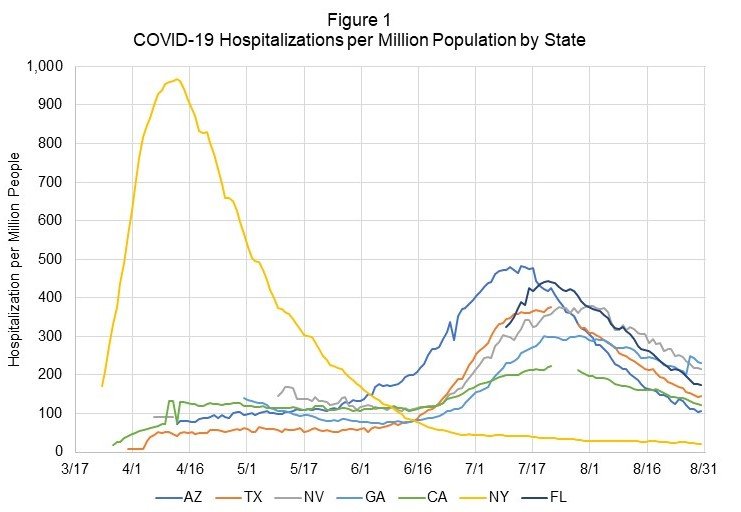

Nearly three months ago, we published a blog entitled Part 2 “Up Around the Bend” blog series, discussing the outlook for production demand and refining margins as we emerge from the COVID-19 pandemic. In the first two blogs, we discussed some of the unprecedented effects that the COVID-19 lockdowns had on petroleum demand, including sending both gasoline and jet demand in the U.S. to levels not seen since the 1960s. We then followed this up by detailing the early part of the demand recover through May and early June. We published the second installment of the series shorty before the “second wave” of COVID-19 moved through the Sun Belt state of the U.S. (We put “second wave” in quotes to note that these states never really experienced any “first wave” in the spring.) We did not, at that time, foresee the full magnitude of the Sun Belt “second wave.” Nonetheless, this wave appears to have, for the most part, passed, and cases, hospitalizations, and deaths are now declining through the Sun Belt. A smaller “third wave” appears to now be hitting some of the states that have thus far avoided outbreaks (i.e., Hawaii, Montana), but these states are smaller and the outbreaks less severe. As a result, national numbers for cases, hospitalizations, and deaths are in steady decline, and we expect this trend to continue over the coming weeks. The decrease in hospitalizations across key Sun Belt states is shown in Figure 1 with the New York spring outbreak shown for comparison. The data is taken from covidtrackingproject.com. Also, note that the methodology for determining Georgia COVID hospitalizations was changed on August 29, leading to the increase in hospitalization shown for that date in the graph below.

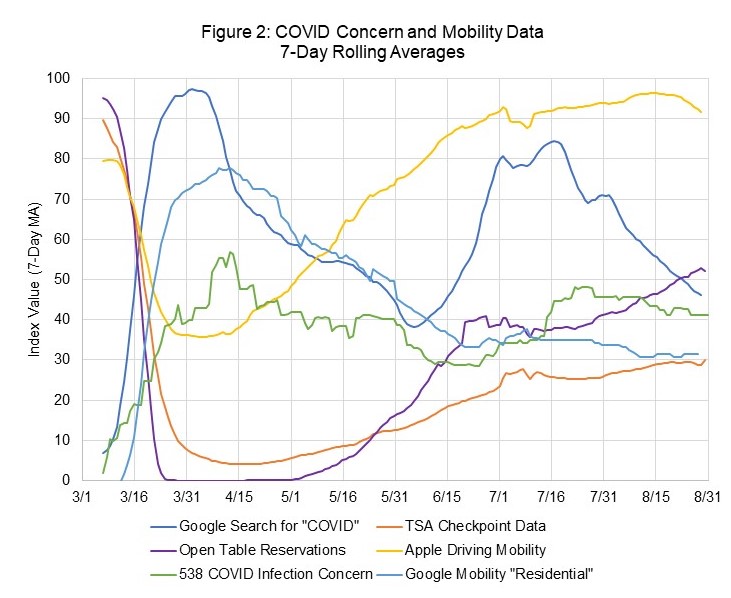

As a result of the Sun Belt “second wave”, several states tightened restrictions, COVID fears among the general populace increased, and companies delayed plans for employees to return to work. Nonetheless, while restrictions have varied by state, all states, except Hawaii, have stopped well short of full lockdown as a response to increases in COVID-19 cases and hospitalizations. Accordingly, the demand and mobility recovery in the Sun Belt stalled and reversed in some cases. However, as the COVID-19 data has turned over the past several weeks, reopenings are slowly resuming, COVID-19 fears among the populace are slowly decreasing, and mobility data is slowly increasing. The pace of the recovery, however, is much slower than that seen in May and the first half of June. Going forward, we expect current encouraging trends in this area to continue, and perhaps accelerate, as the reassuring trends in virus data continue. Figure 2 shows various U.S. mobility and COVID-19 concern data trends since early March. Ideally, if things are going well, Apple mobility data, TSA checkpoint data, and Open Table reservation data should be increasing, while the remaining three data points should be decreasing.

Much of Europe has, thus far, been spared from COVID-19, and the reopening there has generally outpaced that in the U.S. Still, Many European countries have recently chosen to increase restrictions in response to increases in cases, but all have stopped well short of lockdown, with responses largely similar to those seen in the U.S. South over the summer. Further, mobility data appears to already be back on the rise for most of the countries that did recently increase restrictions.

Much of Europe has, thus far, been spared from COVID-19, and the reopening there has generally outpaced that in the U.S. Still, Many European countries have recently chosen to increase restrictions in response to increases in cases, but all have stopped well short of lockdown, with responses largely similar to those seen in the U.S. South over the summer. Further, mobility data appears to already be back on the rise for most of the countries that did recently increase restrictions.

The developing world continues to reopen, with Chinese demand already back near pre-COVID-19 levels. Most CIF countries, similarly, reopened relatively quickly and mobility there appears to have recovered to near pre-COVID-19 levels. Latin America, India, and the Middle East have been slow to reopen, but reopening in those geographies is now in full force, and we expect this trend to continue. The remaining countries of both developed and developing Asia have followed varying trends with some continuing to reopen and others (South Korea, in particular), backtracking a bit in response to new cases.

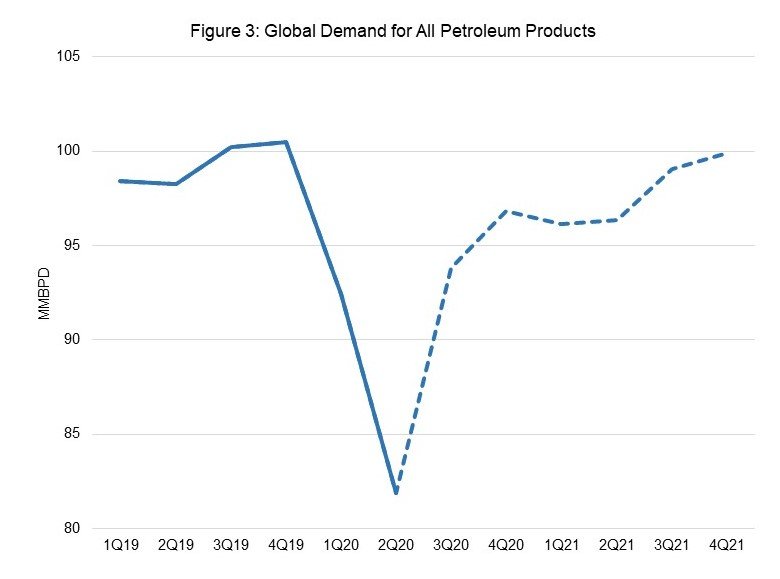

While uncertainties still exist on the timing, we expect continued easing of COVID-19 restrictions and decreasing COVID-19 fears throughout the world. These trends will, in turn, lead to increasing petroleum consumption and a slow return to normal life over the coming months. Through 2021 and 2022, we believe the most important factors impacting global demand will be an economic recession originally induced by the COVID-19 lockdowns and other restrictions. To this end, we anticipate a relatively quick “V” shaped recovery through the rest of Q3, with some lingering damage from the extreme COVID-19 lockdown measures persisting through the end of 2020. By the beginning of 2021, we expect that the resultant economic damage will be the primary factor limiting further demand growth. As such, we anticipate global petroleum demand in 2021 to be ~1.5 MMBPD below that in 2019, with continued residual effects in the following years. Nonetheless, we expect continued global petroleum demand growth through our forecast period and do not expect demand to peak before the end of our forecast period in 2040. Figure 3 shows our Global short-term demand forecast for all petroleum products.

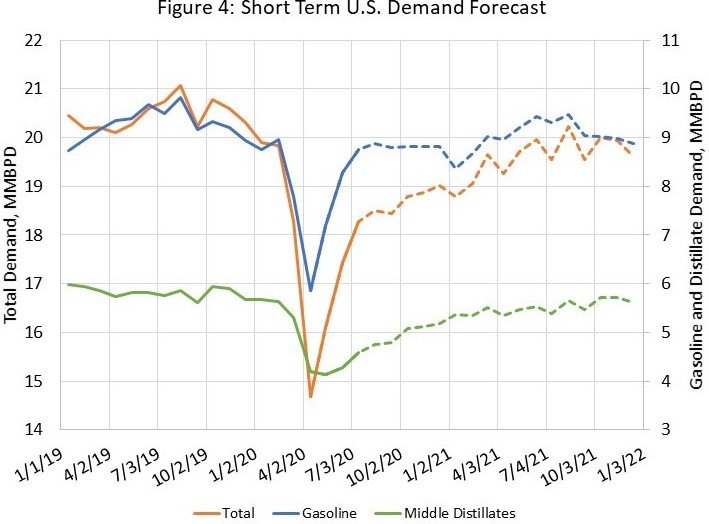

As we’ve stated before, we expect the gasoline demand recovery (on a year-over-year comparison basis) to continue. This has and will continue to be driven by a variety of positive forces including low prices and fear of both public transit and flying. Vacation and holiday travel by car instead of air could provide a major boost over the next few months. These tail winds will be partially offset by the negative impacts of a weak economy and a continued high number of people working from home. Nonetheless, we expect some people will begin returning to work in the coming weeks, with the return of a more typical work environment by the beginning of next year in most locations. Long term, gasoline demand in the U.S. will decline, driven by increasing efficiencies and a switch to alternatives, and we will likely never return to the levels of demand seen in 2017 and 2018.

Jet demand will be the slowest to fully recover due to a continued fear of flying, especially on international trips, limits on business travel and an overall weak economy; however, we do expect continued growth from the current low levels, a process which is already in full swing, with Jet fuel demand growing from under 600 MBPD in May to over 1 MMBPD in August.

We expect diesel demand, which didn’t decline as much as gasoline and jet, to continue its recovery as well. However, diesel demand will remain challenged through 2021 as a weak economy will limit the pace of the demand recovery. Figure 4 shows our short-term U.S. product demand outlook by product category.

Turner, Mason & Company is continually monitoring developments in the global petroleum markets and assessing how they will impact the industry. Considering the dynamic events impacting the petroleum industry (IMO, COVID-19, trade wars, low carbon standards, EV incentives, sanctions, OPEC policy, etc.), the future landscape of the petroleum industry is as uncertain as ever. TM&C not only executes regular and comprehensive studies of the industry, such as the C&RPO and WRCO, but also one-off studies focusing on specific issues. We also use the findings of these studies and our expertise to assist clients in all segments of the petroleum supply chain in specific and focused consulting engagements. For more information on our subscription studies or our consulting capabilities, please call us at 214-754-0898 or visit our website at turnermason.com.