Published on

Tuesday, September 3 2019

Authors :

Eamon Cullinane and John Auers

We certainly hope everyone had an enjoyable and relaxing Labor Day weekend. As we return to work after this traditional “end of summer” holiday, which was created in the late 19th century to honor U.S. workers, we thought it would be appropriate to write a blog detailing the advantages those workers have provided the U.S. refining industry. We’ve written many times in this space about how the downstream segment in the U.S. has become a true global leader over the past few years and perhaps even the most dominant U.S. manufacturing industry. In fact, as we recently watched and listened to Rami Malek (as Freddy Mercury) belt out Queen’s quintessential anthem, “We are the Champions,” in the blockbuster movie, “Bohemian Rhapsody”, it certainly brought to mind this move to dominance. While a lot of factors have played a role in driving U.S. downstream competiveness to “championship levels,” perhaps most notably the benefits of lower cost crude and natural gas refiners have enjoyed as a result of the boom in Light Tight oil and gas production. One factor, however, often gets overlooked, but has been a structural benefit for the U.S. industry for a number of years – labor market advantages in both building and operating refineries. In today’s blog, we will dive a bit deeper into this element as we pay tribute to the American worker on this day after this sometimes underappreciated holiday.

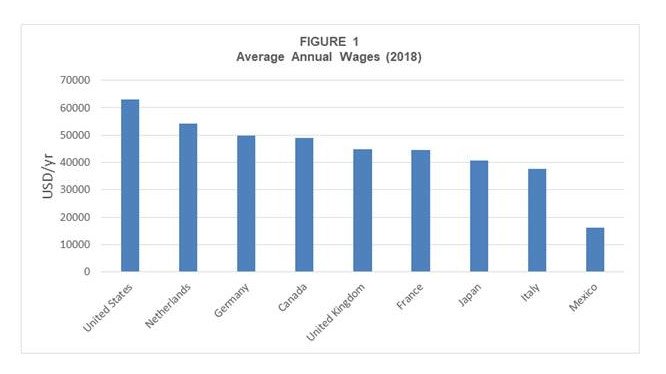

Statistically, the U.S. workforce certainly has among the highest wages out of any country. Constant turmoil exists around large companies like Nike and Apple who have continued to move their manufacturing overseas, attributing high wages domestically as a large factor. Below is a chart (Figure 1) of some of the major countries in the downstream business and their respective average wages in USD/yr.

As shown in this chart, the average U.S. worker makes over $46,000 more than the average worker in Mexico. Even more telling is that the average salaried employee at a U.S. refinery makes a staggering $111,500 USD/yr. Despite the relatively high salaries and wages, U.S. refining continues to run their plants at lower costs than in any other country, largely due to higher productivity levels and greater efficiencies. In fact, it is partly due to the high wages that U.S. refineries have been able to attract the deepest, most talented and experienced refinery labor pool in the world; all the way from management, through the technical ranks and down to the skilled and hourly levels.

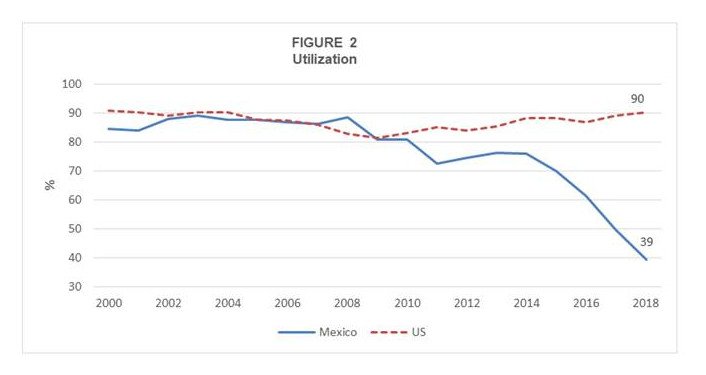

Combined with more flexible employment and work rules that exist in many other countries, particularly in Europe and Japan, this allows U.S. refiners to run their plants at high utilization rates. Below, in Figure 2, is a look at how U.S. refining utilization has strengthened over the last decade while our neighbor and largest destination for product exports, Mexico, has struggled mightily in recent years operating their refineries.

In one measure of the reliability of the workforce, the number and impact of labor strikes across the U.S. refining industry have remained inconsequential compared to the rest of the world. Since the most recent substantive nationwide strike, way back in 1980, there has only been one other national strike against the industry, the 2015 United Steel Workers oil refinery workers strike. Not only are they few and far between, the labor strikes which have taken place in the U.S. have proven to be relatively quickly resolved and have had very limited impacts on actual refinery throughputs and production levels.

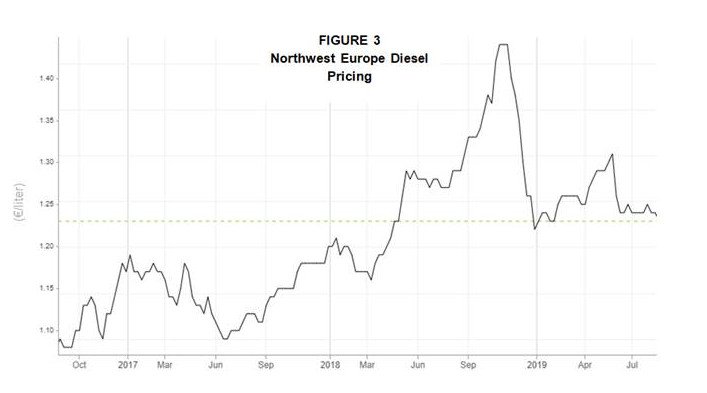

This has not been the case in many other regions around the world. As one example, if we look at the last few decades in France, we see strikes leading to complete refinery shutdowns on every single complex in the country. As recently as 2018, France not only saw large refinery shutdowns due to labor disputes, but also protest over Emmanuel Macron’s diesel tax. This has created mass shutdowns of gas stations across Europe with increased prices at the pump, significant impacts on consumer markets and very negative effects on the bottom lines on refining companies. Figure 3, below, shows diesel pricing in Northwest Europe, and the spike in response to the outages caused by the French refinery strikes in late 2018.

Beyond reliability, the advantages due to a more efficient workforce in the U.S. can be demonstrated by relative manpower levels. We again make a comparison on this metric of labor efficiency by comparing the number of refining employees per MMBBL in the United States Gulf Coast (USGC) vs. our neighbor to the south. Mexico has roughly 28,000 employees per MMBBL of crude capacity, while the USGC refiners average less than one-fifth of this at about 5,000 per MMBBL. This demonstrates how the Gulf Coast refiners continue to leverage their small, but highly skilled employees for success.

A competitive workforce is not only realized in utilization, but also on construction, expansion, and maintenance costs. The superior competiveness of the U.S. workforce, despite higher wage and salary levels, allows them to execute capital projects and perform maintenance activities more efficiently and at lower costs. Almost without exception, you can make capital improvements at refineries on the US Gulf Coast cheaper than anywhere else in the world. This is shown below in table comparing the construction cost factor per region as determined by the Turner, Mason & Company’s (TM&C) Worldwide Refining Construction Outlook, team. (USGC is set at a factor of 1.0, with other regions scaled accordingly).

What this table shows is that an equivalent refinery expansion project on the USGC would cost 20% to over 50% more in Western Europe, 1.5 to 2 times more in the Oil Sands regions of Western Canada, and as in many cases over twice as much in the Middle East and Latin America. It should be noted that the strict regulatory environment in California certainly increases the costs of projects in California (and even the ability to get projects permitted). At the same time, in certain situations and locales in Asia, notably major projects completed by private refiners Reliance and Essar in India, relative costs have actually been below USGC levels.

It’s important to know that building and running refineries is a very complex task, requiring not only experienced and talented manpower, but efficient and properly incentivized planning efforts and many of those elements have been lacking in other parts of the world. These elements have been particularly in short supply for our neighbors to the South in Latin America. Their inability to build capacity, to meet growing demand, has been particularly advantageous for U.S. refiners, who have been able to establish a major foothold by exporting refined products to the region.

Our Latin American neighbors have certainly tried to add capacity to lessen their increasing dependence on U.S. imports, as a significant amount of expansion and greenfield projects have been planned and initiated. However, many of these projects have not even gotten off the ground, while others have encountered significant cost overruns and delays. Much of the problems relate to the sponsorship of these projects by government controlled companies, with the accompanying issues of confused and conflicted planning, incorrect staffing, corruption, and in many cases simple incompetence.

Some of the biggest problems have been encountered by Brazil, the largest consumer of petroleum products in Latin America and the second largest destination of U.S. product exports. Two of the largest involve the Petrobras sponsored Abreu e Lima and ComperJ refinery projects, both of which have encountered overruns running north of $10 billion, and multi-year delays. While part of the Abreu e Lima refinery did actually start up, the ComperJ project appears years (billions of dollars) from being ready to operate, even after billions of dollars in expenditures. The new Bolsonaro administration is attempting to improve the situation by moving to privatize a good chunk of the government owned refining industry (including Abreu e Lima) and partnering with China’s CNPC to participate in completing the ComperJ project.

In Mexico, Pemex has had plans for years to decrease clean product imports by building new refineries, but not only have those never come to fruition but their existing refineries have experienced operating problems and utilization rates have fallen for five consecutive years, moving to levels below 40% over the last year. This has led to record levels of imports from the U.S., reaching over 1.2 million BPD, which is more than double the volumes less than five years ago. The current Obrador Administration has been very public about their intentions to build a new 340 MBPD refinery in the southern Gulf Coast state of Tabasco (the Dos Bocas refinery), initiating construction activities this summer, but we have serious doubts this projects will fare any better than any of the other recent plans to add new capacity.

An even more dramatic example of a refining industry that has experienced a major decline in Latin America is the situation in Venezuela. At one time, the national oil company, PDVSA, was the most efficient national oil company in the region and probably the world, and Venezuela was a big product supplier to other Latin American countries. Since the change in regime, and the 2002/2003 strike, it has become a shell of its former self, losing thousands of skilled professionals and operators, and their refineries have experienced very poor reliability and utilization rates, actually having to import refined product at times. While actual data is hard to come by on current operating rates in Venezuela, it is likely that they are well below 20% and perhaps even in single digits.

It is not just Latin American countries that have experienced overruns and delays in adding refining capacity, but also projects in other parts of the world, in many cases potential competitors for export product markets, such as a number of projects in the Middle East. While a few have come on line in the last few years, such as the Aramco JV plants in Jubail and Yanbu and the Takreer plant in UAE, delays were experienced and the costs for all of these projects exceeded budget estimates and cost much more than similar facilities would cost on the USGC. Even more

Turner, Mason & Company continues to incorporate labor cost efficiencies into our analysis of petroleum markets which we do in a comprehensive way in our biannual publications -the Crude & Refined Product Outlook (C&RPO) and the Worldwide Refining Construction Outlooks (WRCO). We issued our latest edition of the C&RPO this past Friday and will be issuing our Mid-Year version of the WRCO this week. If you would like more information on these or for any specific consulting engagements with which we may be able to assist, please go to our website and send us an email or give us a call at 214-754-0898.