Published on

Tuesday, July 22 2025

Authors :

Tom Kloza Chief Market Analyst & Sandeep Sayal VP, Industry & Market Analytics

The last few years have seen diesel prices climb walls of worry that tend to be common in the second half of any year. The wall appears to be particularly steep in 2025 thanks to a number of factors not likely to disappear between now and year-end.

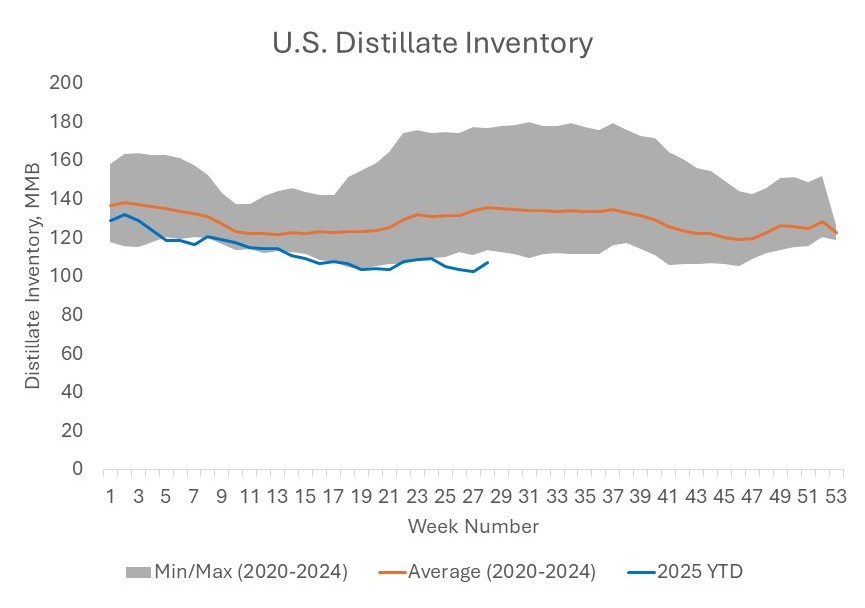

On the one hand, a collective sigh of relief could be interpreted Wednesday July 16 when the EIA reported a robust 4.2-million barrel rise in U.S. distillate stocks, implying that U.S. coffers now hold a total 107-million barrels. The weekly build was the largest such surge since January 3 when EIA measured a more than 6-million barrel increase in inventories. Eleven of the previous 28 weeks this year have seen stock builds but they have skewed toward gains of just a few hundred thousand barrels or so.

Observers warn that it’s too soon to conclude that for global distillate supply the “coast is clear.” Many maintain that the background numbers will be scary between now and the first winter cold fronts, but many caution that the ULSD futures represent the commodity contract that is most likely to register a parabolic move in the remainder of 2025.

With levels of uncertainty at extreme highs, Turner Mason & Company compiled a list of the most salient pros and cons that are likely to impact, tilt, or steer the course for diesel in the coming months.

Some of the bullish pricing ordinances in the arsenal

Tight Inventories and Days of Supply: July roared in with the lowest distillate stocks (102.8-million barrels) since 2005, or before ultra-low sulfur mandates were enforced across the country. The task of producing an on-spec distillate was notably easier back then with plenty of medium and high sulfur diesel. Less distillate molecules flowed to marine usage back then, and indeed the massive desulfurization push with IMO only began in 2020.

With most U.S. distillate molecules destined for use in transportation and industry, it has become more difficult to build stocks ahead of the winter, particularly with autumn maintenance cutting in to production. Real progress on inventories hasn’t taken place until late December when refinery utilization tends to hit its second annual peak.

Simply monitoring inventories isn’t enough. The best analysis considers domestic, export cargoes and overall stocks and calculates an approximate days’ supply figure. Some of those numbers are downright chilling. If one calculates net export demand for distillate and adds it to domestic consumption, one comes up with a weekly need for about 5.4-million b/d. Measured against the 107-million barrels of July 11 inventory, that yields just 19.8 days’ supply.

The most extreme fear arises when one considers the potential for winter paroxysms in consumption. In the middle of a cold December 2018, U.S. domestic demand surged to nearly 4.9-million b/d. Export demand at the time was well over 1.2-million b/d and imports were negligible at 139,000 b/d. The total amount of U.S. distillate delivered into markets hovered above 6-million b/d for two consecutive weeks. Days’ supply reckonings drop to 17-18 under such circumstances.

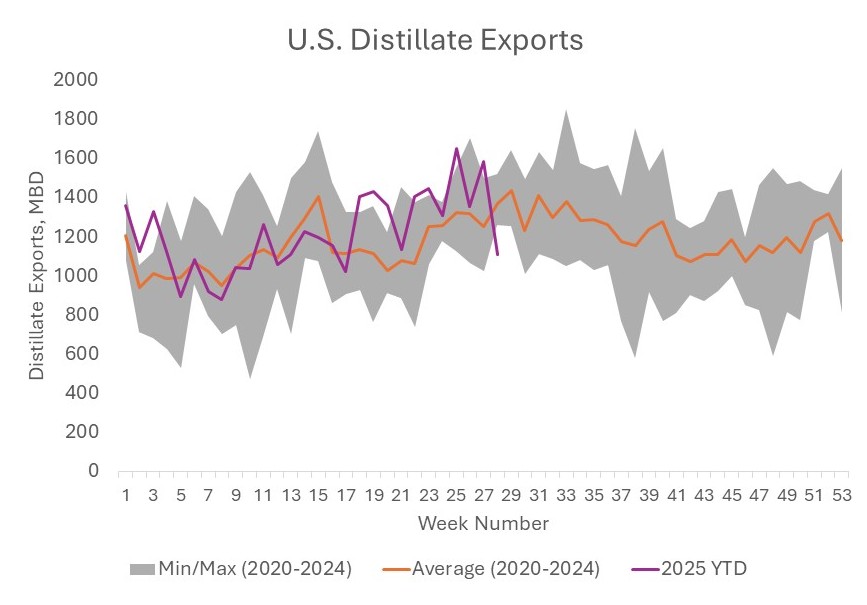

Increasing Exports: In a 20-year comparison between 2005 diesel and 2025 diesel, nothing has changed as much as the demand for U.S. manufactured diesel. Dozens of countries in multiple time zones rely on the U.S. for this product and there are predictions that some 2025-2026 weeks could see nearly 2-million b/d depart the country. America hasn’t observed a week with under 1-million b/d of outbound distillate since February. If there are any further impediments to Russian product exports, the U.S. stands to be a primary beneficiary.

Limited Distillate imports: There are worries that the modest amount of foreign product brought into the U.S. could be further curtailed by tariffs, and the closure of several prominent European plants may keep more barrels on that side of the ocean. Typically, the largest supplier of diesel to the U.S. is the Irving refinery in the Canadian Maritimes. The facility has a turnaround scheduled at the 320,000 b/d complex from mid-September to mid-October, putting pressure on New England inventories.

Crude and Refining Impacts: Crude oil has had an uneven and sloppy summer performance, but global inventories remain quite low. Any storm-induced closures in the Gulf of Mexico would be very material.

The changing crude oil slate continues to have an impact. Too much very light and very sweet crude is having an impact not just in the U.S. but also in European and Asian markets. Those shale blends often lag badly behind medium and heavy sour crude in terms of being distillate rich. Several reports suggest that European refiners have tripled their usage of Midland WTI this year. That has crimped critical yields despite huge profit margins and a strong demand pull.

Dangote and Dos Bocas refineries are unlikely to contribute ultra-low sulfur diesel or gasoline to western hemisphere markets in 2H2025. Nigerian output is coming, but not yet.

Strained Logistics: Supply chains on the U.S. East Coast have yet to be tested. This decade has seen the disappearance of millions of barrels of tankage in Massachusetts, Pennsylvania and New York for asset rationalization and repurposing real estate. Many marketers wonder whether the system could survive a subzero episode where utilities and industry turn to diesel for burns.

Trading Strategies: Incredibly strong seasonal and counter seasonal patterns have been observed in ULSD futures in the 47-year history of the Heating Oil (HO) contract. Much of the daily volume and churn in futures’ markets is now dominated by “quants” who tend to very much ride these seasonal trends. The trend for powerful summer to fall rallies in distillate is unparalleled with typical gains in the last ten years of 42%.

Thus trading strategies may aid and abet a diesel rally. Two very popular spread plays are already seeing advocacy and have the potential to alter the relationship between various energy contracts. From now through mid-October, distillate trading veterans tend to view short sales as extremely dangerous and conversely avoid RBOB purchases ahead of the downshift in RVP. A common play is to buy ULSD against RBOB sales, betting that the premium for diesel may shift higher. Similarly, it’s a time that inspires ULSD buying against WTI sales, with some players dreaming of $40-$50/bbl HO cracks.

Backwardation is likely to curtail any hoarding or storing extra barrels in coming months. December ULSD is about 23cts/gal cheaper than prompt NY physical diesel. This pricing structure inhibits the ability to increase inventories ahead of peak season.

Overdue for a cold winter? The U.S. and Europe have not experienced a sustained cold winter since 2017-18. If the weather in December, January or February scrapes meteorological lows, plenty of distillate will move into the heating oil market and some dual fuel users might need incremental product if they see natural gas curtailments.

Hurricane impact. An appropriate storm analogue for a potential major hurricane landfall might be Hurricane Rita from 2005. Whereas Katrina lifted gasoline prices to all-time highs, Rita’s autumn transit of Texas and Louisiana sent diesel roaring. Right now, hurricane forecasters can’t predict whether a Cat 3 or greater storm might make landfall from Corpus Christi northeast to Pascagoula, but markets need only see precautionary shutdowns if probability cones threaten. The cautionary moves can take crude units down for 24-72 hours and impede distillate output.

Geopolitics: Diesel pricing is globally interconnected. Ongoing unrest in the Middle East and the potential for the EU to tighten sanctions on Russia, particularly targeting reprocessed crude products, are driving volatility. Additionally, increased demand is emerging to meet the new 0.1% sulfur specification for marine fuel under the Mediterranean ECA, which took effect in May 2025.

Politics sometimes dictate that runaway gasoline markets desire government intervention. But what happens with diesel doesn’t elicit the same headlines or concerns. Back in 2008, diesel soared some $50-$75/bbl over crude when global traders thought supplies were unreasonably tight. In 2022, diesel fetched as much as $65/bbl over crude on the mistaken notion that most Russian exports might be stopped. Futures’ gains were dramatically exceeded by some physical markets where diesel margins topped $100/bbl. Gasoline price spikes inspire media and consumer criticism and government action. Diesel spikes elicit no such visceral reaction.

Some of the Bearish Price Observations

Diesel prices are already reflecting extremely tight supply. This is by far the most serious counter to the bulls’ argument. Prices appear to be adjusted for low stocks, high demand, and lofty profits for diesel and gasoil. At midweek (July 16) diesel cracks versus WTI rose to $40/bbl in New York Harbor; $35.50/bbl at the Gulf Coast and in the Great Lakes; and $45.00/bbl in Southern California.

The U.S. East Coast can still attract foreign cargoes of diesel. Right now, the arbitrage for European sales into the USAC doesn’t work but history shows that runaway prices in N.Y. Harbor can attract barrels from multiple countries, including Europe, the Middle East, India, and the Far East.

EIA Data has gaps thanks to renewable treatment. There is about 300,000 bpd of renewable diesel output only measured in the Petroleum Supply Monthly. Similarly, there are inventories of perhaps 7-million barrels of renewable and biodiesel that aren’t included in weekly EIA reports.

Autumn maintenance season is light. There are turnarounds scheduled, particularly in September, October and November, but the work is not as intense as in Fall 2024 or Spring 2025.

Diesel demand can be influenced by the homebuilding business and data suggests that industry is still in a slump.

There is too much bullish sentiment. One tool used to determine whether futures are overbought, oversold or neutral is the Market Vane Bullish Consensus survey. The survey demands that traders identify themselves as bullish or bearish and when the ratio moves to say 65-75% bullish, which is where we are today, it can typically signal an overbought and perhaps overhyped market.

Spread traders are notoriously fickle. A substantial portion of this summer’s rise in diesel can be credited to the buy ULSD/sell RBOB trend. Those bets on diesel eventually trading at 40-50cts/gal over RBOB aren’t necessarily held by traders with strong hands. When spread traders see the tide turning, they may panic to “leg out” of positions.

Conclusions

Diesel prices may indeed represent the most challenging segment of the barrel for forecasting. Based on the myriad of issues that have pushed prices well above midcycle operating norms, the current valuations appear justified, if stretched by historical standards. There is potential for worst-case scenarios to push prices toward stratospheric levels last witnessed in 2022.

But there is also the potential for massive revaluations to the downside since distillate cracks are higher at midsummer than they’ve been since around 2012, except for the Russia-Ukraine spike in 2022. Returns, not just for diesel but for jet fuel, are sufficient to inspire very robust utilization throughout North America, perhaps contributing to inventory builds for diesel once summer is over.