Published on

Thursday, October 9 2025

Authors :

Harold "Skip" York - Chief Energy Strategist

Throughout 2025, Ukraine has intensified its use of long-range drones against Russian oil refineries and export infrastructure. Once limited to sporadic strikes, these attacks are evolving into a sustained campaign targeting some of Russia’s largest refineries. The result is a significant disruption to refining operations, rising domestic fuel shortages, and broader concerns of the interconnectedness of energy security and conflict dynamics.

Refinery Disruptions and Product Shortages

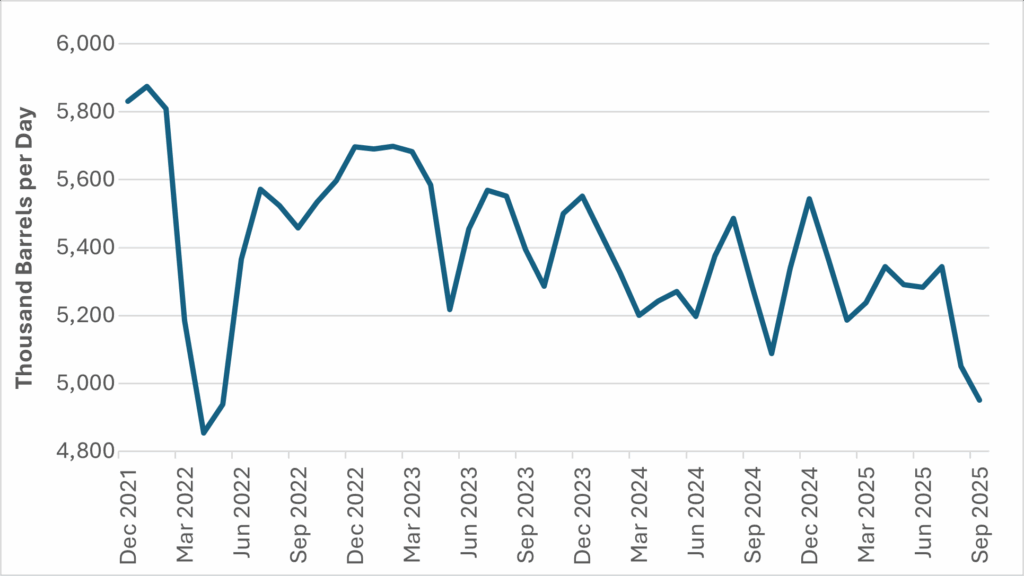

Since July, multiple high-capacity refineries—including Ryazan, Kirishi, Nizhny Novgorod, Volgograd, and Saratov—have suffered damage from drone strikes, some on multiple occasions. September refining runs averaged almost 600 MBPD less than in December 2024. Russia’s refining throughput fell below 5 million barrels per day, the lowest level since mid-2022.

Chart 1: Ukraine Targeting of Russian Refineries in 2025

Source: Bloomberg News

The disruption is being felt most immediately in the gasoline market (down over 25% from a year ago). Russia produces little spare capacity beyond domestic needs and shortages that first appeared in remote regions are moving closer to major population centers.

Winter diesel poses an additional challenge. Production was already lagging seasonal requirements, and the outages risk (down about 20% from a year ago) creating the most acute deficit in recent years. Options such as blending jet fuel into diesel or increasing purchases from Belarus may provide partial relief, but both face limitations.

Ukraine’s Strategic Objectives

Kyiv has framed the refinery strikes as part of a broader effort to erode Russia’s war-fighting capacity. By reducing fuel availability and constraining export revenues, Ukraine seeks to weaken both the military and fiscal pillars of the Kremlin’s war effort. President Volodymyr Zelensky has described the campaign as more effective than traditional sanctions in restricting Russia’s oil industry.

The strikes also stretch Russian air defense resources across a wide geography. New drone designs, equipped with shrapnel payloads, appear to have increased the severity of damage, slowing repair times and magnifying the overall impact.

Chart 2: Falling Russian Refining Runs

Source: Energy Intelligence

Russian Countermeasures

In response to the refinery attacks, Moscow has shifted its energy strategy by prioritizing domestic fuel supply over exports. Authorities have imposed a ban on gasoline and distillate exports for the remainder of the year, and refiners have been directed to concentrate on diesel production. Meanwhile, crude oil shipments are being rerouted to export terminals in the Baltic and Black Sea regions, although limitations in pipeline and storage infrastructure restrict the effectiveness of these adjustments.

Additionally, Russia has escalated its military actions against Ukraine’s energy infrastructure. On October 3, 2025, ballistic missiles and drones targeted Naftogaz facilities in the Kharkiv and Poltava regions. These strikes mark an intensification of Russia’s campaign against Ukraine’s gas infrastructure, which has grown more aggressive since the cessation of Russian gas transit through Ukraine on January 1. European observers are closely monitoring these developments, as they could heighten winter heating supply risks and increase Ukraine’s reliance on gas imports from the European Union. As of August, European middle distillate stocks are about 14 million barrels below the five-year average.

Global Market Considerations

For the global oil market, Ukraine’s drone campaign introduces new risks. Reduced Russian refined product output could tighten diesel and gasoline availability, particularly in Europe and parts of Asia as those markets move towards the winter heating season. At the same time, Western governments remain cautious: while supporting Ukraine’s defense, they are wary of supply shocks that could drive up global prices. To date, international sanctions targeting the export of refined petroleum products derived from Russian crude oil primarily focus on import bans and restrictions imposed by the EU, US, and G7 allies. These measures aim to curb Russia’s oil revenues (e.g., crude or product), with a growing emphasis on closing loopholes allowing third countries (e.g., India, Turkey, China) to refine Russian crude and re-export products.

Russia continues to redirect crude exports toward China and India, partially offsetting lost European markets. However, repeated interruptions to refining and export hubs—such as Primorsk and Ust-Luga—highlight the vulnerability of Russia’s supply chains to sustained drone activity.

Ukraine’s refinery strikes represent a notable shift in the conflict, extending the battlefield into Russia’s energy heartland. The immediate consequences include lower refining runs, constrained domestic fuel supply, and heightened logistical challenges for Russian exporters, while the ability for Ukraine to sustain these impacts remains uncertain.

For global markets, the strikes underscore the interconnectedness of energy security and conflict dynamics. Whether these disruptions evolve into a sustained constraint on Russian capacity—or remain episodic challenges—will be a key factor shaping oil and refined product balances heading into winter.