Published on

Wednesday, February 18 2026

Authors :

Eamon Cullinane - Director, Renewable Energy Markets

The transmix processing industry has remained relatively unchanged in the last decade, but in 2025 two new names entered into the market, VP Racing and VEP Environmental.

VP Racing announced at the beginning of 2025 it had taken over the transmix processing facility formerly owned by Liquid Titan, which began operations in 2003. The facility includes 2.3 million gallons of tank storage, truck/rail logistics, and a distillation tower for transmix processing. It’s unclear how much transmix processing will take place given the lack of direct pipeline access at the facility and VP Racing’s core business operations as a lubricants and specialty fuels marketer.

Additionally, in 2025, VEP Environmental acquired the former Texmark Chemicals site located on the Houston Ship Channel. The facility has eight processing towers and approximately 72,000 barrels of storage capacity provides toll manufacturing and transmix processing.

Competitive Landscape

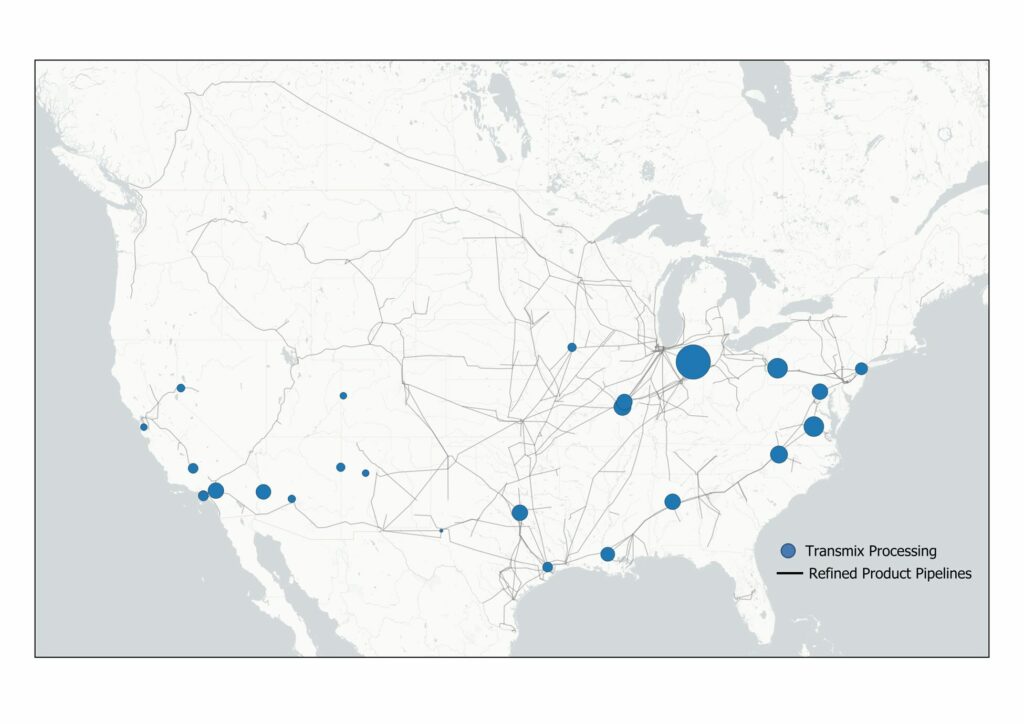

The count of U.S. Transmix Processing facilities now sits around 25, with the overwhelming majority located on major refined product pipelines.

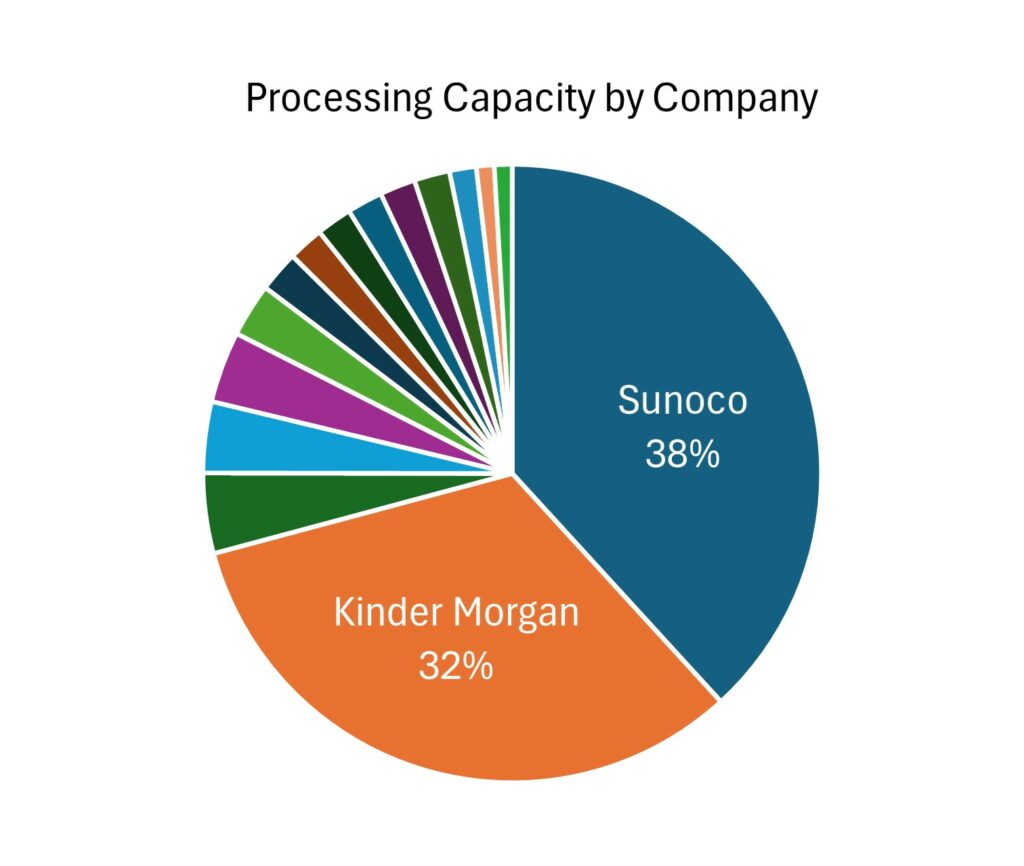

The market is dominated by Sunoco and Kinder Morgan, who make up almost 80% of the processing capacity across 10 different facilities.

Fuels Regulatory Drives Transmix

Transmix volumes are largely driven by two main factors: liquid transportation fuel demand and fuels regulations. As more transportation fuel is consumed in the U.S., more fuel is moved through the network of refined product pipelines, and more transmix volumes are generated. Since 1990, the amount of transmix needing to be processed has increased substantially as a result of increasing regulatory compliance on transportation fuel over the past 35 years.

Transmix can be dealt with in a few ways:

- Blend it back into refined products with no processing (not common any more as fuel specifications have become increasingly strict)

- Sell the transmix for ‘non-transportation’ such as Marine Fuel.

- Re-run the transmix at a refinery. Also, not a common option as transmix processing is generally unfavorable for major refineries compared to crude oil runs due to lower throughput volumes and feedstock costs. Though some refineries are equipped to process the transmix directly to spare downstream units (cokers, hydrotreaters, etc.)

- The last option, which is the most common, is to have a standalone transmix processor upgrade the volume back into refined products.

Each of these options requires careful consideration of fuels regulatory compliance requirements under the EPA.

M&A/Valuations

| Date | Target | Acquiror | Processing Capacity (bbl/day) |

| August 2016 | Emerge Energy Services | Sunoco | 10,000 |

| May 2017 | Motiva Enterprises | Shell | 3,000 |

| February 2022 | Gladieux Energy | Sunoco | 23,000 |

| January 2025 | Liquid Titan | VP Racing | 4,500 |

| April 2025 | Texmark Chemicals | VEP Environmental | N/A |

Transaction activity has been limited in recent years; however, the facilities that have traded were valued at approximately $10,000 per bpsd of processing capacity. Looking ahead, the future of transmix will be influenced by a mix of market, regulatory, and cost factors. Though transportation fuel demand is expected to decline over time, a possible growing share of renewable fuels moving through pipelines might impact how transmix is generated and handled. At the same time, fuel quality and environmental compliance requirements are becoming more stringent and costly for operators.