Published on

Wednesday, November 17 2021

Authors :

Eamon Cullinane and Robert Auers

In this third installment of our blog series on how the oil industry is responding to the energy transition, we will focus on the Midstream sector; exploring how their business will be impacted by Energy Transition forces and the various strategies they have started to employ in response. We will touch upon possible changes to MLP structures, identify potential challenges to their traditional petroleum transportation activities and then discuss some of the new strategies and opportunities they are pursuing, including Renewable Electricity, Biofuels, Carbon Capture, Utilization and Sequestration (CCUS), and Green Hydrogen.

MLP Policy and Structure

Master limited partnerships (MLPs) have been a very popular organizational structure for petroleum-focused midstream companies. A primary reason for this is the ability of MLPs to avoid double taxation by only taxing the shareholders (eliminating the need for the partnership to pay corporate income tax). “They combine the tax benefits of a private partnership—profits are taxed only when investors receive distributions—with the liquidity of a publicly-traded company.” However, MLPs are required to have 90% of their income from qualified sources, which is limited to natural resources (coal, oil, petroleum products, natural gas, minerals, etc.) In the last couple of years, there has been a push to expand the qualifying resources to include renewables. Nonetheless, the midstream industry has been slowly moving away from the MLP structure (despite its tax advantages) to access a larger pool of investors. To this end, several notable large midstream companies, including Kinder Morgan, ONEOK, Williams, Enbridge, TC Energy, and Targa (among others), have completed corporate conversions or “roll-ups” over the past six years, eliminating their MLPs.

Geoff Cooper, president of Renewable Fuels Association, recently said, “This is about fairness and equity. This change could really jumpstart plenty of projects and help support lower carbon fuels.” It could also open the opportunity for traditional oil and gas MLPs to break into the renewables market (beyond the current 10% of income limit). Still, as discussed previously, an increasing number of midstream companies are operating as corporations, and, for these firms, this change in qualified sources would not affect them.

Potential Decline of Traditional Business Lines

Given the focus on the coming energy transition, many investors are concerned about the future decline in the base businesses of many midstream firms. As of now, these declines remain hypothetical but should occur as demand for petroleum products falls and U.S. crude production eventually peaks and declines. (Of course, U.S. crude production has declined by ~15% from pre-pandemic levels, but is now increasing in every major shale basin, according to the latest Drilling Productivity Report released by the EIA.) Further, these demand declines will not be felt evenly across firms, with domestic and global demand for natural gas and NGLs expected to remain stronger than that for refined products (especially gasoline). In addition, the runway for natural gas and NGL production in the U.S. is longer than that for crude oil, as gas-to-oil ratios (GORs) increase over time. Also, demand changes will vary by region, with renewable diesel rapidly replacing petroleum diesel in California and Oregon, while weak population growth in most of PADD II will accelerate demand declines there. PADD IV, however, is likely to benefit from strong population growth, providing a tailwind to demand.

Lastly, ESG pressures have limited the development of new pipelines in multiple instances, especially crude pipelines from Canada and natural gas pipelines to supply the Northeast. Environmentalists who oppose these pipelines have used the argument that these pipelines are not needed as a result of the coming energy transition, which (they believe) will make new oil and gas pipelines obsolete very quickly.

Renewable Electricity

Even though midstream pipelines already offer one of the lowest carbon emissions factors for fuel transportation compared to other modes such as heavy-duty vehicles, rail, and tankers, companies are still looking for ways to lower emissions. Pipelines that currently use electrified equipment in the field can take immediate steps to lower their Green House Gas emissions by acquiring electricity from renewable sources such as wind or solar. Energy Transfer recently announced a 15-year power purchase agreement for 120 megawatts (MW) of electricity from solar in northeast Texas. It was also noted that almost 20% of Energy Transfer’s electricity purchases now come from renewable sources.

Instead of purchasing renewable electricity, entities could develop solar or wind farms in-house and use the energy for operations. Williams has taken this approach by installing various solar panel set-ups for use on their natural gas systems. Plains All American has made similar moves and stated in a recent report, “A key energy efficiency initiative has included eliminating generators and connecting our systems to the electrical grid. In 2020, the team removed 44 diesel and natural gas generators from service by connecting directly to the electrical grid.”

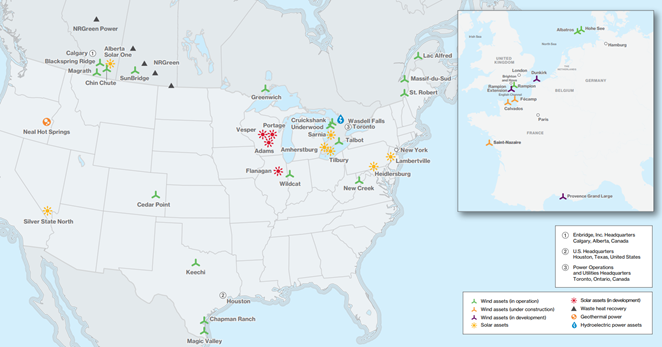

Enbridge has also been particularly open with its goals to achieve net-zero and has been investing in this arena for some time. Their portfolio consists of offshore wind, onshore wind, solar, geothermal, hydro, and waste heat recovery as seen below.

Source: Enbridge

Source: Enbridge

Biofuels

In a more traditional sense, companies such as Kinder Morgan and Magellan Midstream Partners are now transporting large volumes of biofuels ranging from ethanol, RNG, biodiesel, renewable diesel, and soon-to-be sustainable aviation fuel. Aside from the biofuel products, these midstream companies are also transporting the necessary feedstocks for this market (FOG – Fats, Oils, and Grease). Kinder Morgan, notably, acquired Kinetrex (a midwest RNG producer) for $310 million earlier this year.

NuStar Energy, meanwhile, has been heavily involved in California renewable fuels markets as demand for petroleum gasoline and diesel has been replaced by ethanol, biodiesel, and renewable diesel. Approximately one-third of their 2021 growth capital spending is set to be allocated to California renewable fuels projects. Nustar also operates the only operating ammonia pipeline in the U.S. and is exploring opportunities to transport “blue” and “green” ammonia on this pipeline.

Carbon Capture, Utilization and Sequestration

A large opportunity for midstream companies has existed for years in the transportation of CO2 for use in enhanced oil recovery projects (EOR). Kinder Morgan is one of the largest players in the North American market, transporting ~1.2 billion cubic feet per day of CO2. In recent years, the 45Q tax incentives for carbon capture in the United States (U.S.) have pushed this market forward for producers of CO2 to capture and store their emissions. Today, there are over 35 commercial-scale ethanol production, carbon-capture projects under development or construction in the U.S., with most of these announced in the past 24 months.

Navigator and BlackRock are planning to build a new CO2 pipeline to move captured CO2 from eight of its ethanol plants to a sequestration site in Illinois. This sequestered CO2 will be eligible for a $50/tonne federal tax credit and will significantly lower the carbon intensity of the ethanol fermentation process, allowing this ethanol to generate additional LCFS credits if it is ultimately blended into California or Oregon gasoline.

Green Hydrogen

As the movement for clean hydrogen gains momentum, midstream companies will need to play a large role, both from a transportation and storage standpoint. HyDeal Los Angeles (LA) is an initiative to create the first scaled hub for green hydrogen in North America, delivering green hydrogen at under $2/kg by 2030. It will involve transportation via a dedicated, 100% hydrogen pipeline that connects LA with underground geologic storage salt domes in Central Utah. Internally, midstream companies could use hydrogen as a source of fuel for hydrogen-fueled compressors/turbines.