Published on

Tuesday, June 9 2020

Authors :

Robert Auers and John Auers

Six weeks ago, we published a blog entitled “Up Around the Bend” – What lies ahead for product demand and refiners’ prospects as COVID lockdowns ease?”. In that blog, we discussed some of the unprecendented effects that the COVID-19 lockdowns had on petroleum demand, including sending both gasoline and jet demand in the U.S. to levels not seen since the 1960s. At the time, we presented a relatively (in light of the then-current situation) bullish outlook, which we believe has largely played out, with total product demand and gasoline demand surging by ~20% and 50%, respectively, from those April lows. Nevertheless, both total demand and gasoline demand remains down 20%+ on a year-over-year basis. The recovery for jet fuel demand has been even slower, and diesel demand, which had held up at the beginning of the lockdowns, is now hitting some headwinds as well. This was consistent with our early views and we expect demand for both of these middle distillates to recover, although remain more challenged than gasoline. As a result, we remain relatively bullish on petroleum demand, both in the U.S. and abroad, though continued individual caution and lingering economic effects are likely to keep demand well below 2019 levels through 2021.

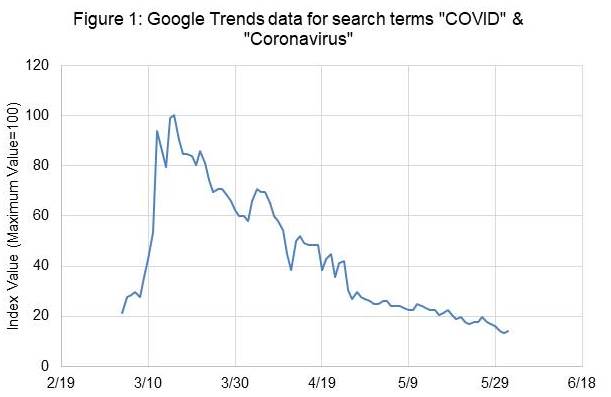

While uncertainties still exist on the timing, we expect almost all of the major remaining COVID-19 lockdown measures in the U.S. and abroad to be substantively removed in the coming weeks. This is, of course, dependent on positive trends in controlling the pandemic and public opinion regarding said measures. Recent signs on both fronts are very encouraging. There has and will continue to be regional variation in reopening speed and return of product demand, though demand recovery even in the states with the most stringent lockdown measures and conservative reopening schedules lags only a few weeks behind those reopening earlier. Further, we believe the civil unrest has substantively shifted the news cycle away from COVID-19 and that pandemic fears are unlikely to return to the unusually prominent place they held in the news cycle for over two months. This is demonstrated in Figure 1, which shows the Google search trend for the terms “COVID” and “Coronavirus” over the past 90 days.

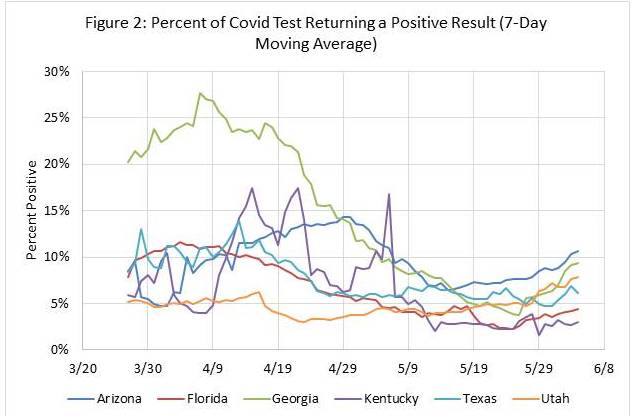

Further, we’ve assumed limited impacts from a “Second Wave.” While this is somewhat of a hopeful guess, it is supported by some key facts. Perhaps the most compelling is the extensive awareness of the possibility, which is leading to significant and effective preparation, a situation that did not exist for the “First Wave.” Some level of herd immunity will also have been developed in most regions as well as advances in treatment options. Perhaps most importantly, we expect more targeted and less economically impactful policy responses would be employed even if a Second Wave were to occur. Lastly, we note that leaders of various foreign countries, including Norway and the Netherlands, have announced that they would not lockdown again, even in the event of a second wave. Still, after initially declining, the percent of tests returning positive results has increased modestly in most of the states that opened earliest, though still remains below 10% in most of these states. While we do not expect COVID to disappear soon in states that have not already had major outbreaks (i.e., New York), we do expect that government policies and individual actions will be successful in “flattening the curve” and avoiding infections in the most vulnerable. Figure 2 shows COVID testing data for a selection of states which chose to reopen early.

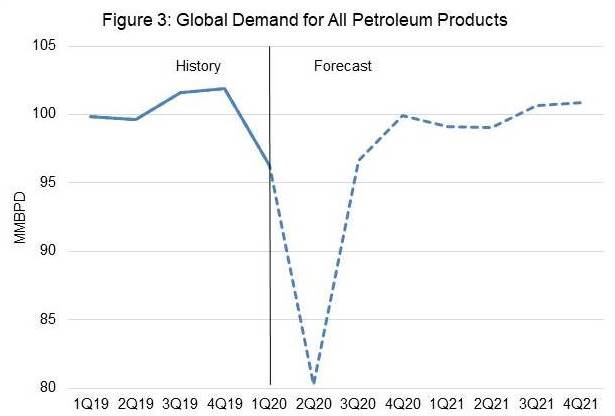

By late 2020 and through 2021 and 2022, we believe the most important factors impacting global demand will be an economic recession originally induced by the COVID-19 lockdowns. To this end, we anticipate a relatively quick “V” shaped recovery though the rest of Q2, with some lingering damage from the extreme COVID-19 lockdown measures persisting in the third quarter. By the fourth quarter of 2020, we expect that the resultant economic damage will be the primary factor limiting further demand growth. As such, we anticipate global petroleum demand in 2021 to be ~1 MMBPD below that in 2019, with some residual impacts felt into 2022. By 2023 our revised demand outlook largely converges with our pre-COVID outlook. Figure 3 displays our short-term global demand outlook.

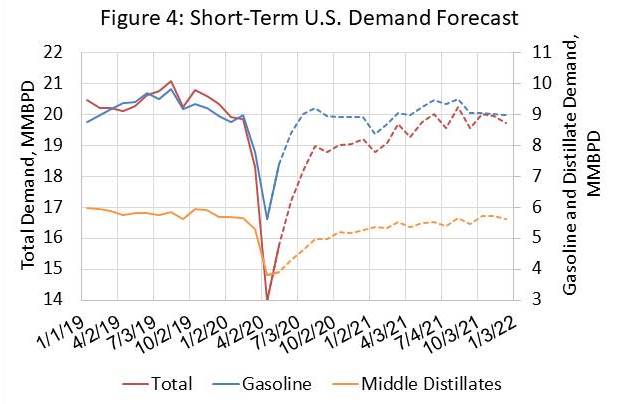

Based on these assumptions and the trends we are already seeing, we expect gasoline demand will recover the quickest. This has and will continue to be driven by a variety of positive forces including low prices and fear of both public transit and flying. Vacation and holiday travel by car instead of air could provide a major boost over the next few months. These tail winds will be partially offset by the negative impacts of a weak economy and a continued high number of people working from home. Nonetheless, we expect some people will begin returning to work by the end of June, with the return of a more typical work environment by the end of the year in most locations.

Jet demand will be the slowest to fully recover due to a continued fear of flying, especially on international trips, limits on business travel and an overall weak economy; however, we do expect a strong bounce back from the very low current levels, a process which has already begun. In next week’s blog, we will focus (in more detail) specifically on the future of jet demand.

We expect diesel, which didn’t decline as much as gasoline and jet, to also have a flatter recovery trajectory, as relative weakness in the overall economy and decreased demand from consumption in the oil patch weigh on demand. Figure 4 shows our short-term U.S. product demand forecast by category.

Turner, Mason & Company will continue to closely monitor developments related to the COVID-19 pandemic, the attempts by some states and countries to reopen their economies and Saudi/OPEC/Russian production negotiations and how these could impact all aspects of the oil industry. We will be commenting on our changing views on all these issues in coming blogs over the next several weeks and incorporating our updated market forecasts into our next edition of our Crude & Refined Products Outlook which will be published to clients in late July. If you would like more information on this publication or for any specific consulting engagements with which we may be able to assist, please visit our website: https://www.turnermason.com and send us a note under ‘Contact’ or give us a call at 214-754-0898. Please stay vigilant during these uncertain times and make good and informed decisions on personal interactions and hygiene practices.